Credit is the buoy for the rescue of any economy, and a service that allows people to borrow money from competitive interest rates with a minimum of paperwork offers a convincing commercial model.

This idea inspired three entrepreneurs with strong technology and expertise in finance to launch a startup that allows individuals to obtain loans against their common funds (MF) via the digital platform.

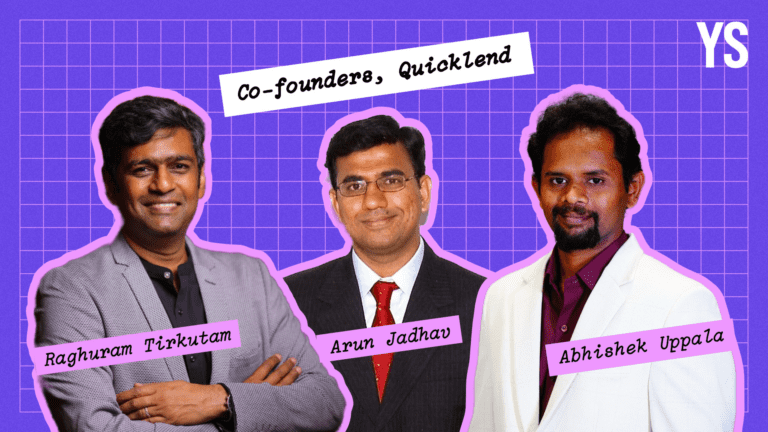

Quicklend, a startup Fintech based in Bengaluru, was founded by Raghuram Tirkutam, Arun Jadhav and Abhishek Uppala in December 2023. The company aims to offer a transparent platform where users can obtain a loan against their common funds in just 30 minutes.

The founders provide a vast experience of established technological companies as well as startups. These include Google, Amazon, Cred, Freeload, Redbus, Stripe and Grab to name just a few.

This experience led the three to believe that they can offer a unique digital credit platform to retail consumers.

The opportunity is certainly important given the size of the industry of the common investment fund in India. According to the Association of Placement Funds in India (AMFI), the assets under management of the common fund industry was 66.93 Lakh crore at the end of December 2024. In addition, the investment investors’ investors Detail thanks to the systematic investment plan (SIP) reached RS 26,459 crosses in December 2024.

However, the current external environment for the creation of such a company remains difficult with the Reserve Bank of India (RBI) imposing strict regulations on credit disbursement through fintech channels, many startups have been forced to rework their commercial models.

But Quicklend thinks that there is still a substantial credit request in the country.

“We believe that this (credit) is a latent market because financial institutions have the money to lend but the discovery mechanism is missing,” explains Tirkutam Yourself.

How does it work?

The discovery mechanism is that of identifying customers worthy of credit. Quicklend’s current business model is to identify customers who need a loan and connect them with financial institutions that provide funding. In doing so, he generates a request for financial institutions.

Tirkutam says, “We have told lenders that you get your margins, get our margins and customers get a good price.”

Currently, Quicklend facilitates the entire loan process for customers using HF Holdings. He has teamed up with distributors of common investment funds and other Fintech companies to identify potential customers. He then connects them to the financial institutions which offer loans.

Quicklend claims that the entire loan process can be completed in just 30 minutes. The platform offers loans ranging from RS 25,000 to Rs 3 Lakh and allows customers to borrow up to 50% of their MF participations.

Currently, it allows customers to benefit from loans up to Rs 1, and the platform even attracts companies looking for credit solutions.

Quicklend wins A committee of financial institutions for each disbursement of the successful loan. He does not charge anything for customers who become kept this installation.

Tirkutam believes that in a hungry country like India, this should be available with significant parameters. In addition, Quicklend’s business model is a matter of the guaranteed loans region.

“In guaranteed loans, we can lend to an interest rate below where everyone benefits,” he says.

The regulator’s directive was largely against unmarked loans where interest rates are higher, which led to better beneficiary margins for all those involved in this company.

Today, Quicklend offers two types of services to its customers. First, it acts as the loan service provider where it manages the entire process, from supply to potential customers to closing the loan. Second, it provides a technological platform for financial institutions to manage and allow this process.

Quicklend linked himself to financial institutions such as Bajaj Finserv and Piramal Finance to provide loans. Currently, the platform processes around 40 to 50 loans each month.

Funding and tracking

The Finutup Fintech has lifted pre-series funding from RS 7, believes in venture capital companies such as Upsparks, Eximius Ventures and Inuka Capital, as well as providential investors.

The founder and general partner of Eximius Ventures, Pearl Agarwal, said: “While vigilance around unsuccessful loans increases, secure loans should grow significantly. The common investment funds for traction in cities at level level 2 and 3, this creates a lucrative opportunity.

Quicklend’s competitive advantage lies in its emphasis on secure loans, which maintains low risks. Second, he does not lend his books and acts as a middleware connecting consumers of detail to financial institutions. Finally, given the entries in the activity of the common investment fund, the demand for such loans should not increase.

As part of its future plans, Quicklend explores the possibility of providing loans against actions or properties, but these are still first days. He also actively seeks to incorporate more “intelligence” in his technological platform where it would mean that he can better guide the consumer of retail on which financial institution would be ideal according to their requirement.

“We build what is good for everyone in the industry, whether it is the retail consumer or the financial partners,” explains Tirkutam.