Exploring the Growth of the Mexican Fintech Market: Insights and Forecast

The IMARC Group has recently published a comprehensive report titled “Mexico FinTech Market Report”, which performs an in-depth analysis of the essential drivers, segmentation, growth opportunities, and competitive landscape of the fintech industry in Mexico. This analysis provides valuable insights into both current and prospective market scenarios from 2025 to 2033.

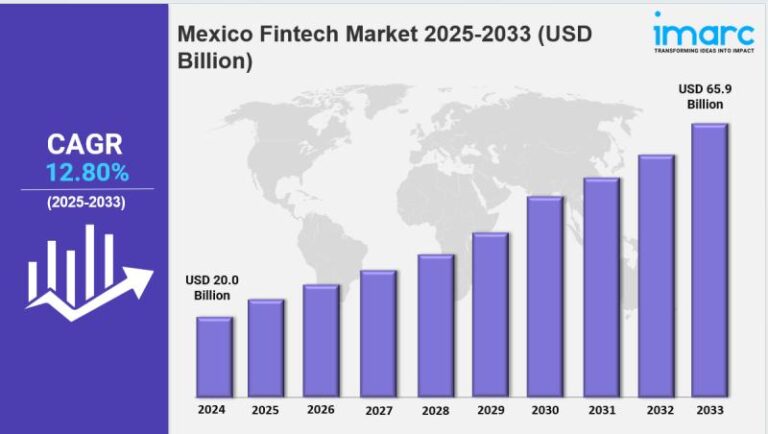

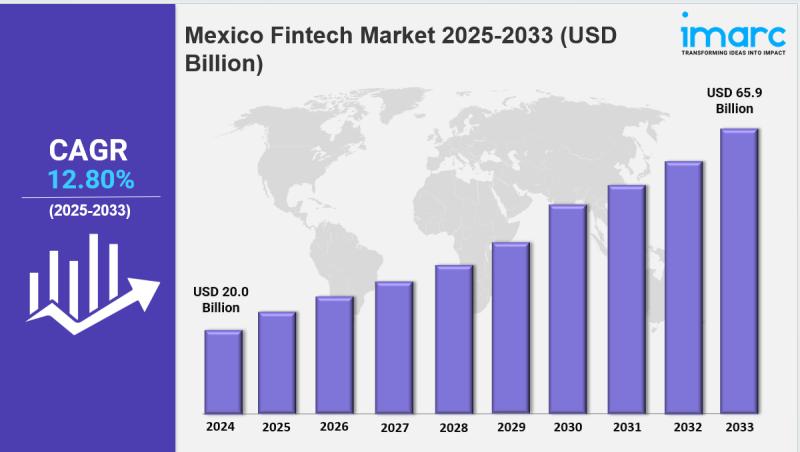

Market Size and Growth Potential

The Mexican fintech market was valued at an impressive $20.0 billion in 2024, with projections indicating a surge to $65.9 billion by 2033. This significant growth represents a compound annual growth rate (CAGR) of 12.80% from 2025 to 2033, showcasing the market’s robust expansion potential.

Drivers Behind Fintech Expansion

As digital transformation becomes increasingly prevalent, the Mexican fintech market is poised for substantial growth. Factors contributing to this escalation include heightened smartphone usage, enhanced internet connectivity, and a growing middle class eager for accessible financial services. As consumers embrace fintech solutions for banking, payments, and investments, financial inclusion becomes a reality. By 2025, demand for innovative financial products is anticipated to rise, showcasing immense potential for fintech companies.

Rise of Digital Payments

The transfer to cashless transactions is significantly influencing the fintech landscape, especially in the digital payments segment. More consumers are adapting to this trend, providing fintech companies with the opportunity to offer seamless payment solutions. As e-commerce flourishes and the acceptance of digital wallets increases, digital payment platforms are predicted to dominate the financial ecosystem by 2025, greatly enhancing user experience while driving competition and innovation.

Regulatory Support Boosting Growth

Regulatory advancements are expected to play a pivotal role in the expansion of the Mexican fintech market. Recognizing the significance of fintech for enhancing financial inclusion and economic progress, the government is likely to establish clear regulatory frameworks by 2025. Such regulations will stimulate healthy competition, protect consumers, and promote innovation, creating a stable environment for fintech enterprises to prosper.

Market Segmentation Insights

The report segments the Mexican fintech market based on various parameters, including deployment mode, technology, application, and end-users. Key categories identified include:

- Deployment Modes: On-premise, Cloud-Based

- Technologies: API, AI, Blockchain, RPA, Data Analytics

- Applications: Payment and Fund Transfer, Lending, Insurance, Personal Finance

- End Users: Banking, Insurance, Securities

Competitive Landscape and Future Outlook

The competitive landscape of the Mexican fintech sector is dynamic and rapidly evolving. The report provides a detailed analysis of key players, their positioning, and the strategies that contribute to their market success. With a comprehensive overview of market performance from 2019 to 2024 and a future outlook from 2025 to 2033, stakeholders are equipped with valuable insights to navigate the fintech arena.

Conclusion

The Mexican fintech market is on an upward trajectory, driven by digital transformation, regulatory advancements, and a rising consumer appetite for innovative financial solutions. As technology continues to integrate with finance, significant opportunities await both new and established players within this exciting market. Understanding the emerging trends and dynamics will be crucial for stakeholders aiming to leverage these growth prospects.