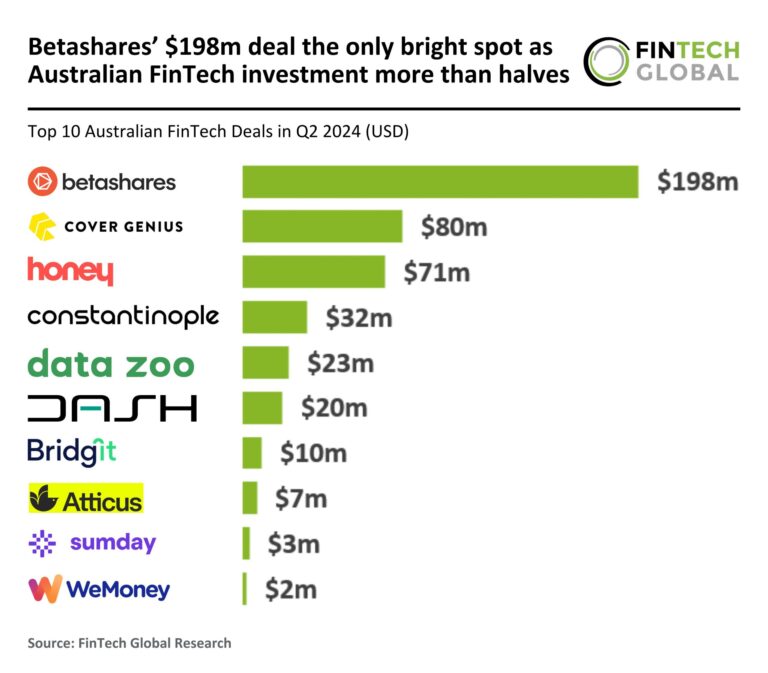

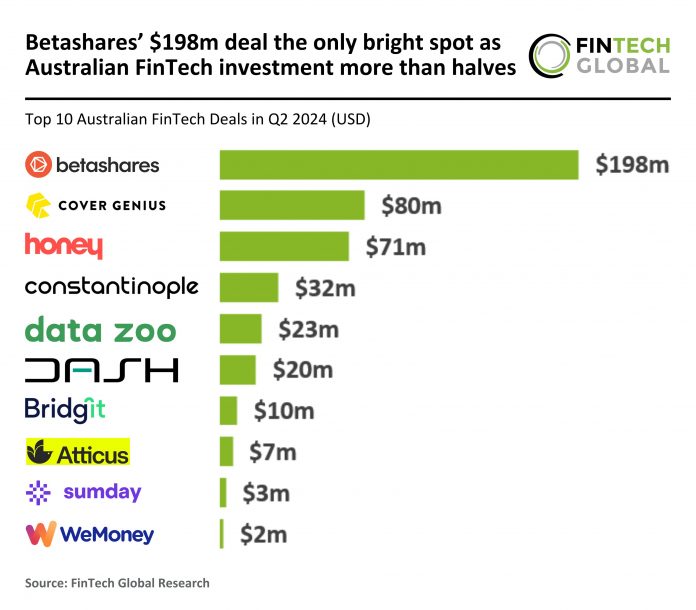

Key statistics on FinTech investment in Australia in Q2 2024:

- Australian FinTech funding in Q2 fell 73% year-on-year

- Average deal size fell from $42.7 million to $29.7 million as investors grew more cautious

- Based in Sydney Betasharessecured largest contract in Australia for Q2 2024 with $198 million funding round

In Q2 2024, the Australian FinTech sector saw a notable decline in deal activity and funding. Only 16 funding rounds were completed in Q2 2024, a staggering 62% drop from the 42 deals completed in the same period last year. Funding also saw a significant decline, with FinTech companies raising just $475 million in Q2 2024, a 73% drop from the $6.9 billion raised in Q2 2023. If deal activity trends continue at the same rate, the projected total for 2024 would be 68 deals, a 60% drop from last year’s total of 169.

The average deal size in Q2 2024 was approximately $29.7 million, down 30% from $42.7 million in H1 2023. This decline in average deal size suggests that not only has the number of deals declined significantly, but the size of investments has also declined, indicating a more cautious approach by investors within the Australian FinTech sector.

Betashares, a leading Australian financial services company known for its Betashares Direct investment platform and range of exchange-traded funds (ETFs), has closed the largest deal for an Australian fintech in Q2 2024 with an investment of $198 million. Temaseka global investment firm headquartered in Singapore. This capital injection follows a period of rapid expansion for Betashares, which has managed over $25 billion on behalf of over one million investors, financial advisors and institutions. Temasek’s investment, which will see the company become a minority shareholder alongside TA Associates and Betashares staff, underscores Betashares’ long-term ambition to become a leading independent financial services provider. The company continues to innovate with initiatives such as Betashares Direct, a retail investment platform designed to help self-directed investors build long-term wealth. Betashares remains committed to transparency, cost-effectiveness and simplicity as it expands its market presence and offerings, with the aim of creating long-term value for clients, partners and shareholders.

Stay up to date with the latest FinTech research here

Copyright © 2024 FinTech Global

Investors

The following investors have been identified in this article.