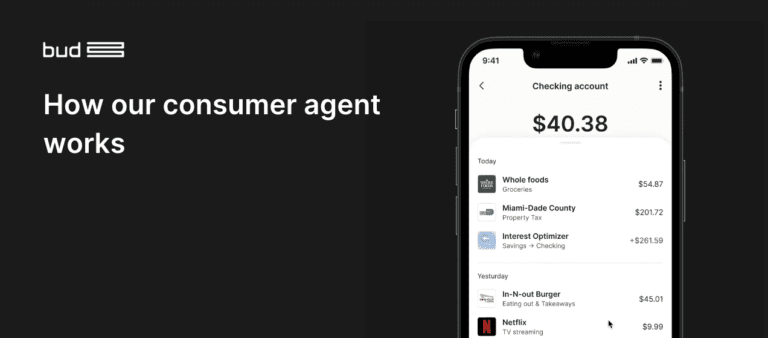

AI-powered financial data platform Bud Financial has launched an AI agent that can perform tasks on behalf of customers, such as transferring money between accounts to avoid unnecessary overdrafts.

Unlike AI agents that simply respond to prompts, an agentic model can perform many tasks and learn from its experiences. In this case, it will take information about the customer, such as their financial history and situation, to help them improve their finances.

Bud said it will integrate the consumer-facing agent — which can also move money between customer accounts to improve interest — into its GenAI and customer-facing product suite.

“At Bud, we already have a technology stack that understands financial data like no one else in the market,” said Edward Maslaveckas, CEO and co-founder of Bud. “This means our agent capabilities are built on trusted individual context.”

“Every area of banking can benefit from these models: fraud, AML, marketing, pricing, credit decisions and risk management. The applications of agent technology are far-reaching,” Maslaveckas added.

According to Bud, a recent analysis of a U.S. bank’s customer base indicated that, had the agent been in business, it would have generated at least $500 in profits over the course of a year for more than 27 percent of customers.

Bud, a staunch defender of financial inclusion He claims that for a low-income profile, the agent would have effectively protected clients from overdraft fees, which would have avoided an average of $460 in fees – and for some clients, the avoided fees were in the thousands of dollars, according to Bud.

The technology will be available on Bud’s platform for its customers, and any bank or financial institution interested in leveraging agentic AI can license the software.