Intel Corp’s Stock Performance: A Closer Look

On Thursday, October 3, shares of Intel Corporation (INTC) fell for the fifth straight day, as rumors surrounding potential restructuring, spin-offs, and acquisitions subsided. Investors’ focus has shifted to significant geopolitical developments in the Middle East, impacting market sentiment.

Recent Trends in Intel’s Stock

Intense trading activity characterized the previous weeks when Intel’s stock experienced a notable rise for six consecutive sessions, from September 19 to September 26. This surge occurred as investors speculated on potential agreements between Intel and various interested parties, including potential partners and acquirers. Companies such as ARM, Apollo Global Management (APO), and Qualcomm (QCOM) have been mentioned as potential stakeholders interested in Intel’s business segments.

Market Reactions to Recent News

Recent downturns have resulted in Intel’s stock giving back nearly half the gains made over the previous months as investors are now taking a wait-and-see approach. While some analysts have speculated on potential partnerships, others express cautious optimism about Intel’s path to recovery.

Upcoming Earnings and Market Expectations

As September wraps up, anticipation for the upcoming earnings season heats up, with Intel scheduled to report its third-quarter results on October 31. Unless there are substantial updates regarding Intel’s possible commercial partnerships in the interim, shareholders will eagerly await the earnings report, especially after the company’s previous disappointing performance.

The consensus revenue estimate for Intel’s third-quarter results stands at $13.04 billion, with projections indicating a potential loss of $0.03 per share (non-GAAP). Achieving this revenue target would signify an 8% decline in sales compared to the same quarter last year, raising concerns among investors regarding Intel’s financial health.

Analysts’ Outlook on Intel’s Stock

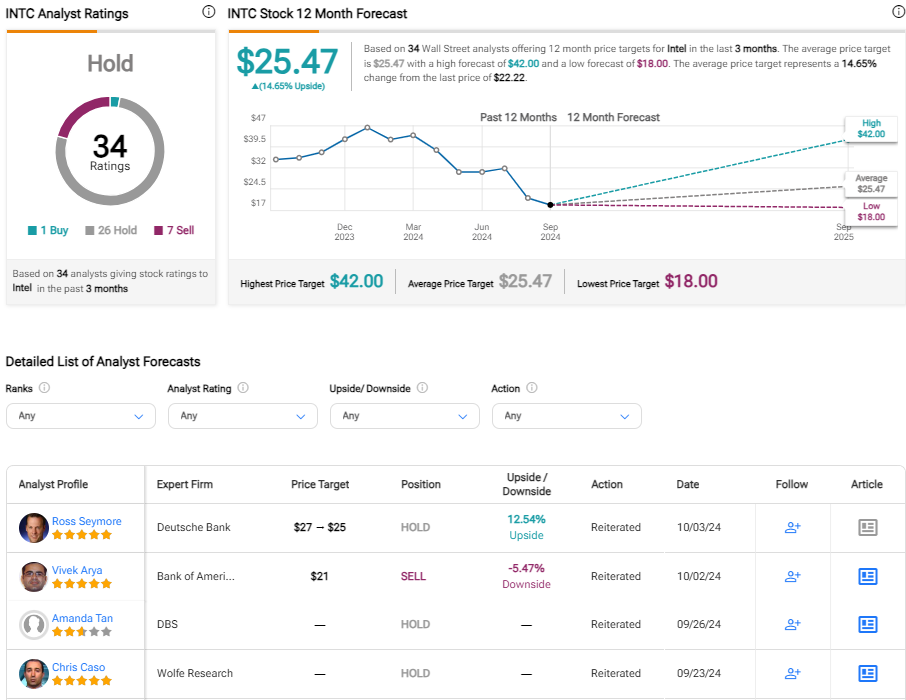

Based on insights from 34 Wall Street analysts, Tipranks provides a consensus hold rating for Intel’s stock. Notably, just one analyst recommends a buy, while seven have issued sell ratings, with a significant majority—26 analysts—advocating for a hold. The average price target for Intel shares is currently set at $25.47, indicating around a 15% upside potential from its current trading levels.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.