AI is transforming personal services, from fitness to financial planning. Allison Schrager’s personal trainer Doug adapts his workouts remotely via an app, leveraging technology to provide premium services at an affordable price. Likewise, AI-powered financial advisors are revolutionizing the way we manage money, offering personalized advice to a wider audience. Even as technology improves efficiency, the human touch remains essential to building trust and overcoming emotional challenges. The future likely holds a hybrid approach, combining AI precision and human connections.

Sign up for your morning brew from BizNews Insider to stay up to date on content that matters. The newsletter will arrive in your inbox at 5:30 a.m. weekdays. Register here.

By Allison Schrager

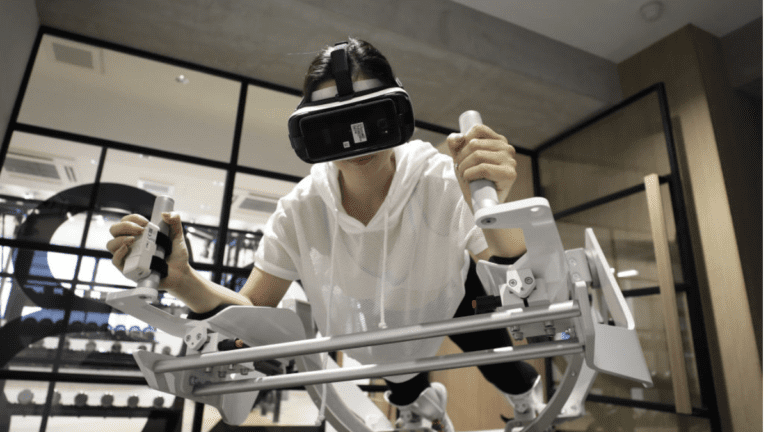

I see a personal trainer five days a week and am now in the best shape of my life. I couldn’t have afforded Doug when I was younger – and I couldn’t today, without technology. Doug lives on the West Coast and trains me (and dozens of others) via an app. It programs the exercises I like, takes into account possible injuries, monitors my efforts, corrects my form and sends me motivational messages. Thanks to AI, it now has the potential to create even more personalized workouts for even more customers. ___STEADY_PAYWALL___

I suppose AI could replace him entirely, but the fact that Doug is a real person is important. I know he’s watching and I believe he’s invested. I feel like I’ll disappoint him if I don’t show up every day. I wouldn’t care if he was a robot.

My experience with Doug is a case study in how to use technology to bring what was once a high-end personalized service to the masses. It is the future of not only fitness but also financial planning.

In fact, the entire service sector is on the verge of transformation. Just as the industrial revolution changed the way goods are manufactured and consumed, the technological revolution will have a beneficial effect on services. Once a product can be produced at scale, its market can expand and be segmented; some people may want (and can afford) Birkin bagswhile others will prefer canvas totes. The same goes for financial planning.

Financial planning is already in a transition phase. First, the transition to defined contribution Pension schemes and increasing life expectancy mean more people need advice. Planning for retirement is not easy; you don’t know how long you or your spouse will live, or what health problems will arise, and yet you must decide how much you will save, spend and invest. Sometimes you’ll just need someone to talk you out of selling when the market is falling.

A prevailing theory is that the more money you have, the more financial advice you need. But everyone needs help. And the fewer you have, the smaller your margin for error. Good advice is less about beating the market and more about planning and managing risk.

Traditionally, financial advisors — those who pay only fees — only took on high-net-worth clients, usually people with at least $1 million. But robo-advice, which has been around for more than a decade, has changed the economics of the field. Automated asset allocation has become accessible to more people, regardless of their net worth.

At the beginning the the first users were millennialswho were more comfortable with technology and did not have complex needs. NOW AI can provide even better advicemore adapted to individual needs and able to discuss like a human advisor. It can even be trained to anticipate behavioral quirks that prevent people from making less-than-optimal financial decisions.

That said, the future is likely a hybrid model – the financial planner equivalent of my personal trainer Doug. In this hypothetical future, my financial advisor – let’s call him Warren – uses AI to help me design a personalized portfolio for me and for basic communication. This gives Warren more time for his primary function: managing our relationship.

A good advisor is both a financial planner and a therapist. They will force you to have difficult discussions about issues such as the viability of financing your 40-year-old son’s music career and end-of-life costs. I suppose AI robots could get better at these kinds of discussions, but would you really want to connect with a robot after your spouse dies and you take charge of the household finances for the first time? Or when your child faces a costly illness? People often rely on their financial advisors during difficult times. And they are willing to pay a lot for a human touch.

So far, the market for AI-assisted financial advice is small. But growth and segmentation are inevitable. If you have a trust fund, your advisor may use some technology but will still give you a lot of time and attention. If you have more than $100,000 but less than $1 million, you’ll likely end up with an AI-enabled human advisor who will keep an eye on your portfolio while continuing the difficult discussions. If you have less than $100,000, you’ll likely rely entirely on technology to manage your money — which, at least when it comes to portfolio construction, could soon be as effective as a high-end advisor.

Like I said, Doug got me into the best physical shape of my life. It’s not crazy to think that the same AI-assisted model could also help many people improve their financial situation.

Read also:

© 2024 Bloomberg LP