ARLINGTON, Virginia (7News) — Would you turn to artificial intelligence (AI) for financial planning?

Alexander Harmsen hopes you will say yes; he came up with the idea for an AI program after becoming frustrated with financial planners.

“What they really wanted me to do was move all my assets into their accounts, and then they would charge me a management fee of 1% or 1.5%, whether they beat the market or not,” Harmsen said. “I felt like I either had to hand over complete control of all my money to a portfolio manager or do it all myself.”

His project, WalletPilotis designed to act as a financial coach and help people make the best financial decisions for them.

“We took human financial advisors, broke them down into their constituent parts and reassembled them into this software. So part of it is the actual financial advice: “Buy this, sell this, this is the right asset allocation.” So we built that. It was part tax optimization, part scenario modeling, part estate planning. Part of it is just having control over yourself to not do crazy things,” Harmsen said.

He said users can see what happens in different scenarios, like if the 2008 financial crisis was happening now. It can also show what would happen if everything went well.

“The system is very opinionated and will tell you: This is a good idea, this is not a good idea,” Harmsen said.

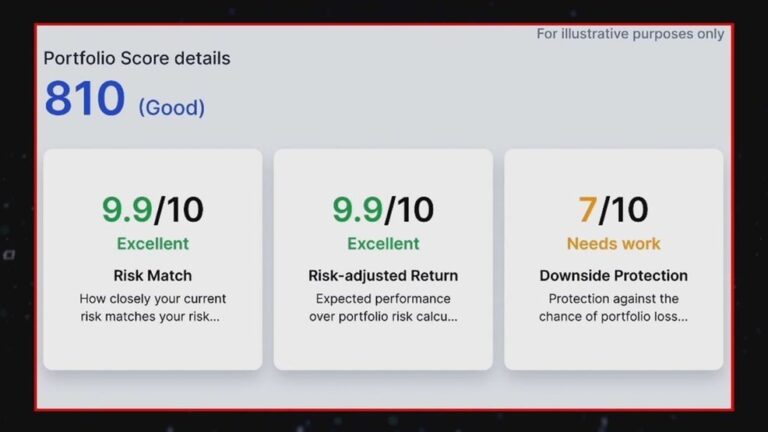

Harmsen said it would also provide a report card, assessing users’ current financial situation.

“We’ll literally give you a score from 0 to 1,000, kind of like a credit score, where we’ll tell you you’re at 720. That’s pretty good, but you know, you could do better,” he said. -he declared.

As of early October, Harmsen said PortfolioPilot had 23,000 users across its three tiers, including a free tier.

Harmsen insists that user data is never shared and that they don’t ask people to transfer money to them.

“…So we give you advice on your current situation…401K, IRA, 529, your brokerage accounts, your crypto account, even your real estate, whether it’s your primary residence or your rental properties, stock options, student loans. , private debts, jewelry, cars. You know, you can add whatever you want into the product,” Harmesen said. “And so, at its core, it’s just a portfolio tracker and a portfolio tracker. net worth, updated daily and giving an estimate of your current net worth. as markets evolve. »

Aaron Clarke, wealth advisor at Heritage Financial, LLC, and president-elect of Financial Planning Association from the National Capital Region, believes that AI could be a good place to start one’s investment journey. However, he believes that AI is limited and that a real financial planner is sometimes necessary. Here is his full statement:

“For new investors, navigating the stock and bond markets can seem overwhelming, especially if you’re not sure if you’re ‘qualified’ to work with a financial advisor. In these situations, AI-powered financial tools can be a great place to start. can help keep costs low, offer tailored investment strategies, and even provide basic financial planning information that fits your needs.

However, it is essential to recognize that while AI tools can be useful, they have their limitations. These platforms may not fully capture the unique details of your financial situation or provide the comprehensive advice you need. As your financial journey evolves, consulting with a professional can offer you valuable insight into your situation and the strategies best suited to your goals.

At some point, you’ll likely find that the one-size-fits-all approach of these AI tools no longer meets your growing financial and emotional needs. When this happens, partnering with a financial advisor becomes essential to advancing your wealth-building efforts and increasing your well-being.

So no matter where you are in your journey, start today by speaking to a fiduciary financial planner through Planner Search and find out what type of tool or advice is best for you in your current situation.