Nigeria SEC Revamps Minimum Capital Requirements for Capital Market Entities

The Nigeria Securities and Exchange Commission (SEC Nigeria) has initiated a comprehensive overhaul of the Minimum Capital Requirements (MCR), leading to substantial increases in the financial thresholds for various operators in sectors including traditional finance, fintech, commodities, and digital assets. This significant regulatory change aims to foster resilience and enhance investor protection within the Nigerian capital market.

New Framework Overview

Outlined in Circular n°26-1 dated January 16, 2026, this framework has been issued under the Investments and Securities Act, 2025. It signifies the most extensive reform of Nigeria’s capital market in over ten years.

Goals of the Revised Requirements

The SEC’s review focuses on enhancing the market’s robustness and protecting investors. The updated requirements are anticipated to:

- Strengthen the financial stability and operational resilience of market entities.

- Align capital levels with the intricacies and risk profiles of contemporary market activities.

- Promote market stability and mitigate systemic risks.

- Encourage innovation and orderly growth in emerging sectors like digital assets and commodities.

Who Does This Affect?

The revised MCR applies to all SEC-regulated entities, which include:

- Core and non-core capital market operators

- Market infrastructure institutions

- Capital Markets Consultants

- Fintech Operators

- Virtual Asset Service Providers (VASP)

- Commodities market intermediaries

Significant Changes in Capital Requirements

Regulations have been tightened across various segments, particularly for brokerage and fund management activities:

- Broker (client execution only): Increased to ₦600 million from ₦200 million.

- Broker (own account trading): Now ₦1 billion instead of ₦100 million.

- Broker-Dealer: Set at ₦2 billion, up from ₦300 million.

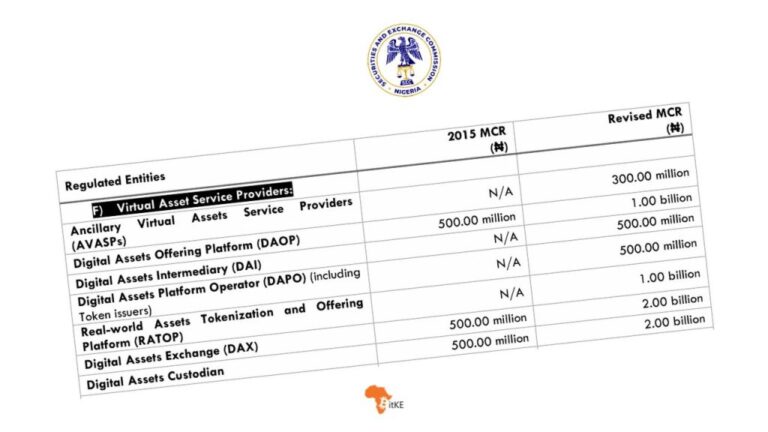

Impact on Fintech and Digital Asset Markets

The revised requirements specifically address the fintech and digital asset space, solidifying the regulatory stance in Nigeria. For instance, new capital benchmarks for virtual asset service providers have been introduced, marking a crucial step in the formal integration of these sectors into the capital market structure. Such measures signal a commitment to establishing a well-capitalized and compliant environment for crypto operators.

Compliance Timeline and Future Oversight

Entities affected by the updated regulations must adapt to the revised MCR by June 30, 2027. The SEC has warned that non-compliance could range from regulatory sanctions to the suspension or withdrawal of registration. Moreover, the Commission will provide guidance on compliance processes in due course, ensuring that transitional arrangements can be managed effectively on an individual basis.

Conclusion

This strategic reform by the SEC marks a critical shift toward stricter regulations and stronger institutional participation in Nigeria’s financial landscape. The updated framework not only aims to bolster investor confidence but also positions Nigeria prominently in the evolving global digital asset environment. As the country moves forward, the message is clear: robust capital standards are essential for sustainable growth and regulatory compliance in Africa’s largest economy.