An artificial intelligence capable of making autonomous decisions without human intervention. Discover agentic AI.

AI and agentic AI could have a greater impact on economics and finance than the Internet era.

This paradigm shift in AI relies on a combination of technological advances in contextual understanding, memory and multitasking capabilities.

Agentic AI is effectively driving the Do It For Me (DIFM) economy. In financial services, users will have their own bots or AI agents helping them choose products and execute transactions. Competition will intensify as start-ups grow.

The nature of the work could change. Tasks that are today outsourced to subcontractors or third parties will increasingly be carried out by agentic AI.

The financial services sector is the second largest consumer of GenAI after the telecommunications and media sector. Historically, banks spend the most on technology (outside of the tech industry). This trend will likely continue with GenAI and agentic AI as well.

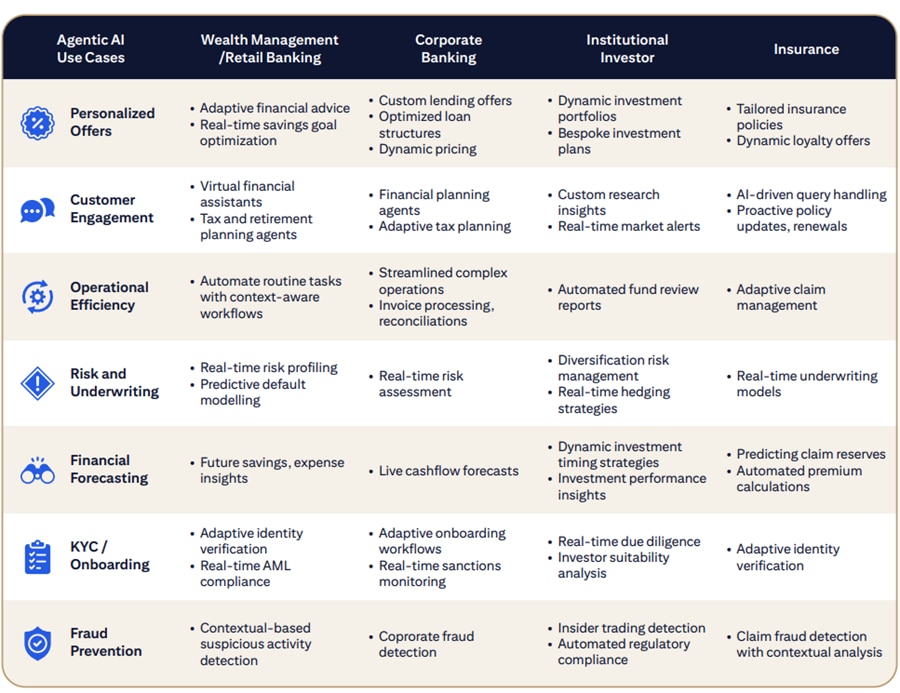

Agentic AI Use Cases in Financial Services

Agentic AI is largely in an experimental phase – and this report offers insights gleaned as we looked under the hood at what’s currently being built for future production.

We spoke with more than 30 AI startup founders, BigTech executives, and other external experts to prepare this GPS report.

It highlights some of the top use cases for agentic AI in financial services, ranging from compliance, deepfake and fraud prevention, onboarding and KYC, wealth, credit , cash flow and much more.