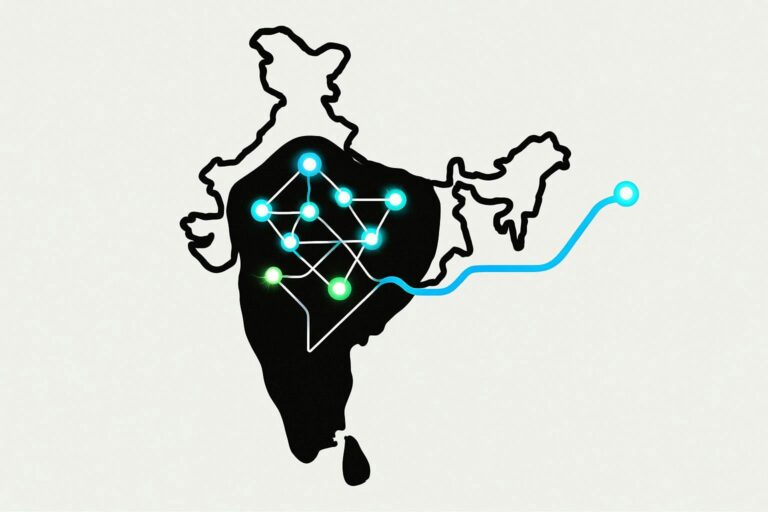

Central Bank of India Unveils AI Initiative

The Central Bank of India has announced an ambitious plan to develop and implement its own artificial intelligence (AI) models tailored specifically for the financial sector. This strategic move is set to revolutionize how financial institutions operate, ensuring they meet local needs and standards.

The Significance of AI in India’s Financial Landscape

The initiative represents a paradigm shift orchestrated by the Reserve Bank of India (RBI). Under the guidance of computer scientist Pushpak Bhattacharyya, the plan aims to integrate AI into the financial industry fabric. By enhancing digital infrastructure and establishing a dedicated fund for innovation, RBI intends to facilitate the growth of AI in banking.

Framework Overview: Free AI

Dubbed “freeai,” the roadmap encompasses various critical aspects, including technical capabilities, policies, governance, and risk management. The RBI envisions AI systems operating seamlessly alongside existing digital platforms like the UPI payment system, ensuring robust monitoring through regular risk assessments involving a diverse group of stakeholders.

Aiming for Innovation and Security

The primary goal of this initiative is to stimulate innovation while staying ahead of potential risks. The introduction of localized artificial intelligence is not just about adaptation but about fostering a secure environment that promotes sustainable growth in the financial sector.

Implications for the Market

The focus on developing local AI capabilities is expected to shift the competitive landscape. Indian banks and fintech companies could find themselves at an advantage, lessening dependency on foreign tech giants. With digital payments in India skyrocketing more than 50% last year—managing a staggering $1.8 billion—targeted AI solutions could unlock new avenues for growth and enhance security measures.

Establishing Digital Surveillance Standards

India’s proactive approach to AI deployment signifies the possibility of harmonizing technological advancement with effective risk management. As the RBI seeks to modernize processes ranging from fraud detection to loan approvals, its model may serve as a prototype for other emerging markets as they navigate similar challenges.

The Future of Digital Finance

As global discussions on AI governance continue, India’s advancements will likely influence the trajectory of digital finance worldwide. The emphasis on localized solutions not only reflects a commitment to innovation but also a strategic understanding of the evolving needs in financial services.