Technological actions linked to artificial intelligence fell at the start of this week on the back of the release of the Chinese company Deepseek of a profitable AI model.

Deepseek is developing models of large open source language and its application has climbed download graphics, the company launching its R1 model last week.

The start-up said that the new model offers “On-Par-Par-Par-Smart-Spelle performance with the Openai O1 model. Deepseek also said that its AI assistant has extended to lower cost fleas and use less data than data than data than data than data than data than data than data than The main models.

These advances have shaken investors, because it has aroused concerns about the level of expenditure on AI by major technological companies in the United States.

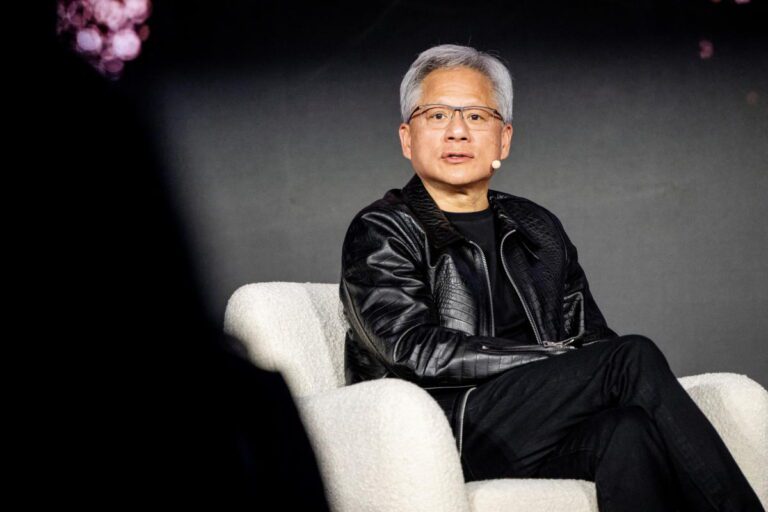

Shares in the NVIDIA flea manufacturer (Nvda), which was considered a major beneficiary of the BOOM of the AI, plunged 17% on Monday. This suffered $ 589 billion (474 billion pounds sterling) on the market value of the flea manufacturer, who marked the strongest loss of a day in the history of the stock market.

Find out more: Where the Millionaires Isa of the United Kingdom invest

US markets have dropped more widely, although actions have since started to recover as Déclaisse des gains “Magnificent 7” companies, including meta (Meta) and apple (Aapl) has increased the optimism of investors.

Friday, in a note, Thomas Mathews, market manager, in Asia-Pacific in Capital Economics, said: “Deepseek does not seem to be an existential threat to the” Bulle of IA “for us: if anything , the interest in this emphasizes the hype around technology.

“But readers may remember that during the last year of the” Dotcom bubble “, the US stock market began to drag its peers from the developed market (despite the publication of otherwise important gains).”

“It is not difficult to imagine the news of Deepseek Kickstartant a underperformance of us, if it is really the case, if it is really the case that large language models can be formed with less chips Advanced that was assumed previously, “he said.

However, he added that “he is probably too early to throw in the towel in the American market”.

In a survey this week, we asked if you spent China’s problems for us Big Tech. We received 1,046 votes, 36% of readers thought it was a concern. Almost half (30%) of readers did not agree, while 15% were undecided.

Find out more:

Download the Yahoo Finance application, available for Apple And Android.