Data analysis expert BigBear.ai (NYSE:BBAI) has soared in 2024. On New Year’s Eve morning, the stock was up 128% in 52 weeks. Inquiring minds (and growth-hungry investors) want to know if the gains can continue into 2025 and beyond.

So let’s take a look at BigBear.ai and its growth prospects. Is this a great artificial intelligence (AI) stock to buy in early 2025?

BigBear.ai is not a legendary name, even though its main business has been around since the 1980s.

The current form of this company came into existence in 2020, when a special purpose acquisition company (SPAC) named Lake Acquisition has acquired several AI-based business intelligence companies. This initial splurge included the makers of well-known software such as the ProModel process simulation package, as well as the technical consulting services of Open Solutions Group. Some of these operations were founded in the late 1980s and early 1990s.

The resulting organization provides AI-driven data analytics services for healthcare, government and heavy construction companies. The U.S. Army, Navy and Air Force are three of the company’s largest customers. Its systems help people manage and organize equipment and other resources on a large scale, often under tight deadlines.

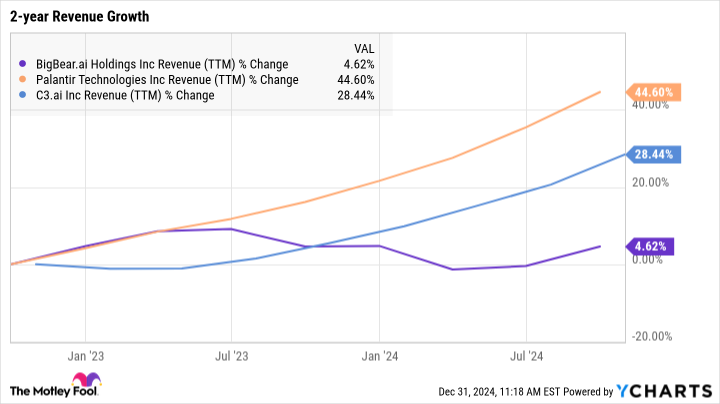

If my description of BigBear.ai looks a lot like C3.ai (NYSE:IA) Or Palantir Technologies (NASDAQ:PLTR), you are on the right track. These companies often bid on the same contracts. Computerized support for the defense sector is a large and thriving market, and BigBear.ai is a diversified company with significant interests in other growing sectors.

The direct comparison with C3.ai and Palantir raises important questions about BigBear.ai. The company is catering to some major markets, but how big and successful has it been so far?

Here’s how BigBear.ai currently compares to its main competitors:

|

Metric |

BigBear.ai |

Palantir |

C3.ai |

|---|---|---|---|

|

Market capitalization |

$1.14 billion |

$174.5 billion |

$4.56 billion |

|

Stock market performance over one year |

114% |

347% |

23% |

|

Revenue (TTM) |

$155.0 million |

$2.65 billion |

$346.5 million |

|

Adjusted net profit (loss) |

($57.5 million) |

$476.6 million |

($274.4 million) |

Data source: Collected from Finviz and YCharts on December 31, 2024. TTM = last 12 months.

BigBear.ai is the smallest name in this group. The stock has been climbing recently, but hasn’t been able to keep pace with Palantir’s massive gains.

It’s important to note that BigBear.ai’s recent price increases have not been driven by strong business results or new contract announcements. Indeed, the stock fell nearly 11% in the days following its latest earnings report, which met Wall Street expectations but missed consensus revenue targets.