Better Home & Finance Holding Company Sees Stock Surge Amid Breakthrough Innovations

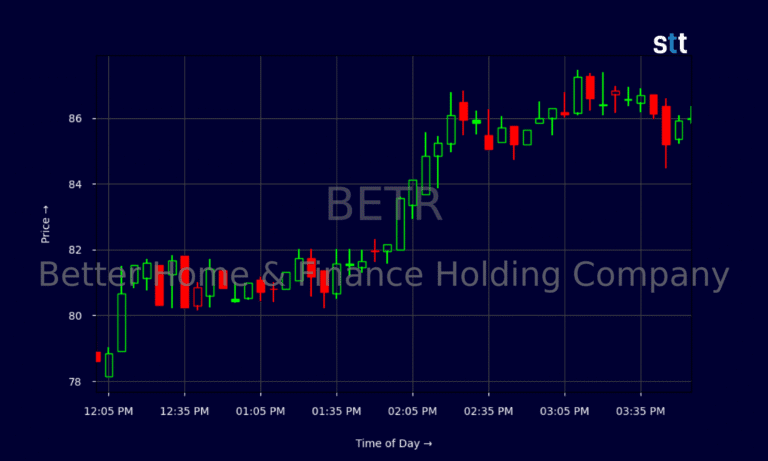

Shares of Better Home & Finance Holding Company (NASDAQ: BETR) have surged by 29.99%, fueled by an influx of positive market sentiment. This remarkable increase sets the stage for a closer look at the innovative advancements that are reshaping the company’s trajectory.

Revolutionary AI-Powered Solutions

Better.com has recently unveiled a pioneering AI-driven bank statement HELOC (Home Equity Line of Credit) program specifically designed for small business owners and self-employed individuals. This new initiative aims to break down the traditional barriers associated with home equity financing, making capital more accessible for a broader audience.

Leah Price, Vice President of the Tinman AI Platform at Better.com, earned recognition as one of the Most Influential Women Mortgage Bankers for 2025. Her groundbreaking contributions to the field of mortgage banking through AI innovations emphasize the company’s commitment to technological advancement.

Strategic Talent Acquisition and Partnerships

Better.com has welcomed industry veteran Jim Juergens to NEO Home Loans, powered by Better, signaling a strategic move to disrupt the mortgage sector with a value-oriented approach. This is complemented by a partnership with Finance of America, aimed at introducing innovative home equity products powered by AI technologies.

The collaboration with Finance of America marks a significant stride in the company’s mission to develop cutting-edge home equity solutions. With a seamless integration of new AI capabilities, Better.com is well-positioned to expand its offerings in the reverse mortgage market, further enhancing its competitive edge.

Financial Overview and Market Challenges

Despite revenues surpassing $120 million, Better Home & Finance Holding Company faces significant challenges in achieving profitability, with negative margins affecting its overall financial health. Recent earnings reports reveal substantial losses in both operating profit and net income, painting a complex picture of the company’s growth trajectory.

On the cash flow front, Better.com contends with considerable free cash flow shortfalls driven primarily by investments in technology and infrastructure expansion. However, the company’s aggressive strategy, including a $75 million “at-the-market” stock sale, underscores its commitment to strengthening its operational capabilities.

Market Positioning and Future Potential

As the market evaluates Better.com’s current standing, it’s essential to juxtapose immediate financial hurdles against the long-term potential for innovation. While operational setbacks remain, the company’s determined focus on AI and fintech solutions can pave the way for future growth, enhancing investor interest and market resilience.

Strategic partnerships, like those formed with Finance of America, could strengthen investor confidence, especially as the company’s AI-driven solutions continue to evolve. With dynamic leadership and a comprehensive approach to financial solutions, Better.com is setting the stage for a promising rebound in the competitive mortgage landscape.

Conclusion

Better Home & Finance Holding Company is navigating a transformative journey through innovative AI solutions, strategic talent acquisitions, and valuable partnerships. While financial challenges persist, the company’s forward-thinking approach could lead to sustainable growth and market repositioning.

Traders and investors must remain vigilant, assessing the evolving financial landscape of Better.com. As the company continues to innovate and adapt, its potential for revitalization in the real estate finance sector appears promising, making it a focal point in the industry.

This article serves as informative content and does not constitute investment advice.