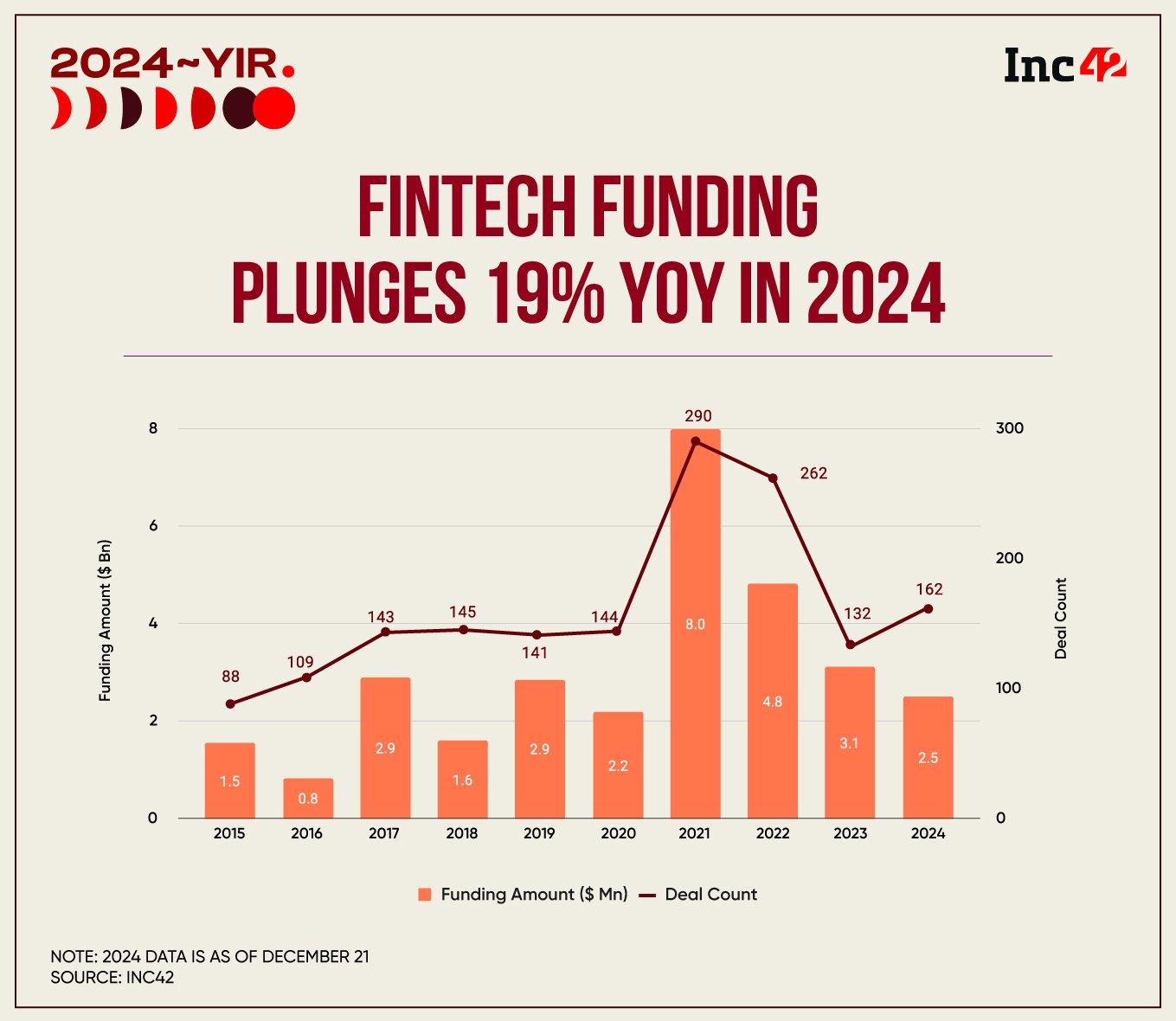

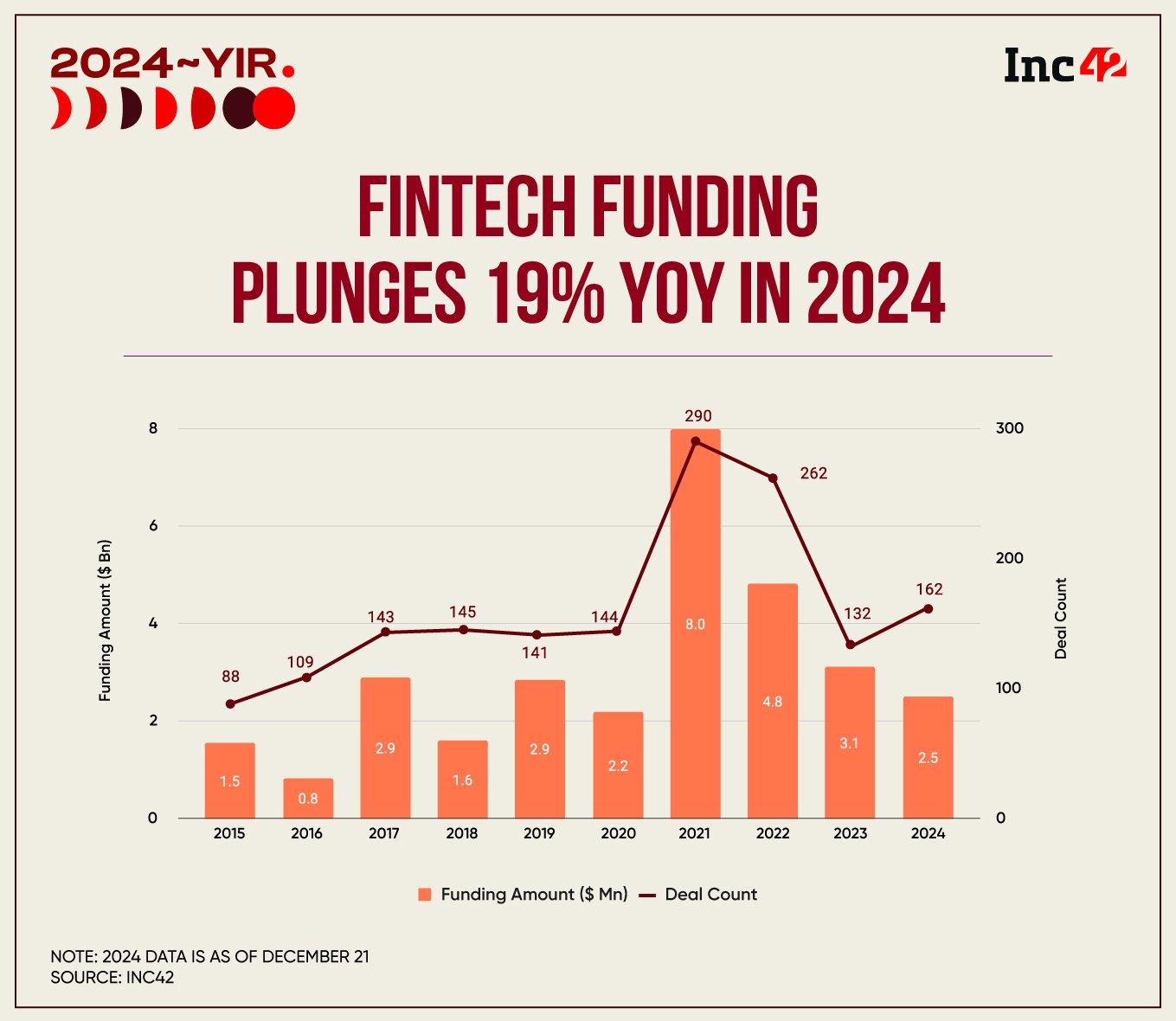

Funding raised by local fintech companies plunged 19% to $2.5 billion in 2024, from $3.1 billion last year.

The fintech sector continued to dominate the Indian investment landscape in 2024 across stages

While the local fintech ecosystem has made great strides over the past decade, the industry expects greater disruption in 2025 due to AI.

Caught in the grip of an unforgiving funding winter in recent years, Indian startups breathed a sigh of relief in 2024. As cautious investors gradually began rolling out dry powder last year, the local new age tech ecosystem saw green shoots of revival on the funding front, which grew 20% year-on-year (y-o-y) to over $12 billion.

