India’s Fintech Blockchain Market: Growth Projections and Trends for 2033

The India Fintech Blockchain market is undergoing significant growth, as highlighted in a recent report by the IMARC Group titled India Fintech Blockchain Market Size, Share, Trends and Forecast by Industry, Application, End User and Region, 2025-2033. This report provides a comprehensive analysis of the current market dynamics, along with forecasts for the upcoming years.

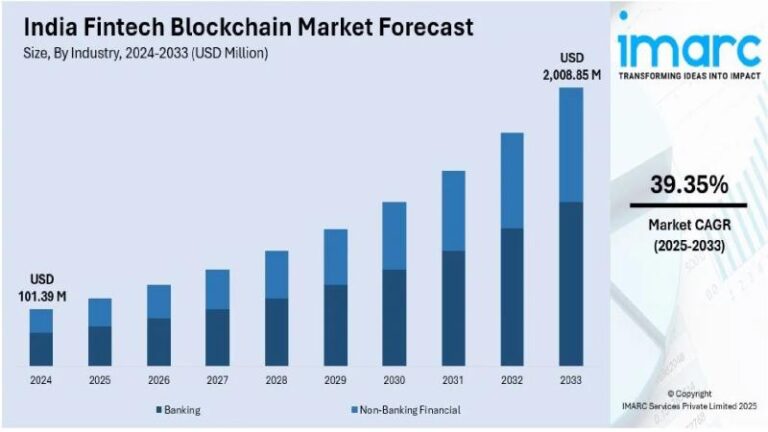

As of 2024, the market’s size reached approximately USD 101.39 million, and projections indicate it could soar to USD 2,008.85 million by 2033. This rapid expansion reflects a compound annual growth rate (CAGR) of an impressive 39.35% from 2025 to 2033, indicating strong upward momentum in the sector.

Current Trends and Drivers in the Fintech Blockchain Landscape

The persistent adoption of decentralized technologies by banks and financial institutions is a key driver propelling the Fintech Blockchain market in India. The demand for secure, transparent transaction methods is elevating blockchain to a foundational layer across both banking and non-banking sectors. Furthermore, ongoing government support for digital innovation significantly enhances the appeal of blockchain solutions. The improving digital infrastructure and regulatory framework also contribute to this growth, fostering an environment conducive to financial inclusion and increased consumer trust.

Technological Advancements Shaping the Future

Automation via blockchain technology is transforming traditional financial processes. Intelligent contracts and decentralized financial solutions (DeFi) are simplifying operations across various domains like credit applications, digital identity verification, and cross-border fund transfers. As fintech companies increasingly leverage these technologies, fractional ownership of assets and enhanced liquidity on capital markets are becoming mainstream. Moreover, synergies between Indian startups and global tech players are broadening the application scope of blockchain solutions.

Segment Analysis of the Fintech Blockchain Market

The IMARC Group’s report breaks down the Fintech Blockchain market into industry segments, application sectors, and end-user categories. Key industries adopting blockchain technologies include banking and non-banking financial institutions, while applications span intelligent contracts, fund transfers, identity management, compliance solutions, and more. End users vary from small and medium-sized enterprises (SMEs) to large corporations, showcasing the diverse impact of blockchain across the financial spectrum.

Regional Insights and Future Collaborations

India’s Fintech Blockchain market reflects geographical diversity, with notable developments across regions such as Northern, Southern, Eastern, and Western India. Recent collaborations, like the alliance formed between Lysto and Nazara Technologies in December 2024, aim to establish a Blockchain Infrastructure platform for digital marketing applications. Additionally, initiatives like Algorand’s partnership with T-Hub support the growth of web3 startups, enhancing the innovation landscape in the industry.

The Bigger Picture: Financial Inclusion and Security

The drive towards secure digital payment channels and transparent transactions is a significant factor fuelling growth in the India Fintech Blockchain market. Regulatory incentives promoting blockchain adoption, alongside increased investments from venture capitalists, foster innovation among startups. Addressing issues like fraud, data integrity, and real-time settlements continues to motivate companies to explore and implement blockchain-based solutions.

Conclusion: A Bright Future Ahead

With a burgeoning ecosystem and strong market drivers, the India Fintech Blockchain sector is poised for exceptional growth. As the landscape evolves, companies are likely to enhance their offerings and embrace innovative technologies, ensuring that blockchain remains a key element of the nation’s financial infrastructure. For those interested in delving deeper, the full report by the IMARC Group offers extensive insights and details about market dynamics and projections.

For further information and to access the complete report, visit: IMARC Group.