Investment Interest in Green Dot Corp Amid Economic Challenges

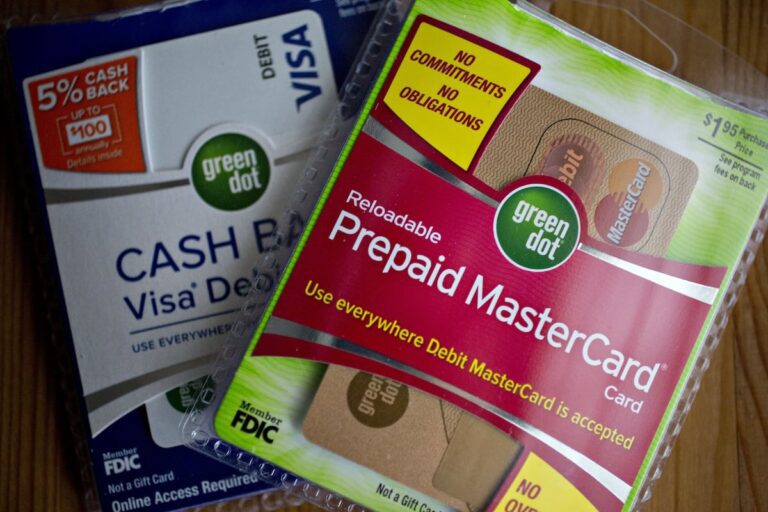

(Andrew Harrer | Bloomberg) Packages containing a Green Dot Corp debit card, alongside a Prepaid Mastercard Inc. and a Visa Inc. debit card, arranged for a photo in Washington, DC, February 15, 2018. Green Dot is set to report earnings on February 21.

The current economic landscape has created hurdles for various financial transactions, yet Green Dot, the Utah-based fintech known for its prepaid debit cards, remains resilient. Last week marked the scheduled first-round offers for Green Dot, which successfully drew significant investment interest, according to industry insiders.

Sources revealed that private equity firms are forming consortia to facilitate the acquisition of stakes in Green Dot. The complexities of this potential sale arise from the fact that Green Dot possesses a banking institution, which restricts private equity companies from holding more than 24.9% ownership under federal regulations. As a result, the sale process could involve intricate negotiations, according to individuals familiar with the discussions.

Private equity consortium engagement is not a new trend within banking acquisitions. Notably, last year, Liberty Strategic Capital, led by Steve Mnuchin, collaborated with investors like Hudson Bay Capital Management to acquire a 40% stake in the then-troubled New York Community Bank, which has since been rebranded as Flagstar Financial.

Green Dot recently signaled its openness to strategic alternatives, appointing Citi to guide this exploratory process. Although this typically indicates a potential sale, the specifics remain undisclosed. William Jacobs, who formerly chaired the board, has taken the reins as interim CEO following the resignation of George Gresham, who had served in the role since 2022.

Since announcing its strategic review, Green Dot’s stock has surged over 12%, trading at $8.05 a share, resulting in a market capitalization of approximately $443.1 million. The fintech firm is anticipated to share its first-quarter earnings results on May 8, heightening investor interest.

Founded in 1999, Green Dot provides a variety of financial products, including debit and prepaid cards, and boasts around $5.3 billion in assets within Green Dot Bank. Among its notable partnerships, Green Dot provides banking services for Apple Cash, facilitating monetary transfers. Its longstanding relationship with Walmart further solidifies its market position, as Walmart is a key issuer of Green Dot’s money cards.

Walmart and Apple collectively account for 65% of Green Dot’s $1.7 billion revenue for the 2024 fiscal year, with Apple alone contributing approximately $948 million. The presence of regulatory complexities regarding Green Dot’s banking charter may limit its pool of prospective buyers, and regulatory pressures surrounding interchange fees may deter larger institutions, according to analysts.

Despite economic challenges, transaction timelines are expected to lengthen, with deals projected to span six to nine months instead of the traditional three to four. This extended timeline may impact various sectors, including consumer goods, while fintech companies may encounter temporary adjustments in pricing dynamics, ultimately stabilizing in due course.

This article was originally featured on Fortune.com.