South African FinThe FinTUPS Fintech Float and Peach Payments have joined forces to allow the thousands of fishing merchants to instantly integrate Buy Now Pay technology from Float Now (BNPL) at the cash register, widening the scope of monthly payments without interest for more consumers across South Africa.

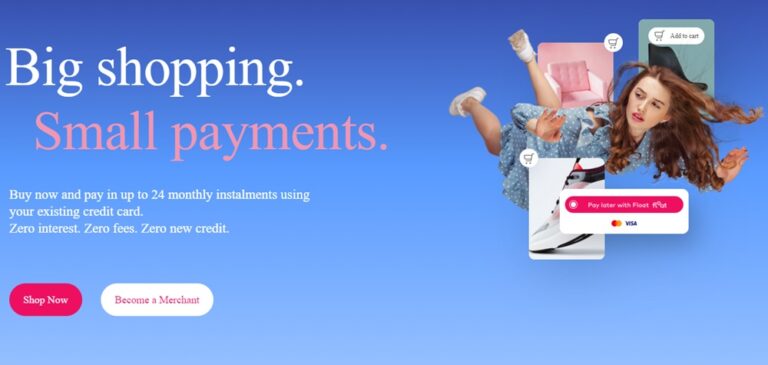

Launched in November 2021, Float Encourages responsible use of credit cards and, at the same time, helps traders to increase their sales. The technology owner of the startup allows buyers to buy now and divide their payments up to 24 monthly payments without interest without interest by using the available limit on their existing visa or mastercard credit card.

Fishing paymentsAs for it, was founded in 2012 and provides a complete toolbox to help companies accept, manage and pay payments via web and mobile. This is the second largest online payment gateway to South Africa and has also extended to Kenya and Mauritius.

The two startups have now been associated to integrate the Float BNPL in the payment of fishing payments, allowing customers to pay over time for their purchases. Unlike the regular BNPL credit options, Float does not make buyers with a new credit, but rather offers buyers a smarter way to pay with their credit card by dividing their purchases over several months, without interest, without additional costs .

“The partnership with Peach Payments Marks yet another key step for Float, allowing thousands of merchants to stimulate sales with flexible payment solutions related to cards that allow buyers of responsible payment options,” said Alex Forsyth-Thompson, CEO of Float.

Anine de Kock, head of partnerships at Peach Payments, said that the company had increased in the popularity of BNPL options, in particular how these options increased conversion rates for merchants considerably.

“Fishing payments add value to traders in many ways. One of them offers a range of BNPL payment options so that customers can take full advantage of merchant offers, “said Kock.