Insights into the Indian Fintech Market: Trends and Projections

Overview of the Indian Fintech Landscape

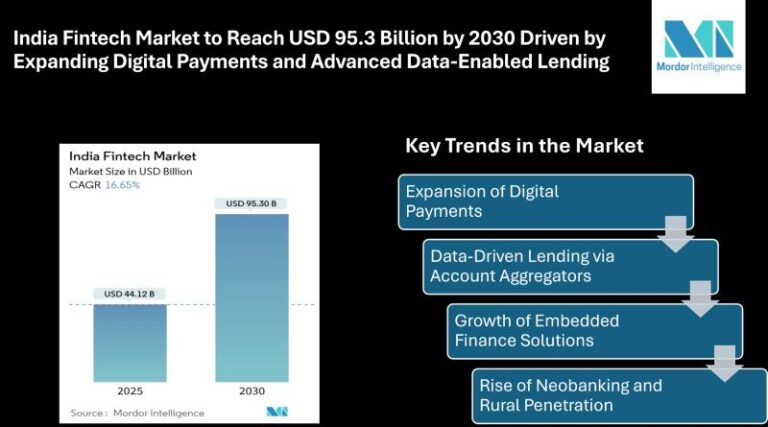

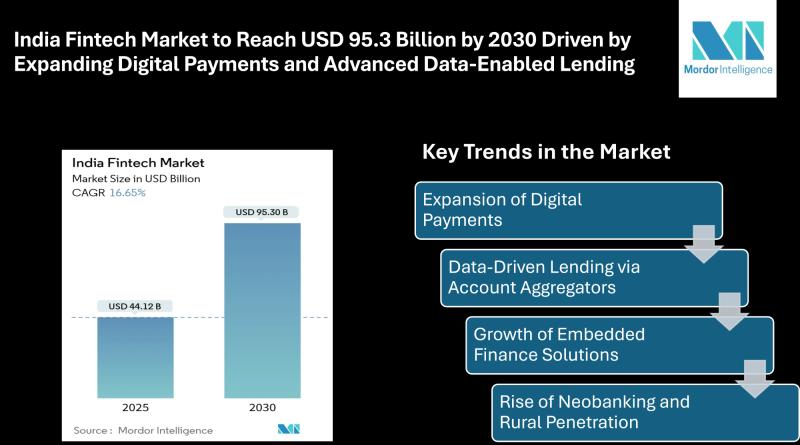

The Indian fintech market is projected to grow from $44.12 billion in 2025 to an impressive $95.30 billion by 2030, showcasing a robust compound annual growth rate (CAGR) of 16.65%. This growth is driven by a combination of factors, including government-backed digital infrastructure, affordable mobile data, and an increasing penetration of smartphones. Together, these elements significantly enhance access to financial services across the country.

Key Trends Shaping Indian Fintech

1. Rise of Digital Payments

The surge in the use of mobile wallets, UPI (Unified Payments Interface), and QR-code-based systems is enabling seamless and quick financial transactions, benefiting both consumers and businesses alike.

2. Data-Driven Lending via Account Aggregators

Through consent-based sharing of financial records, lenders can now extend credit to previously underserved individuals and small to medium-sized enterprises (MSMEs), thereby democratizing access to credit.

3. Integrated Financial Solutions

Innovative integration of payments, loans, and insurance directly into e-commerce and gig platforms enhances customer convenience, providing a holistic financial experience.

Market Segmentation in Indian Fintech

Understanding the market segmentation can help identify the areas with significant growth potential:

- By Service Proposal: Digital payments, digital loans and financing, digital investments, insurance technology, neobanking.

- By End User: Retail and businesses.

- By User Interface: Mobile apps, web/browsers, POS/IoT devices.

Prominent Players in the Indian Fintech Market

Several companies are making a mark in this competitive landscape:

- Paytm: A leading digital payments platform specializing in mobile wallets and various financial services.

- PhonePe: Prominent for its UPI-based payment app facilitating money transfers and bill payments.

- Razorpay: Offers payment gateway solutions and business banking services.

- Pine Labs: Known for point-of-sale solutions and seamless payment integration.

- PayU: Provides a range of digital payment solutions, including online payment processing and lending services.

Future Outlook

The Indian fintech sector is poised for remarkable growth, largely propelled by the increasing adoption of digital payments amid evolving consumer needs. With strong governmental support and a heightened focus on mobile-first solutions, the fintech ecosystem in India is set to thrive further.

Conclusion

As the Indian fintech market continues to expand, staying informed about the latest trends and projections is essential. By leveraging insights from industry reports, stakeholders can navigate this evolving landscape and harness the opportunities it presents.

For a deeper understanding of the Indian fintech market and its dynamics, you can explore additional resources and reports available at Mordor Intelligence.