The Rapid Growth of the Fintech Market

Fintech market

Market Overview

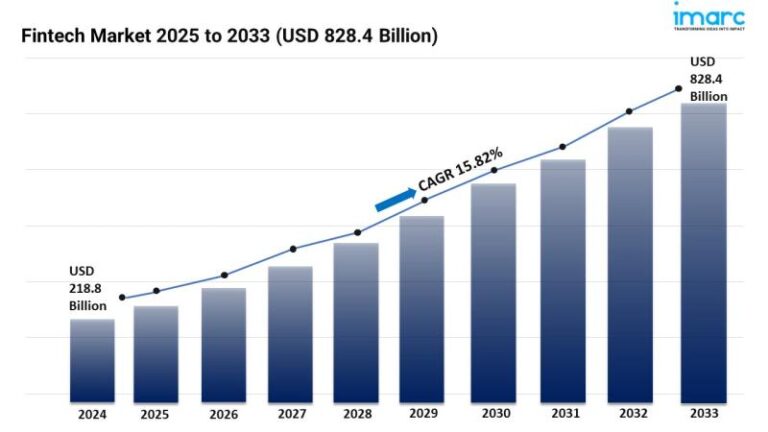

The Fintech market is currently experiencing remarkable growth, propelled by the rise of digital payments, advancements in regulatory frameworks, and the demand for personalized financial services. According to research by the IMARC Group, the global fintech market was valued at 218.8 billion USD in 2024 and is projected to skyrocket to 828.4 billion by 2025-2033.

In-Depth Analysis

This comprehensive analysis delves into industry size, commercial trends, market shares, key growth drivers, and regional forecasts. The report encompasses a thorough examination of market dynamics, including growth opportunities and challenges, as well as technological advancements and emerging trends. Furthermore, it provides insights into the competitive landscape of the fintech sector.

Key Growth Factors

Dominance of Digital Payments

The fintech industry is significantly motivated by the growing adoption of digital payment solutions. Consumers and businesses are increasingly embracing mobile wallets, digital platforms, and contactless payment methods due to their convenience and efficiency. This shift is supported by the proliferation of smartphones, widespread internet access, and the move toward cashless transactions, creating a surge in demand for secure and instant payment options.

Evolving Regulatory Landscape

As the fintech market expands, the evolving regulatory landscape plays a crucial role. Governments and financial authorities worldwide are adapting regulations to foster innovation while ensuring consumer protection and financial stability. These changes can present both opportunities and challenges, affecting business models and market entry strategies for fintech companies.

Personalized Financial Services

A significant trend within the fintech market is the increasing demand for personalized financial services. Fintech firms are leveraging data analytics, artificial intelligence, and machine learning to offer customized products, such as tailored budgeting tools and personalized investment advice, enhancing customer engagement and loyalty.

Main Industry Players

Key companies shaping the global fintech industry include:

- Adyen NV

- Afterpay Limited (Block Inc.)

- Klarna Bank AB

- PayPal Holdings, Inc.

- Robinhood Markets Inc.

- and many others.

Segmentation of the Fintech Market

By Deployment Mode

The market is segmented by deployment modes, primarily into on-premises and cloud-based solutions. On-premises solutions represent the largest segment due to a preference among financial institutions for maintaining control over sensitive data and infrastructure.

By Technology

Technological segmentation includes application programming interfaces (APIs), artificial intelligence, blockchain technology, robotic process automation, and data analytics, enabling varied fintech applications.

Regional Insights

Regionally, the fintech market is robust in North America, benefiting from a high number of fintech startups and established financial institutions. The Asia-Pacific region is also showing rapid growth, driven by strong demand for innovative financial solutions.

Get the Full Report

If you’re interested in a complete analysis and specific details, you can obtain a sample report here.

About IMARC Group

IMARC Group is a global management consulting firm dedicated to providing comprehensive market entry services and strategies. They assist businesses in navigating complex market landscapes through feasibility studies, regulatory approvals, and competitive analysis, among other services.

Contact Information

For further inquiries, reach out to the IMARC Group:

Address: 134 N 4th St. Brooklyn, NY 11249, United States

Email: sales@imarcgroup.com

Phone: +91 120 433 0800 (India), +1-631-791-1145 (USA)