Presents an in-depth assessment of the market shares, growth strategies and service offerings of key players – FIS, Fiserv, Google, Microsoft, Zoho, IBM, Socure, Workiva, Plaid, SAS and C3 AI, among others in the domain of AI in finance. walk.

AI in the financial market

Dublin, December 20, 2024 (GLOBE NEWSWIRE) — The “AI in financial market by product (algorithmic trading, virtual assistants, robo-advisors, CRM, IDP, underwriting tools), technology, application (fraud detection, risk management, trend analysis, financial planning, forecasting ) and region – Global forecasts to 2030″ the report has been added to ResearchAndMarkets.com offer.

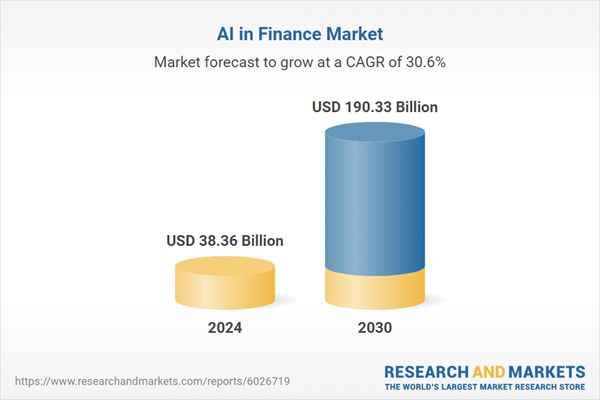

The AI in finance market is expected to grow from USD 38.36 billion in 2024 to USD 190.33 billion by 2030, at a compound annual growth rate (CAGR) of 30.6% during the period. forecast. Chatbots and virtual assistants are in high demand in the AI-driven financial market due to their ability to automate customer service, improve user experience, and reduce operational costs. The growing demand for AI-based algorithms improves risk identification and mitigation, promoting safer financial practices and shapes the AI in finance market.

The research covers detailed information about key factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the AI in Finance market.

FIS (US), Fiserv (US), Google (US), Microsoft (US), Zoho (India), IBM (US), Socure (US), Workiva (US) -United States), Plaid (United States), SAS (United States), and C3 AI (United States); are among the key players in the AI in finance market. The study includes an in-depth competitive analysis of these key AI in Finance market players, including their company profiles, recent developments, and key market strategies.

By end user, Fintech segment will register the highest CAGR during the forecast period

Fintech companies are increasingly leveraging AI to automate financial services, improve customer experience and improve operational efficiency. This technology enables real-time data analysis, which is crucial for personalized financial solutions and effective risk management. As consumers demand faster and more efficient services, fintech companies are using AI for tasks like fraud detection, credit scoring, and customer engagement through chatbots. The fintech sector’s continued innovation and competitive landscape is driving the need for sophisticated AI solutions, positioning this segment for substantial growth in the years to come.

By region, Asia Pacific is expected to register the highest market CAGR during the forecast period.

Rapid digital transformation across economies and the rise of fintech startups are driving AI solutions in Asia Pacific. Countries like China and India are investing heavily in AI technologies to improve financial services and customer experience. The region’s large consumer base presents significant opportunities for personalized financial products and services. Regulatory bodies such as the Monetary Authority of Singapore (MAS) and the Cyberspace Administration of China (CAC) are fostering innovation and further driving market growth. The growing focus on data-driven decision-making and the need for effective risk management solutions are also contributing to the rapid adoption of AI in finance, positioning Asia Pacific as a leader in this sector .