Key Insights on Stock Performance and Financial Metrics

Stay informed about the latest trends in stock quality, assessment, techniques, and more to make better investment decisions.

Quality Assessment of the Stock

Quality:

{{dashverdictreult.dashboard.dotsummary.q_txt}}

Understanding the quality of a stock is crucial for making informed investment choices. The quality metric evaluates various factors, such as financial health, earning potential, and reliability.

Comprehensive Assessment Summary

Assessment:

{{dashverdictreult.dashboard.dotsummary.v_txt}}

An overall assessment of the stock provides insights into its current standing in the market, helping investors gauge potential risks and rewards associated with it.

Quarterly Financial Trends

Quarterly financial trend:

{{dashverdictreult.dashboard.dotsummary.f_txt}}

Analyzing quarterly financial trends can help investors track the performance trajectory of a stock, allowing them to identify patterns and make forecasts on future performance.

Technological Innovations in Stock Performance

Techniques:

{{dashverdictreult.dashboard.dotsummary.tech_txt}}

Keeping an eye on the latest techniques and innovations within a company can provide a competitive edge. This section emphasizes the significance of technology in driving stock performance.

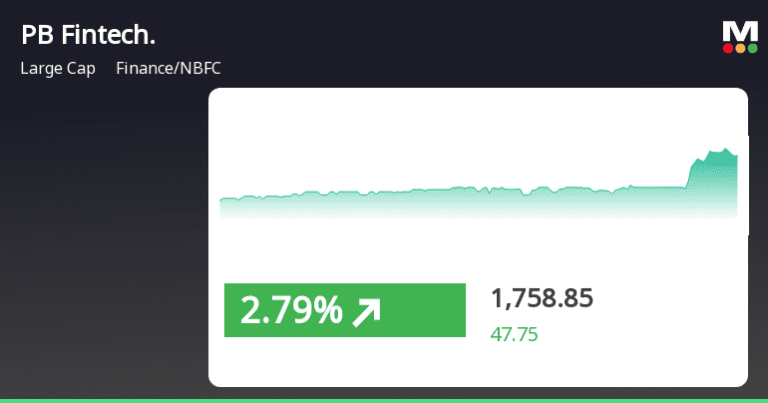

Key Stock Information

Stock information:

BSE – {{dashverdictreult.dashboard.stock_details.Sripcode}} / NSE – {{dashverdictreult.dashboard.stock_details.symbol}}

Stock market capital – {{dashverdictreult.dashboard.priceinfo.mcap_class}} (Rs. {{dashverdictreult.dashboard.priceinfo.mcap | number: 0}} Cr)

Sector – {{dashverdictreult.dashboard.stock_details.ind_name}}

52-Week Highs and Lows

52 Week High / Low (Rs.) – {{dashverdictreult.dashboard.priceinfo.wk_high52}} / {{dashverdictreult.dashboard.priceinfo.wk_low52}}

Investors should monitor the 52-week high and low as it provides context for the stock’s historical performance. This metric helps gauge volatility and potential for growth.

Market Volume Insights

Middle flight (6m) – {{dashverdictresult.dashboard.priceinfo.vol}}

Understanding the trading volume over the past six months can indicate investor interest and liquidity. Higher trading volumes often suggest strong investor confidence in the stock.