Singapore and UK Join Forces on AI in Finance

Published by Entrepreneur Asia Pacific

Strategic Partnership Announcement

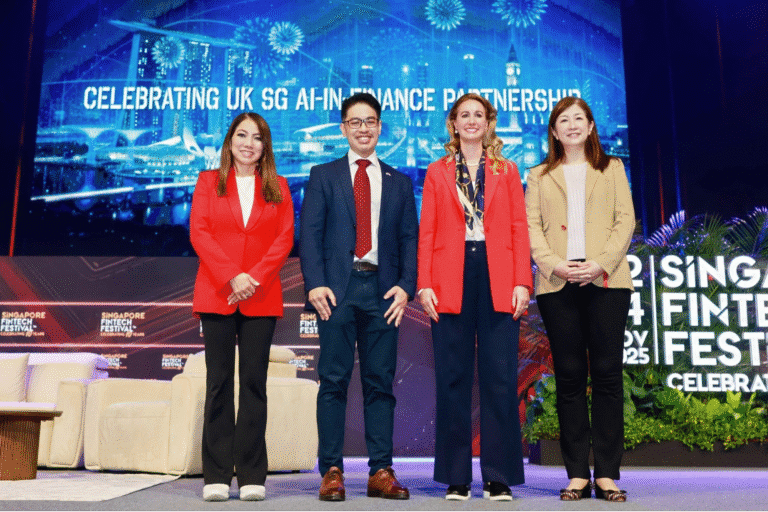

The Monetary Authority of Singapore (MAS) and the UK’s Financial Conduct Authority (FCA) have unveiled a groundbreaking collaboration focused on artificial intelligence (AI) in the financial sector. This initiative, known as the UK-Singapore AI-in-Finance Partnership, was introduced during the prestigious Singapore FinTech Festival.

Aims of the AI-in-Finance Partnership

The primary goal of this partnership is to promote the safe and responsible application of AI technologies while enhancing cross-border innovation between these two significant financial hubs. By fostering collaboration, both nations aim to bolster their global competitiveness in the fast-evolving fintech landscape.

Benefits for Financial Institutions

Through this collaboration, AI solution providers in Singapore and innovators in the UK will have greater opportunities to scale their technologies in both markets. Financial institutions from both countries can look forward to accessing shared knowledge, testing platforms, and a rich exchange of best practices regarding AI implementation in finance.

Focus Areas for Initial Collaboration

The MAS and FCA plan to concentrate on joint testing of AI solutions, sharing vital regulatory information, and engaging in meaningful discussions on responsible AI usage. Collaborative events showcasing cutting-edge approaches to AI in finance will also be part of this initiative.

Existing Programs to Build Upon

This partnership will leverage existing programs, including MAS’s PathFin.ai and FCA’s AI Spotlight, to facilitate the sharing of innovative AI solutions. Strengthening cooperation between the two countries will be essential in establishing best practices and advancing responsible AI usage.

Perspectives from Industry Leaders

Kenneth Gay, Director of FinTech at MAS, emphasized the importance of secure and scalable AI adoption. He described the UK-Singapore partnership as a vital bridge for collaboration among financial institutions, innovators, and regulators in the realm of trustworthy AI.

On the other hand, Jessica Rusu, the FCA’s head of data, information, and intelligence, highlighted that this partnership enhances the global influence of both regulators. She stated, “British and Singaporean businesses will be able to grow through collaboration, evaluate new cross-border opportunities, and shape the future of responsible AI innovation in finance.”

Opportunities for AI Innovators

AI innovators and financial institutions from Singapore and the UK are encouraged to participate in future collaborative events through the FCA’s AI Spotlight and MAS’s PathFin.ai programs. This partnership has the potential to set new standards for the responsible use of AI across the global financial landscape.