The Vital Role of AI Reliability in Finance

In today’s fast-paced financial landscape, artificial intelligence (AI) has become integral to various operations, from fraud detection to enhancing customer experiences. As financial institutions increasingly embed AI within critical operations, a pressing question arises: Can these systems be trusted to perform reliably when the stakes are highest?

Understanding AI Reliability in Financial Services

Prominent AI expert Ankush Sharma, recognized for his extensive two-decade experience in AI and infrastructure, emphasizes the significance of AI reliability for the future of financial technology. Opposed to merely chasing media attention, Sharma focuses on combating hidden fragility within large-scale AI implementations in unpredictable real-world conditions.

Key Contributions to AI in Financial Systems

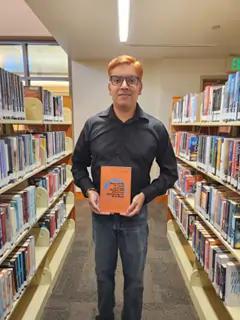

Sharma’s latest publication, Observability for Large Language Models: SRE and Chaos Engineering for Large Scale AI, serves as a vital resource for various industries, particularly financial services. This book, endorsed by AI scientist Vaibhav Shukla of PayPal, guides organizations in ensuring that AI-powered systems in sensitive sectors like finance remain trustworthy and resilient.

Why Reliability Matters in Banking AI

Financial institutions encounter distinct hurdles in deploying AI systems. A fluke in a fraud detection model could allow hundreds of thousands to fall through the cracks, and a downtime in digital banking services could disrupt millions of customers globally. Unlike consumer technologies, failures in reliability can lead to reputational damages, regulatory scrutiny, and potentially billions in losses.

Sharma’s Expertise and Educational Background

Ankush Sharma’s academic credentials are impressive. With a diploma in computer engineering and a master’s degree in computer science, he also boasts affiliations with renowned institutions such as Stanford, MIT, and the University of New Hampshire. His recent work combines observability—the ability to measure and understand AI behavior—with chaos engineering, to stress test systems under real-world failure conditions.

Bridging Research and Practice

Sharma’s influence stretches into academia with his peer-reviewed article, “The Role of Artificial Intelligence in the Revolution of Financial Services: From Fraud Detection to Personalized Banking” (Taaleem Journal, 2024). This research outlines how AI transforms the operational framework of the financial sector, emphasizing transparency and reliability in every interaction.

Building Trust in Financial AI

While news headlines often highlight sensational AI failures, the true essence of reliability remains behind the scenes. Customers and regulators alike expect unwavering stability from financial systems. As businesses harness AI technology within their operations, Sharma’s frameworks ensure that these systems not only captivate attention but also establish long-lasting trust. The narrative of AI in finance will be less about flashy breakthroughs and more about the sustained confidence reliability brings to every transaction.

In conclusion, as financial services continue evolving, the importance of building reliable, transparent AI systems cannot be overstated. For decision-makers in the finance sector, acknowledging and prioritizing AI reliability could represent one of the most significant advancements in the industry’s future.