However, the year did not turn out to be very promising for India’s large fintech sector, even though it emerged as the most funded sector, outperforming others. Additionally, the sector lagged behind e-commerce and business technology in terms of the number of transactions.

According to Inc42 Annual Funding Report, 2024, funds raised by local fintech companies plunged 19% to $2.5 billion in 2024, from $3.1 billion a year ago. Thus, 2024 turned out to be the third consecutive year of declining funding for the fintech ecosystem, which also returned to pre-2021 funding levels.

Although wary investors are largely to blame for the drop in numbers, fintech financing has also been hit as fewer late-stage deals materialized in 2024. Fintech mega-deals (over 100 million of dollars) were cut by almost half, to six last year, compared to 12 the year before. year. This figure was still lower than the quantum of 2022, when the sector had signed 10 deals above $100 million.

On the positive side, the total number of transactions increased by 23% to 162 in 2024, up from 132 in 2023. Against this backdrop, the median ticket size of fintech startups increased sharply by 32% to 5.4 million. dollars during the year, compared to $4.1 million in 2023. However, the media ticket size was still below 2022 levels and 2021, when the measurement was . $6.4 million and $6 million, respectively.

Despite the double-edged sword that 2024 was for fintech, it was not a disastrous year for the sector. Much more was brewing beneath the surface.

For example, the fintech sector crossed the $30 billion funding milestone in 2024. The year also saw the ecosystem add two new unicorns to its kitty, Moneyview and Perfios, while companies like Finova Capital , Drip Capital and M2P stood out by landing some of the biggest deals this year (all over $100 million).

Furthermore, the sector continued to dominate the Indian investment landscape in 2024 at several stages. It is the most funded late-stage sector, capturing 23.8% (or $1.7 billion) of the total $7 billion raised by Indian startups at this stage across all sectors.

Fintechs also won the highest number of late-stage deals last year. With 53 transactions, the sector was well ahead of its close rival, e-commerce, which could only handle 23 late-stage transactions.

The trend has also spread to lower levels. Local growth-stage fintech players accounted for $599 million (or 17.1%) of the total $3.5 billion raked in by Indian growth-stage startups in 2024. In terms of number of growth-stage deals growth, fintech platforms took second place with 42 transactions, behind only e-commerce.

The sector also shone at the seed stage and was the second most funded sector at this level. Early-stage fintech startups accounted for 18.3%, or $163 million, of the total $893 million raised by seed-stage startups in the country in 2024.

