Shaping the future of payments and finance

The fintech ecosystem is evolving at an unprecedented pace, driven by technological advancements and changing consumer preferences. Businesses and consumers are increasingly moving away from cash and adopting digital payment solutions. From mobile wallets to contactless payments, digital-first financial ecosystems are quickly becoming the norm.

As the global payments industry grows, fintech continues to play a central role in improving accessibility, improving user experience and promoting financial inclusion. This shift is not only transforming developed markets, but also opening new opportunities in emerging economies.

According to BCG Global Payments Report 2024Although overall payments growth may slow (CAGR expected to fall from 9% to 5% by 2028), the industry remains on track to generate $2.3 trillion in revenue. Investors are increasingly focused on value, paving the way for innovation-driven competition in fintech.

.jpg)

Top Fintech Trends for 2025

The global Fintech market size is expected to grow from $103.75 billion in 2024 to $141.18 billion by 2028, driven by the proliferation of online payments, integrated financial services and growing demand for digital solutions in emerging markets. Here are the main trends that will shape fintech in 2025:

1. Integrated finance is gaining momentum

The seamless integration of financial services into non-financial platforms is accelerating. E-commerce platforms, social networks and SaaS marketplaces integrate payment, lending and insurance services directly into their ecosystems. This change enables a smoother user experience and helps small and medium-sized businesses (SMEs) streamline their financial processes.

Despite its potential, embedded finance faces regulatory, compliance and security challenges. As demand increases, companies will evaluate options for creating, purchasing, or partnering with fintech companies to develop integrated solutions. Strategic partnerships are expected to dominate, allowing platforms to leverage fintech expertise while mitigating development risks.

In the future, AI and data analytics will enable further refinement of integrated financial offerings, creating personalized financial products tailored to user behavior and specific industry needs.

