Ambak, who claims to be India’s Fintech Fintech in India’s fastest growth for home loans, announced Tuesday that it had raised $ 7 million in combined seeds and pre-series pre-series funding Round led by Pierre XV Partners.

The Tour also witnessed the participation of other investors, notably Advanteedge VC, DEVC and a network of providential investors.

Simplify the home finance sector

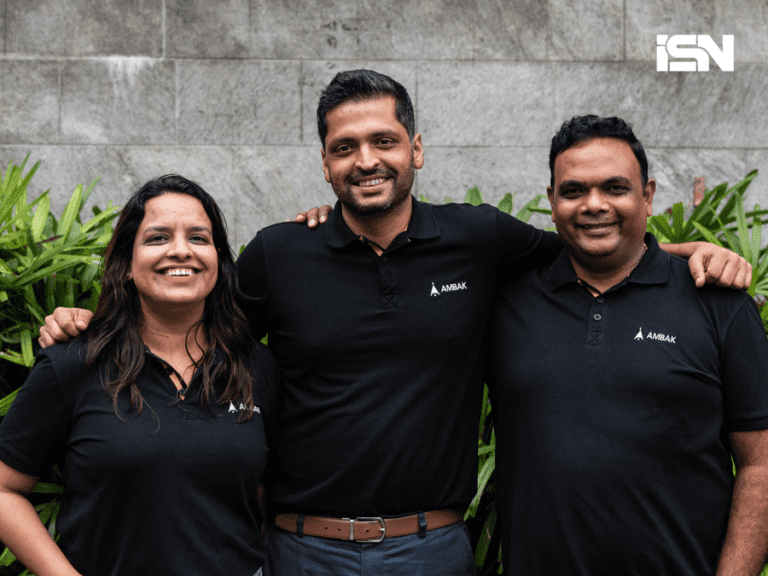

Launched in January 2024 by the former leaders of PB Fintech, Freeload, Cardekho and Zestmoney, Ambak says that it aims to simplify a home financing sector worth $ 160 billion per year.

The startup notes that even with government programs such as Pradhan Mantri Awas Yojana, borrowers still find the heavy process, due to more than 150 financial institutions offering various options.

Ambak simplifies this by providing a transparent process in three steps to select the right financier, supported by digital public infrastructure (DPI) and banking rules.

Presence of the Ambak market

During its first 12 months, Ambak joined more than 15,000 customers in six states, integrated into more than 50 lenders and built a network of 3,000 manufacturers and brokers.

He also signed an official partnership with the Delhi Development Authority, which should serve up to 35,000 house buyers during the coming year.

This growth prompted their existing investors with Pic XV, which allowed additional $ 3.7 million in January 2025 to co-create new products, build AI tools and extend distribution to all the main Centers in India.

Leadership comments

“For a majority of Indians, the purchase of a house is the biggest financial decision they will take, but the process remains extremely complicated,” said Ambak CEO Raghuveer Malik.

“Ambak’s mission is to distribute $ 20 billion in home financing per year over the next five years, providing transparency, affordability and predictability on the market.”

Ashish Agrawal, Managing Director of Peak XV, added that the mortgage is the largest credit market in India and highlighted Ambak’s high traction as proof that the startup is well placed to meet the needs of ‘industry.

“We think they can take advantage of technology effectively to resolve borrowers, intermediaries and banks,” said Agrawal.

The startup uses technology and integrations with digital public infrastructure services (DPI) to serve both the customer and their loan partners, offering a simple and assisted process to obtain a mortgage.

“We estimated that the distribution of the secure retail sale space, in which real estate loans are the largest component, has been riddled with lack of innovation despite lenders who have made monumental upgrades during of the last 5 years, “said Ramehwar Gupta, CTO d’Ambak, which previously, the CTO of Freeload (by Axis Bank). Ambak expansion and innovation objectives

Plans to develop in 35 cities

Ambak says that it will use the capital raised to extend its operations in 35 cities and serve more than 100,000 customers, crossing $ 1 billion in disbursements during financial year 26. The startup is focused on strengthening its tools Loan comparison, the development of vernacular robots for better awareness of customers and improving its AI / ML loan processing engine.

He co-creating products with financiers to extend the options and deepen financial penetration across the country.