Banks and insurers should both invest in human-artificial intelligence (AI) interaction and AI applications for decision-making, according to a new report.

Global data AI in financial services The report notes that AI is already increasingly used in customer-facing and back-office environments within the financial services sector, with the sector having seen “significant digitalization in recent years”.

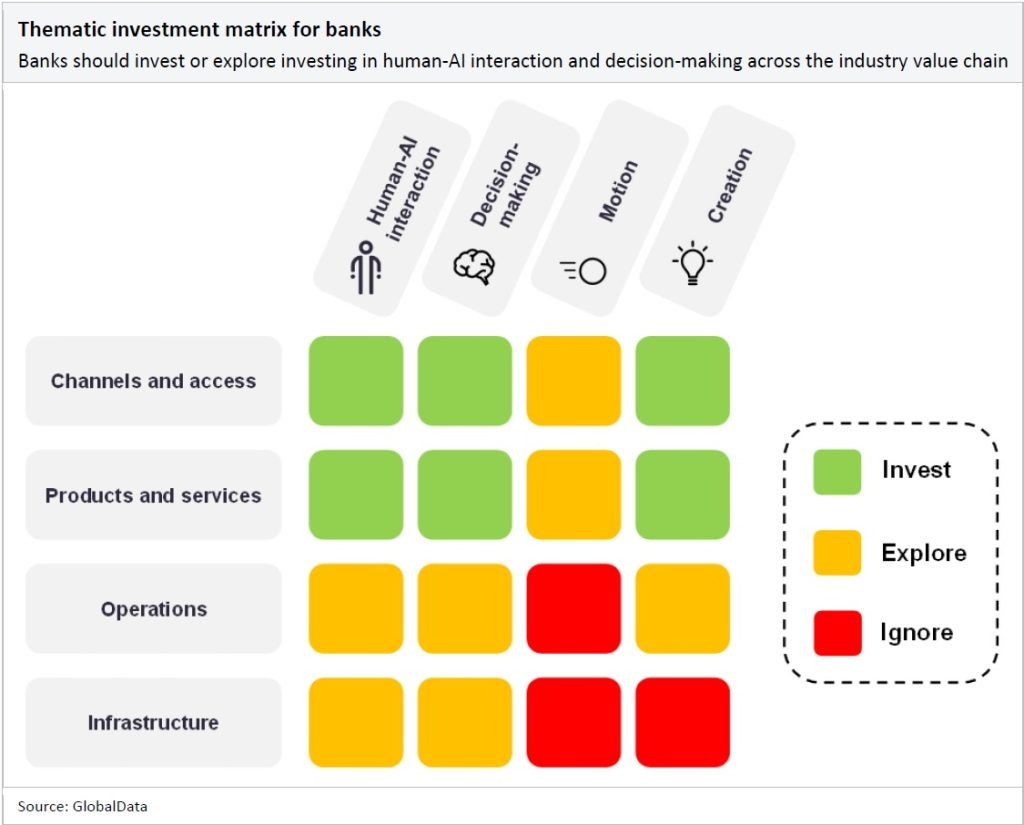

Based on a matrix of categories of advanced AI capabilities (human-AI interaction, decision making, movement, creation and sentience) and layers of the value chain for the banking sector (from infrastructure to operations to through products and services, as well as channels and access). and insurance (from customer service to claims management; underwriting and risk profiling; marketing and distribution; and product development), the report recommends to banks and insurers where they should focus their time and their resources.

Investing in AI for Banks

GlobalData analysis reveals that banks should invest in human-AI interaction, decision-making and creation across channels, access and product and service layers of the value chain. banking value. Specifically, in the area of human-AI interaction, he points to conversational platforms as an area of necessary investment, with the continued shift to digital banking requiring a combination of customer service staff and virtual assistants to provide full support.

On the customer side too, the report flags computer vision as an area of investment due to its role in biometric identification and security.

In the decision-making segment, he suggests banks invest in market trend forecasting and price forecasting capabilities, and also advises continued investment in generative AI across channels and access as well as product and service layers.

Access the most comprehensive company profiles on the market, powered by GlobalData. Save hours of research. Gain a competitive advantage.

Company Profile – Free Sample

THANKS!

Your download email will arrive shortly

We are confident in the unique quality of our business profiles. However, we want you to make the decision that is best for your business, which is why we are offering a free sample that you can download by submitting the form below.

By GlobalData

On this subject, the report explains: “Generative AI can play a vital role in portfolio management by providing market analysis, risk assessment, portfolio optimization, scenario analysis and investor communication . It can help analyze market trends, assess risks, optimize portfolio allocation, simulate scenarios, communicate with investors, combat behavioral bias, and use historical data for predictive modeling .

Investing in AI for insurers

Although the report recommends banks to invest more in categories of AI capabilities, it advises insurers to invest more in the value chain. Indeed, there are investment recommendations for insurers at four of the five levels of the value chain.

“AI is becoming an increasingly important tool in underwriting and risk profiling,” the report said. “Virtual assistants and forecasting capabilities, which fall under the human-AI interaction and decision-making segments respectively, are particularly important for assessing risks and supporting policy underwriting. These AI tools can also create more personalized insurance products.

Notably, when it comes to banks, the report also recommends insurers to invest in generative AI, highlighting that it has the potential to streamline services. He gives the example of a technology company Sedgwick’s Sidekick Toolwhich it describes as “an AI-driven generative application that uses OpenAI’s GPT-4 technology to improve the workflow of insurance claims professionals.” The application can streamline the processing of claims documents, thereby reducing human errors and saving time on manual tasks.

Across financial services, the report says AI can help address the challenges of personalization through customer data analysis, cybersecurity through monitoring, and channel switching through the provision of digital touchpoints.