Licensed and regulated financial institutions are essential partners for fintech companies seeking to offer the broadest and most robust range of financial services to their customers. In the United States, this runs the gamut from issuing cards and opening bank accounts to holding deposits and accessing a Federal Reserve account. The banks that provide these services on behalf of fintechs are typically invisible to the fintech providers’ end users and operate discreetly behind the scenes. In this report, we discuss the trend of fintech partner banks and the different approaches emerging in the market.

Banks play a vital role in enabling fintechs to offer financial services to their end customers. For financial institutions, the benefits of these partnerships may lie in profitable deposit and revenue growth, but they must balance this with the lack of a relationship with the end customer. Various approaches are emerging to enable bank-fintech collaborations. Some banks rely on banking-as-a-service platform providers to streamline fintech integrations, while others create their own internal banking-as-a-service divisions or subsidiaries. Regardless of the approach taken, rigorous due diligence, risk management and oversight must be at the forefront of any banking-as-a-service strategy to ensure fintechs operate in a secure and compliant manner.

Context

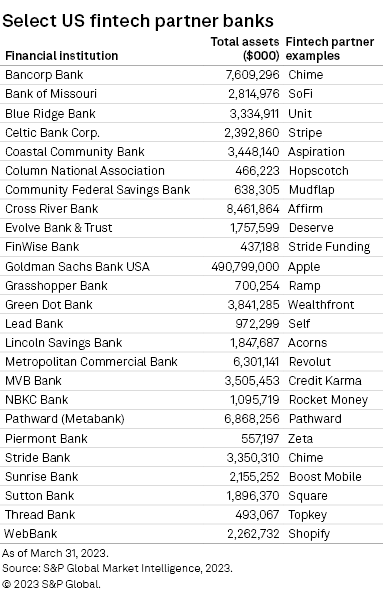

In the United States, there are more than 50 financial institutions supporting fintechs on an “as-a-service” basis. These are commonly referred to as “partner banks” or “sponsor banks” and often have less than $10 billion in assets. Banks of this asset size are exempt from the Durbin Amendment’s debit card interchange fee caps, making them particularly attractive to fintechs as they can help fintechs achieve margins. higher on debit transactions. Below, we highlight 25 examples of partner fintech banks in the United States.

Although it’s still early, banking as a service is increasingly a priority for financial institutions, with the term mentioned during 62 bank earnings calls in 2022, up from six in 2019, according to S&P data Global Market Intelligence. The benefit for banks participating in banking-as-a-service models is to increase deposits and revenue (interchange, interest) at a relatively low cost (no customer acquisition cost). In an analysis of 42 community banks offering banking as a service, S&P Global Market Intelligence found that these institutions increased their deposits by 18% on average between the first quarter of 2022 and the first quarter of 2023, while growth in Deposits among other U.S. banks with less than $10 billion in assets remained essentially stable during the same period.

Building a banking business as a service means accepting the absence of a direct customer relationship and therefore the absence of means to generate cross-selling or loyalty. Comfort in this regard naturally varies by industry. As Bill Demchak, CEO of PNC Financial Services Group Inc., said during the bank’s first-quarter 2021 earnings call: “As a low-cost supplier to someone else who owns relationship, you just sold your soul to the devil. (We) must take ownership of the customer relationship, and we must deserve to take ownership of the customer relationship through an offer that does not need this upstream fintech platform. »

Reaffirming its position, PNC closed BBVA Open Platform in 2022 following the acquisition of BBVA USA in 2021. On the other side of the coin, some large banks believe they will eventually be able to attract fintech customers looking for premium services once their usage has reached a scale where they feel comfortable serving them directly.

Pursuing a new business model may result in an identity crisis for some financial institutions. However, in a way, avoiding the trend altogether is like avoiding the inevitable. Consider that nearly one in three consumers plan to meet their financial needs significantly (12%) or slightly more (18%) through fintech providers in the next 12 months, or 48%. of Generation Z and 43% of millennials surveyed, according to the Quantifying the Customer Experience 2022 survey from 451 Research.

Banking as a service

Banks generally participate in integrated finance by offering their banking charter “as a service”. This allows the fintech provider to offer core banking services, such as making loans nationwide and accepting FDIC-insured deposits, with the underlying regulated financial institution supporting these use case.