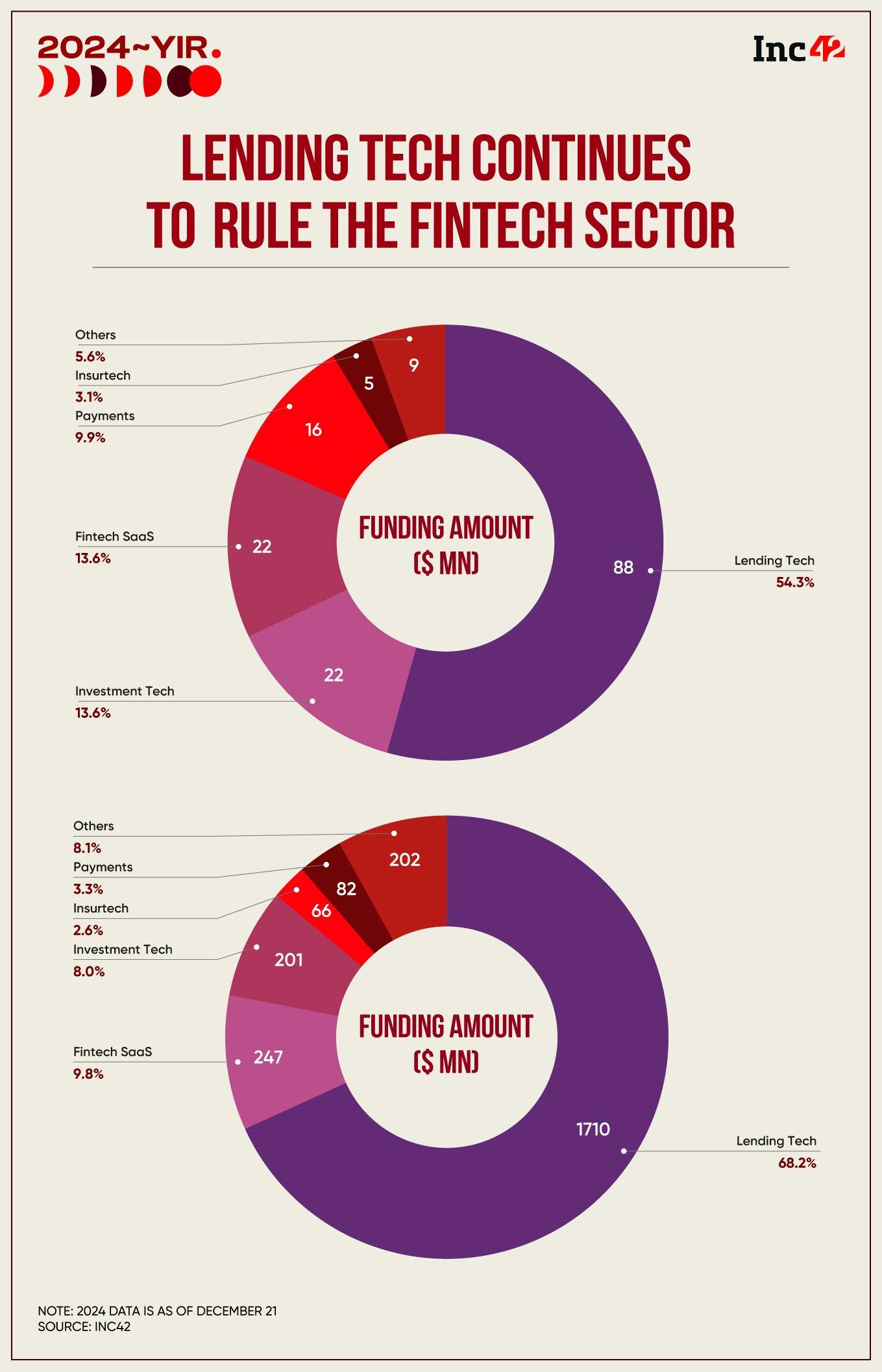

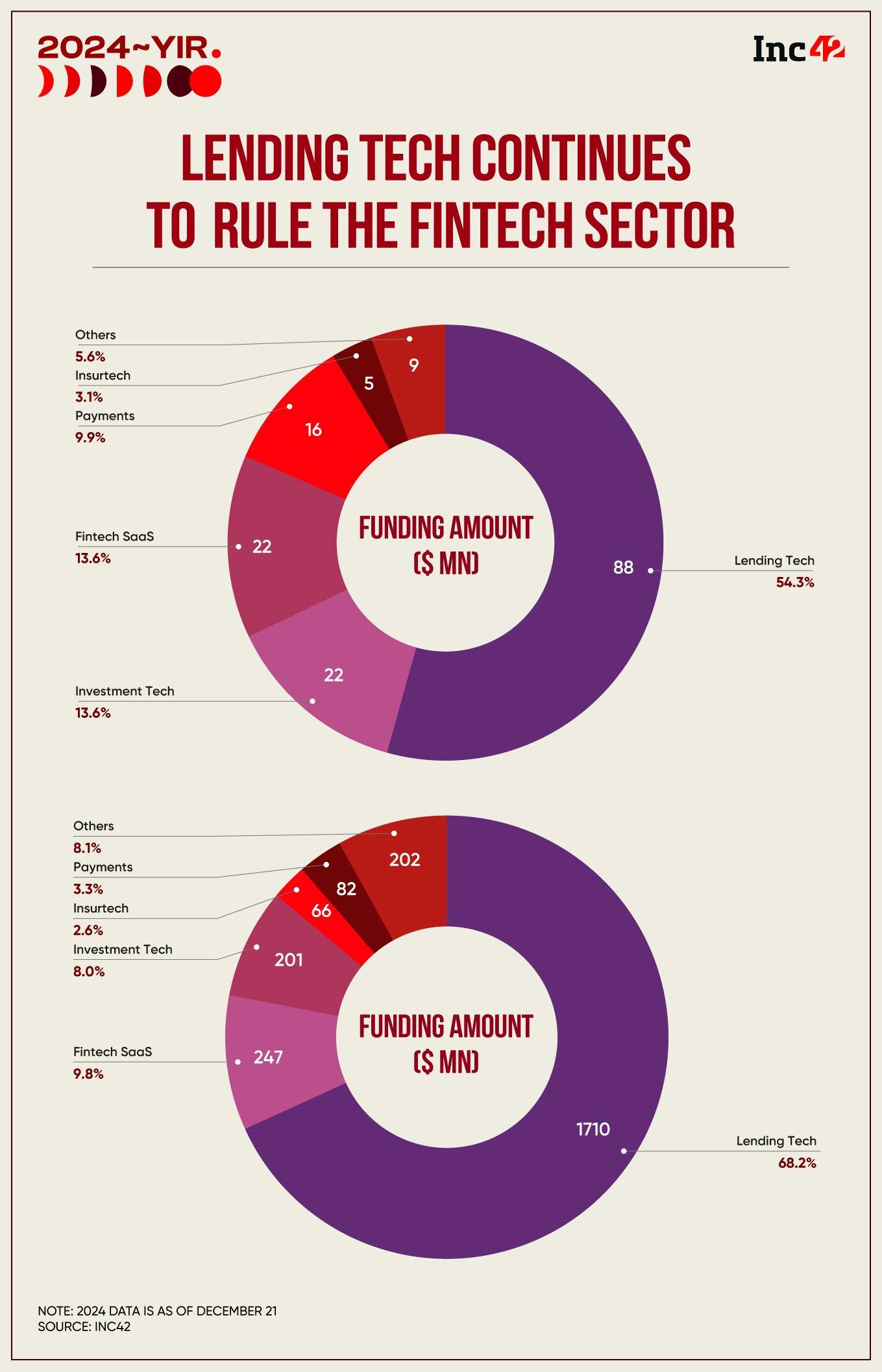

Lending Technology Remained the Core of Fintech Power

Expected to cross the $1.3 billion mark by 2025, the tech lending sector continued to dominate the fintech funding cycle in 2024. The sub-sector raised $1.7 billion in funding, representing 68% of the total funding raised by the local fintech sector during the period. .

Lending tech also closed 88 deals in 2024, more than half (54% to be precise) of the total 162 financing deals the industry closed last year.

Other key players in the sector were fintech SaaS and investment technology, which generated $247 million and $201 million respectively in 2024. Payments industry startups also closed deals worth 82 million dollars last year.

Notably, this dominance of lending technologies within the fintech ecosystem has been a recurring theme over the past decade. Between 2014 and 2024, the subsector accounted for $10 billion of the $30 billion raised by fintech startups in the country.

That said, Bangalore has remained the fintech hub of the country. In the last 10 years, Bengaluru-based fintech platforms have raised over $10 billion, followed by Delhi NCR with $10 billion. Fintech companies located in India’s financial capital, Mumbai, have successfully raised $5 billion since 2014.

What awaits Fintechs in 2025?

While the local fintech ecosystem has made great strides over the past decade, the sector expects even greater disruption in 2025. account of artificial intelligence (AI). Industry insiders see AI as paving the way for new advisory and underwriting models.

Compliance will remain a major bottleneck for fintech startups, particularly for payment platforms. There are also concerns that the largest digital payment processors will be affected as the Center should maintain its zero MDR regime.

Industry observers also see more and more fintech players are relocating their bases to India to take advantage of the current initial public offering (IPO) boom. However, competition is lurking and Jio Financial Services (JFS) is expected to go all out, investing heavily to take on established fintech incumbents, especially super apps like CRED, Groww and PhonePe.

While it remains to be seen how the sector will evolve in 2025, there is no doubt that fintechs remained the centerpiece of attracting investors in 2024. With much to come later this year, the ecosystem crosses fingers for an exceptional year. .

(Edited by Shishir Parasher)