In today’s fast-paced digital environment, financial teams face ongoing challenges in managing high volumes and complex transactions. A significant portion of their time is devoted to manually consolidating data, overseeing cash flows, and generating financial reports from disjointed systems.

These manual efforts can lead to cash flow issues and gaps in financial decision-making across organizations, resulting in lost income from cash flow leaks and inefficient workflows. A Gartner survey indicates that 18% of accountants report financial errors daily, with many also making weekly and monthly mistakes.

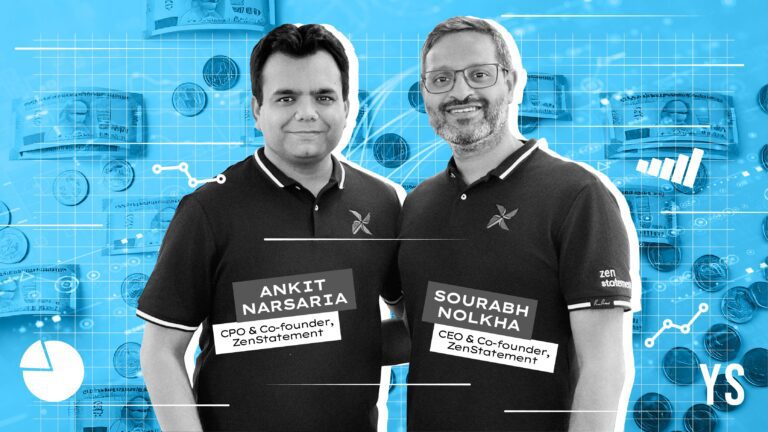

Zenstant, founded in 2023 by former ISB student Surabh Nolkha and IIM graduate Ankit Narsaria, provides a financial management solution tailored for fast-paced businesses in Bengaluru. This platform facilitates the monitoring, optimization, reconciliation, and forecasting of cash flows, empowered by AI-driven commercial finance insights available through natural language queries.

The goal is to streamline financial operations, providing companies with real-time visibility into their cash flow and enabling data-driven decision-making.

“As financial teams utilize various tools and applications for their processes—be it accounts receivable or payable, reports, or cash management—challenges often arise from disconnected systems, resulting in decreased productivity, heavy reliance on spreadsheets, cumbersome processes, and revenue losses due to cash flow issues,” explains Nolkha, the CEO and founder with experience at Deloitte and in financial leadership roles at companies like Mensa Brands and Itilite.

On the other hand, Narsaria brings over 12 years of experience in retail, e-commerce, and fintech, having held product leadership roles in companies like Shopup and Justpay.

### How It Works

Zenstant is developing a comprehensive financial operating system that streamlines and automates accounts payable, receivable, reporting, and treasury management.

“Our core focus is automation,” Nolkha adds, noting how the platform seamlessly integrates with existing financial systems—payment gateways, bank accounts, ERP platforms, and sales channels—to automatically reconcile transactions and combine financial data.

By eliminating manual data entry and fragmented processes, Zenstant seeks to enhance accuracy, lower operational costs, and expedite financial close processes. Its automation-centric approach allows financial teams to focus on strategic decision-making rather than repetitive tasks.

The platform continuously monitors transactions, detects anomalies, and predicts cash flow trends, enabling businesses to make proactive, data-informed decisions. AI-driven forecasts help financial teams anticipate cash gaps and optimize working capital to minimize liquidity risks, enhancing financial stability and flexibility.

### Business Model and Early Momentum

Zenstant operates on a monthly subscription model, with pricing based on transaction volumes processed through its platform. Since launching its MVP in January 2024, the 15-member startup has attracted clients including unicorns and enterprises within digital commerce, retail, and fintech.

“As awareness and adoption grow, there is rapidly increasing demand for data-driven financial analysis and automation,” remarks Nolkha, revealing that the platform currently manages approximately 10 million transactions, worth about $60 million for clients each month.

### Market Opportunities and Growth

The financial automation market was valued at $6.6 billion in 2023 and is projected to grow at a CAGR of over 14.2% from 2024 to 2032.

In October 2024, Zenstant raised $1.62 million in seed funding from 3one4 Capital and Boldcap VC, along with participation from Dynais Ventures and Atrium Angels, supported by notable angel investors from the tech and finance sectors.

The company intends to utilize the capital to expand its product offerings and develop a sales and marketing strategy to enhance its presence both in India and internationally.

Regarding competition, Nolkha notes that while solutions targeting CFOs have emerged within the SaaS niche, many current competitors focus on specific financial functions, leaving gaps that Zenstant aims to address with its integrated financial operations solution. “We are positioning Zenstant as a comprehensive financial operations platform for CFOs, effectively complementing existing solutions and better serving finance leaders and their teams.”