In some cases, banks offer their balance sheet to support lending use cases, and many choose to specialize in a certain area, for example lending, cryptocurrencies, or cards. It is not uncommon for a fintech to work with multiple banks to meet specific needs. Affirm Holdings Inc., for example, is partnering with Evolve Bank & Trust for the Affirm Card while leveraging Cross River Bank and Celtic Bank Corp. for financing.

Several trends are emerging around banking collaboration as a service, including:

Banking-as-a-Service platform providers. Small and mid-sized banks often partner with a banking platform-as-a-service provider, such as Synctera Inc., Treasury Prime Inc., or Unit, to meet the providers’ diverse technology and infrastructure needs. of financial technology. This can be thought of as a middleware layer that removes some of the inherent complexity and operational overhead involved in banking and fintech integrations. It’s common for banking-as-a-service platform providers to work with multiple banks, both for redundancy reasons and to support specific use cases. For example, Unit has various partner banks, including Pacific West Bank, Piermont Bank and Thread Bank. Small fintechs tend to work with banks through banking-as-a-service platform providers, while large, sophisticated fintechs often partner directly with operationally mature banks.

Banks creating banking-as-a-service divisions. Banks such as Westpac Banking Corp., Skandinaviska Enskilda Banken AB (publ), Standard Chartered PLC, Synovus Financial Corp. and Goldman Sachs Group Inc. have recently taken steps in this direction by creating their own banking-as-a-service units. supported by a tailor-made technology platform that enables direct collaboration in the fintech space. Several banks, including Green Dot Corp. and Cross River Bank, have long operated as “full service” banking providers. NatWest Group PLC has taken an interesting approach as it has entered into a strategic partnership with fintech startup Vodeno Group in 2022 to create a new UK banking-as-a-service entity, 82% majority-owned by NatWest Bank.

Banking-as-a-Service platform providers become (and buy) banks. A few banking-as-a-service platform providers, such as Germany-based Solaris SE and U.K.-based Griffin Financial Technology Ltd., have obtained their own banking licenses to operate as full-stack providers in Europe. It should be noted, however, that the vendors cited in these examples, particularly Solaris, are not inclined to build balance sheets. They leverage securitization to transfer loan assets/risks to investors, which could be the banks themselves. There are also selected examples of banking-as-a-service platform providers that have acquired banks or been formed through bank acquisitions. Column provides an intriguing example, as the vendor launched after acquiring and modernizing Northern California National Bank’s technology stack. BM Technologies Inc., on the other hand, recently canceled its planned acquisition of First Sound Bank following a lengthy regulatory approval process.

It is important for banking-as-a-service platform providers and partner banks to develop technologies, systems and processes to oversee the operations of their fintech partners and the types of activities that take place there. As banks are regulated entities, they must ensure that their fintech partners operate in a compliant manner – providing customers with necessary information, preventing fraud and complying with necessary laws, for example on debt recovery – or risk jeopardizing their banking charter. In the United States, the Office of the Comptroller of the Currency (OCC) has stepped up its review of bank and fintech collaborations. In October 2022, she announced the creation of the Office of Financial Technology to further focus on this trend.

The OCC’s growing involvement in fintech partner financial institutions is perhaps best illustrated by its 2022 run-in with Blue Ridge Bank, where it uncovered “dangerous or unhealthy practices, including those related to the management of risks linked to third parties, to the law on banking secrecy”. “Anti-Money Laundering Risk Management, Suspicious Activity Reporting, Information Technology Controls and Risk Governance” regarding its fintech partnerships. Blue Ridge Bank subsequently entered into an agreement with the OCC on requiring it to improve its compliance and oversight processes relating to its fintech partners. Most notably, the agreement requires Blue Ridge Bank to obtain approval from the OCC for future fintech partnerships.

In a more recent example, the FDIC entered into a consent order with Cross River Bank in March regarding what it considers “unsafe or unsound banking practices” related to Cross River’s compliance with “applicable fair lending laws “. The FDIC required a number of actions for Cross River, including obtaining third-party assessments of its fair lending compliance and information systems, in addition to obtaining a no objection from the FDIC for any new credit product or any new partnership with third parties.

The recent regulatory actions send a signal to the rest of the banking industry that there is a greater need to strengthen due diligence and risk management of fintech partners and ensure ongoing monitoring and oversight of their operations. This should not be an opportunity that banks find themselves without a formal strategy and operational development.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. To learn more about 451 Research, please contact 451ClientServices@spglobal.com.