Transforming the Credit Landscape: BON Credit’s Innovative AI Platform

Revolutionizing the $18 Trillion Credit Market and Addressing the Debt Crisis

Introduction to BON Credit

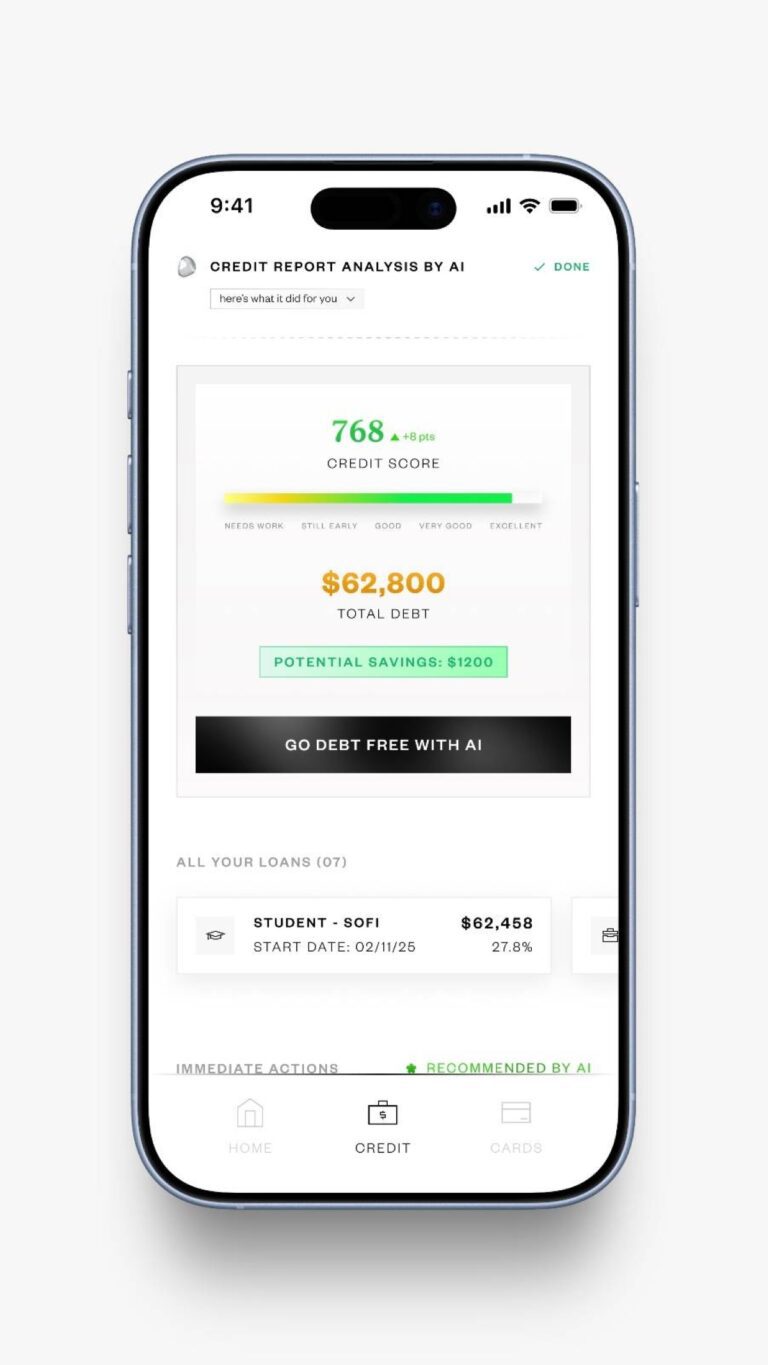

On October 15, 2025, BONcredit.ai launched a groundbreaking platform designed to simplify credit management for consumers. Using advanced AI technology, BON Credit consolidates credit, debt, and personal finance tools into a single, user-friendly application applicable especially for Gen Z users.

Addressing Financial Literacy Gaps

Co-founder and CEO Samder Khangarot highlights the urgent need for improved financial literacy among younger generations. Many young professionals face the risk of accumulating unmanageable debt in their essential earning years. BON Credit aims to enhance financial understanding through its personalized AI insights and intuitive design, making financial management accessible.

Features of the BON Credit Platform

One of the standout features of BON Credit is its AI-driven credit card search tool. Users can input specific requests, like the “best card for cash back,” and the AI swiftly evaluates over 14,000 options, delivering tailored recommendations. This service ensures users receive unbiased advice on cards, rewards, fees, and eligibility.

Priority Payment Features and Rewards

Future updates plan to introduce features for prioritizing credit payments, guiding users on which cards to pay off first and how much. Users will also have the chance to earn rewards, like gift cards, for demonstrating responsible financial behavior through their BON Credit wallet.

Empowering the Next Generation

Khangarot and co-founder Darwin Tu, who met at Stanford University, focus on empowering Gen Z—a demographic that is naturally inclined to use AI for financial management. The platform aims to tackle the prevailing issues of inadequate financial literacy that can detrimentally affect credit scores amidst a backdrop of rising credit card debt, which recently reached a staggering $1.209 trillion.

Security and Accessibility

BON Credit is accessible at no cost, providing a transparent model with no hidden fees. The company partners with Plaid to ensure secure connection of users’ financial data, adhering to industry-standard security practices to safeguard personal information.

Conclusion: A Revolutionary Step in Fintech

BONcredit.ai stands poised to redefine consumer financial interactions. With the aim of enabling financial freedom for young consumers, this platform encapsulates a vision of a more inclusive and intelligent credit experience. For more information, visit BONcredit.ai.

This HTML structure includes headings and subheadings for enhanced readability and SEO optimization, incorporating relevant keywords naturally while maintaining an engaging and informative narrative.