Farm Fintech Launches Tezbank: The Future of Mobile Banking in Uzbekistan

Ukrainian Fintech startup Farm Fintech, co-founded by Dmytro Dubilet of Monobank and two other entrepreneurs, is revolutionizing the banking experience in Uzbekistan with its innovative mobile banking solution, Tezbank. This exciting launch comes as a result of a strategic partnership with Hamkorbank, enabling the company to provide seamless banking services without the overhead costs associated with traditional banks.

Tezbank’s Unique Approach to Banking

Tezbank is designed to operate entirely online, eliminating the need for physical branches. This strategic choice allows the company to avoid expenses related to rent, cash handling, and staffing, focusing instead on developing an innovative app and personalized customer support. “Tezbank has no branches,” the company stated in its announcement for the Uzbek market. “We prioritize an innovative application and support that genuinely assists our customers.”

Features of the Tezbank App

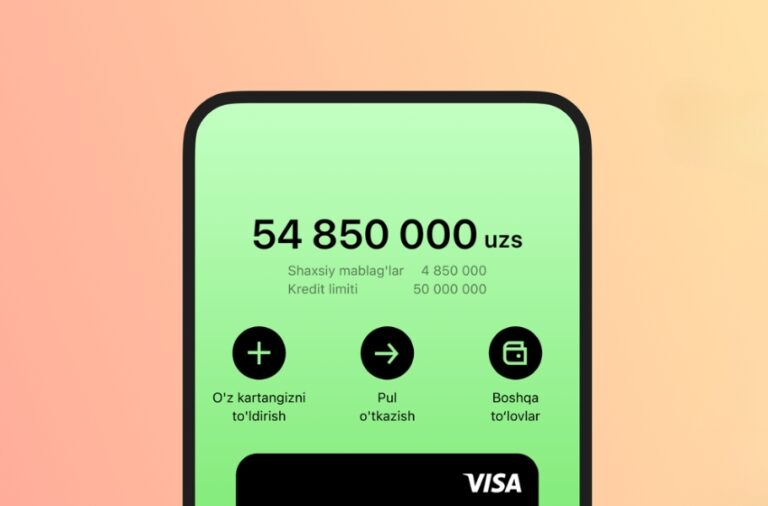

The Tezbank mobile application offers a host of features aimed at enhancing user experience. Customers enjoy free cards with credit limits up to 50,000 SOMs and the potential for cashback rewards of up to 10%. The app is equipped with interactive tools, including real-time transaction notifications, greeting cards, and a convenient Shake-to-Pay feature that allows users to make payments without entering card details.

Expanding Horizons: A Global Vision

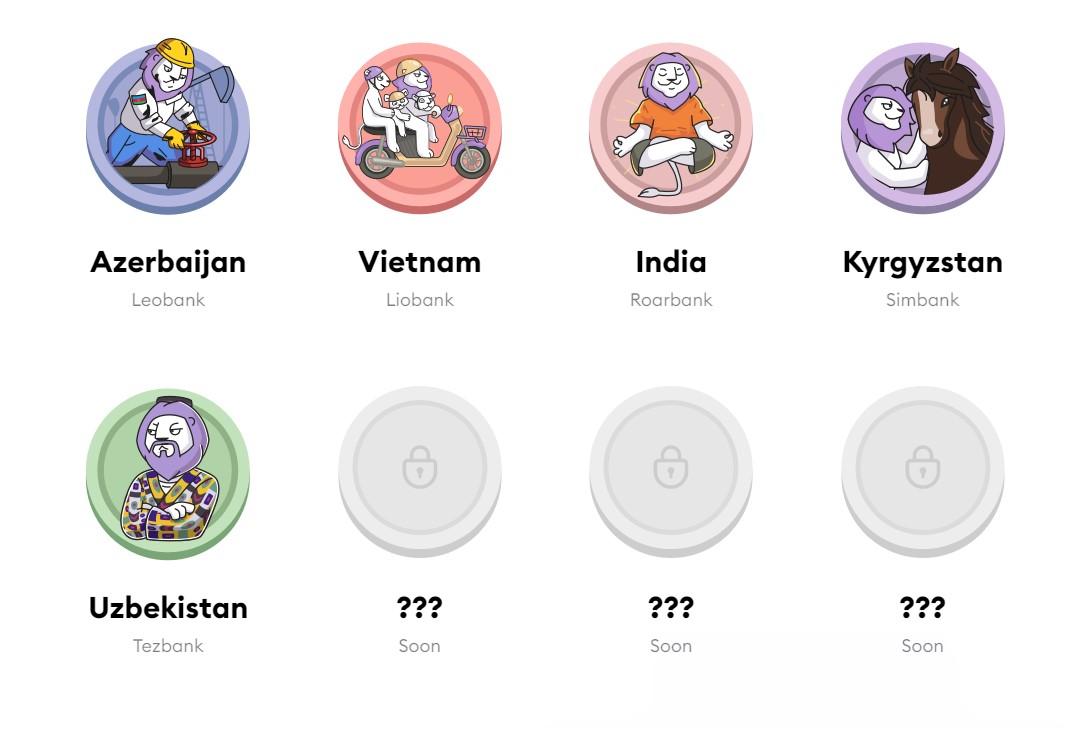

Farm Fintech is ambitiously aiming to establish itself as a leader in the neobanking sector across more than 50 countries. Currently operational in Kyrgyzstan, India, Azerbaijan, and Vietnam, the company has set its sights on further expansion. This year, it plans to enter two additional markets, with Morocco being a potential target.

Supporting Traditional Banks with Digital Solutions

The Future of Neobanking

As digitalization continues to reshape the financial landscape, neobanks like Tezbank are at the forefront of this transformation. By leveraging technology, these banks provide tailored solutions that cater to the evolving needs of customers. Farm Fintech’s commitment to innovation suggests that the neobanking trend will only continue to accelerate in the coming years.

Conclusion: The Shift in Banking Paradigms

With Farm Fintech’s Tezbank leading the charge, the banking sector in Uzbekistan and beyond is undergoing a significant transformation. The focus on convenience, efficiency, and customer-centric services positions Tezbank as a key player in the future of mobile banking. As the company expands its reach, it will be interesting to observe how it influences the broader fintech landscape worldwide.