Overview of the Fintech Market in Mexico

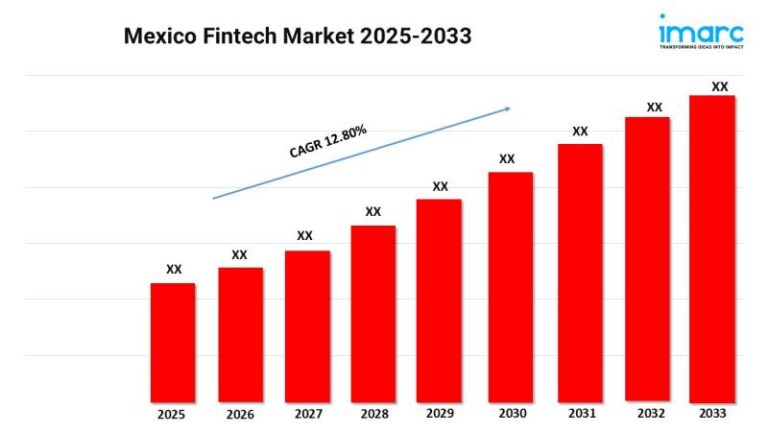

The fintech industry in Mexico has witnessed remarkable growth over recent years, driven by an increasing acceptance of digital payments, a rise in the unbanked population, and regulatory measures encouraging financial inclusion. In 2024, the size of the Mexican fintech market reached approximately USD 20 billion. Forecasts from the IMARC Group predict that this figure will soar to USD 65.9 billion by 2033, marking a compound annual growth rate (CAGR) of 12.80% during the period of 2025 to 2033.

Key Drivers of Growth

Several factors contribute to the expansion of the fintech market in Mexico. The blend of regulatory support, technological advancements, and a drive for financial inclusion presents significant opportunities for innovation. With more than 700 fintech companies operating in the country, Mexico stands as one of the leading fintech hubs in Latin America. Segments include digital payments, loans, insurance, and wealth management, all catering to a youthful population and a significant unbanked demographic.

Innovations in Financial Services

Digital payment solutions such as Clip and Mercado Pago have transformed how small businesses and individuals access financial services. The introduction of open banking provisions via the Fintech Act of 2018 has not only increased collaboration between banks and fintech entities but has also established a competitive landscape fostering continuous innovation.

Financial Inclusion Initiatives

Financial inclusion remains a focal point for the fintech sector in Mexico. With nearly 40% of the population lacking access to traditional banking services, fintech companies harness mobile technologies and alternative data to reach underserved communities. Non-traditional sources, like utility payments and social media behavior, are utilized by emerging platforms such as Konfío and Albo to evaluate creditworthiness and extend loans to individuals and small enterprises.

Emergence of Blockchain and Cryptocurrency

The interest in blockchain technology and cryptocurrency continues to grow, with companies like Bitso leading the charge to make these technologies more accessible to the Mexican market. While adoption is rising, businesses must still navigate challenges such as cybersecurity risks, regulatory compliance, and the need to enhance financial literacy among consumers.

Market Segmentation and Competitive Landscape

The fintech industry is segmented into various categories including deployment modes (on-site and cloud-based), technology used (API, AI, blockchain), application areas (payments, loans, insurance), and user demographics (banking, insurance, securities). This segmentation allows businesses and investors to identify key areas for growth and innovation.

Conclusion and Future Prospects

As the Mexican fintech industry evolves, it is set to play a significant role in reshaping the nation’s financial landscape. The market’s trajectory, fueled by technological advancements and a focus on financial inclusivity, is expected to attract substantial investments from both domestic and international players. For those interested in a comprehensive analysis of this dynamic market landscape, detailed reports and insights are available.

For more in-depth information, request a sample report here.