Emerging Technologies in Fintech: A 2034 Market Outlook

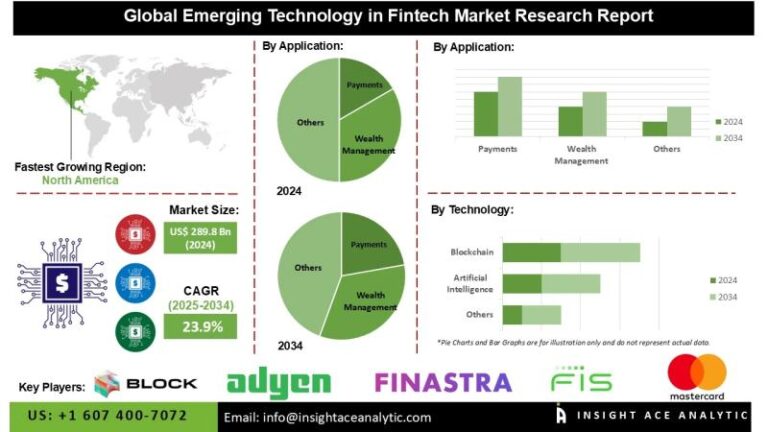

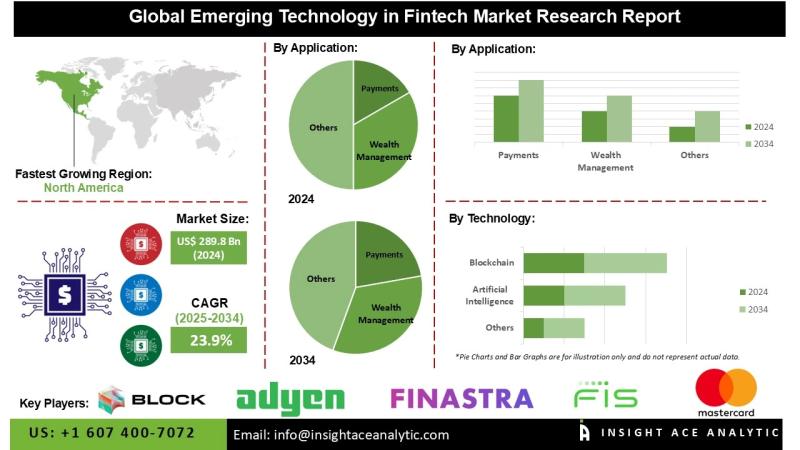

InsightAce Analytic Pvt. Ltd. has released a comprehensive market assessment report titled “Emerging Global Technology in Fintech Market, Size, Share, and Trend Analysis Report,” covering pivotal technologies such as artificial intelligence (AI), blockchain, cloud computing, and quantum computing. The report projects a financial evolution from a market size of US$ 289.8 billion in 2024 to an anticipated US$ 2,369.8 billion by 2034, reflecting a remarkable CAGR of 23.9% from 2025 to 2034.

Key Drivers Behind Fintech Transformation

The rapid adoption of technologies such as AI, blockchain, and cloud solutions is catalyzing significant changes in the fintech landscape. These innovations are enhancing operational efficiencies, security, and customer experiences across various financial services. Enhanced financial inclusion strategies are particularly benefiting underserved populations, expanding access to secure banking and payment services.

Impact of Mobile and Regulatory Frameworks

With the surge in smartphone usage and supportive regulatory initiatives like open banking in Europe, the fintech market is accelerating its growth. AI-driven credit scoring and blockchain-based payment networks are vital in providing reliable services to unbanked communities. The adoption of API-based ecosystems further simplifies operational processes, fostering a more democratic financial landscape.

Leading Players in Fintech Innovation

The fintech sector features several key players, including:

- PayPal

- Block, Inc.

- Stripe, Inc.

- Ant Group CO., Ltd.

- FIS

- Adyan

- Finastra

- MasterCard

- Revolut Ltd.

- Robinhood

- Goldman Sachs

- N26 SE

- Zelle

- Visa

- Chime Financial, Inc.

Challenges in Emerging Fintech Technologies

While growth is evident, challenges exist in implementing these advanced technologies. Transitioning from legacy systems entails significant expenses and operational risks. Many smaller institutions may struggle with these financial burdens and complexity, leading to disparities in market penetration.

Regional Trends Shaping the Market

The fintech landscape in North America exhibits robust growth driven by digital transformation. Financial institutions are leveraging AI for enhanced security and personalized services. In Europe, regulatory frameworks like PSD2 promote a competitive environment, enabling secure data sharing among banks and fintech firms. This collaborative ecosystem supports the rapid proliferation of digital financial services.

Future Developments in Fintech

Recent advancements paint a promising picture for the sector. For instance, in January 2025, Adyen launched a new AI-powered payment suite aimed at streamlining transaction processes. Similarly, FIS introduced a cutting-edge revenue insight solution to improve accounts receivable management for businesses.

Conclusion: Navigating the Fintech Future

As the fintech market continues to evolve, identifying growth opportunities and embracing technological innovations will be key for stakeholders. InsightAce Analytic is dedicated to providing strategic insights and customized market intelligence to empower businesses as they navigate this rapidly changing landscape.

For additional insights and to explore potential market opportunities, visit InsightAce Analytic or reach out via email at info@insightaceanalytic.com.