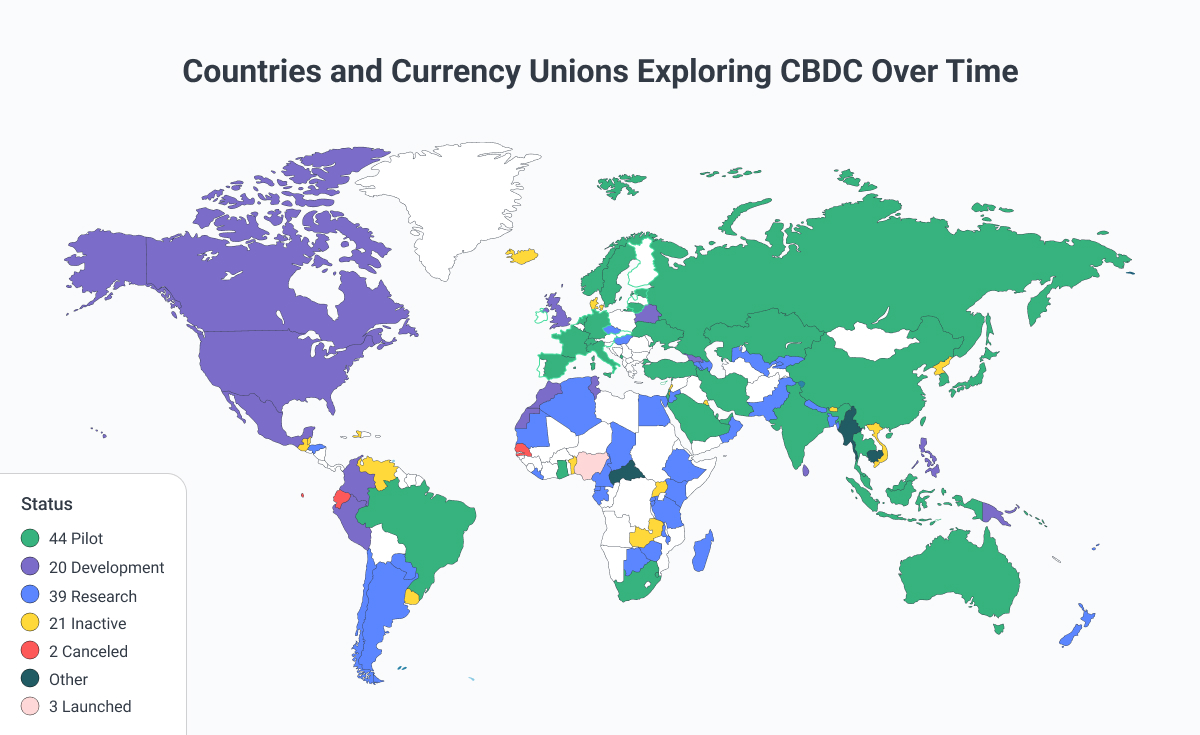

2. The acceleration of CBDCs

The rise of central bank digital currencies (CBDCs) continues to shape digital finance. Governments around the world are exploring CBDCs to improve financial inclusion, reduce transaction costs and modernize payment infrastructure. Countries like China, the Bahamas, and Nigeria have launched or tested CBDCs, while others, including the United States and Sweden, are still in the exploratory phase.

In 2025, adoption of CBDCs is expected to grow, with countries collaborating on cross-border payment initiatives. The IMF and BIS are actively studying the implications of CBDCs on global finance, while private fintech players are developing digital wallets and infrastructure to support these initiatives.

3. Decentralized finance (DeFi) comes of age

DeFi, once a nascent segment, is entering a maturity phase. Platforms like Aave and Uniswap continue to refine decentralized lending, borrowing, and trading protocols. In 2025, expect increased scalability, improved liquidity, and stronger regulatory frameworks to drive DeFi adoption.

Decentralized insurance and risk mitigation platforms are also gaining traction, providing users with protection against smart contract vulnerabilities and other risks. As DeFi infrastructure evolves, it will increasingly integrate with traditional finance, creating hybrid models that combine the best of both worlds.

4. The expansion of super apps

Super apps are consolidating services across industries and have become an integral part of users’ daily lives. WeChat, Alipay and Grab exemplify this trend, offering everything from payment to ride sharing within a single platform.

In 2025, the global super apps market is expected to witness significant growth, driven by convenience and customer demand for unique solutions. European and Southeast Asian players like Revolut and Gojek are rapidly expanding their offerings, challenging incumbents and reshaping the competitive landscape.

.jpg)

5. The future of banking as a service (BaaS)

BaaS adoption is evolving, but not without challenges. Initially driven by partnerships between banks and fintechs, BaaS is now under scrutiny as some collaborations fail to produce the expected results. Banks are increasingly cautious and seeking fintech partners with proven API expertise.

In the future, successful BaaS providers will focus on specialized segments, offering tailored financial products and expanding beyond traditional financial institutions.

-Global-Market-Report-2024.jpg)

6. AI-Driven Personalization in Fintech

Artificial intelligence (AI) is redefining the way financial services are delivered. From hyper-personalized banking experiences to AI-powered fraud detection, fintechs are leveraging AI to boost user engagement and improve operational efficiencies.

By 2025, AI-powered chatbots, virtual assistants, and predictive analytics will play a critical role in shaping customer interactions. This trend not only improves personalization but also strengthens security by detecting fraudulent activities in real time.

7. The continued rise of open banking

Open banking initiatives, driven by regulations such as PSD2, continue to expand globally. While Europe leads the adoption of open banking, countries in Asia, North America and Latin America are introducing frameworks to encourage data sharing and foster competition.

By 2030, the open banking market is expected to reach $135.17 billion. This growth reflects growing consumer demand for flexible, data-driven financial services and the rise of third-party providers leveraging APIs to offer innovative solutions.

The future is now

THE fintech landscape The 2025 horizon is defined by innovation, collaboration and evolving user expectations. As embedded finance, CBDCs, DeFi and AI reshape the industry, fintech players must remain agile to stay competitive.