(Bloomberg) — Chime Financial Inc., a financial technology company focused on fee-free banking, has submitted a confidential filing with the U.S. government for its IPO, according to people familiar with the matter.

Most read on Bloomberg

The company aims to go public in 2025, said the sources, who asked not to be identified because the information is confidential. The timetable for the IPO is not finalized and plans could still change, they added.

Chime offers a digital-first mobile banking offering, although it doesn’t operate as a bank itself and is part of a wave of such companies that have emerged around the world in recent years. Using an “Asset Light” approach that reduces branch and staff costs helps these businesses, like Monzo Bank Ltd. in the United Kingdom, to offer more attractive services than traditional banks.

A Chime spokesperson declined to comment. The company has raised $2.65 billion to date, according to PitchBook data. Investors include Menlo Ventures, Forerunner Ventures, Sequoia Capital, Coatue Management and Acrew Capital.

Chime, based in San Francisco, offers users banking-like services through an app, including high-yield checking and savings accounts. Earlier this year, Chime rolled out the ability for customers to access up to $500 of their paycheck before they arrive. The company also signed a deal with the NBA’s Dallas Mavericks that puts its logo on the team’s jerseys.

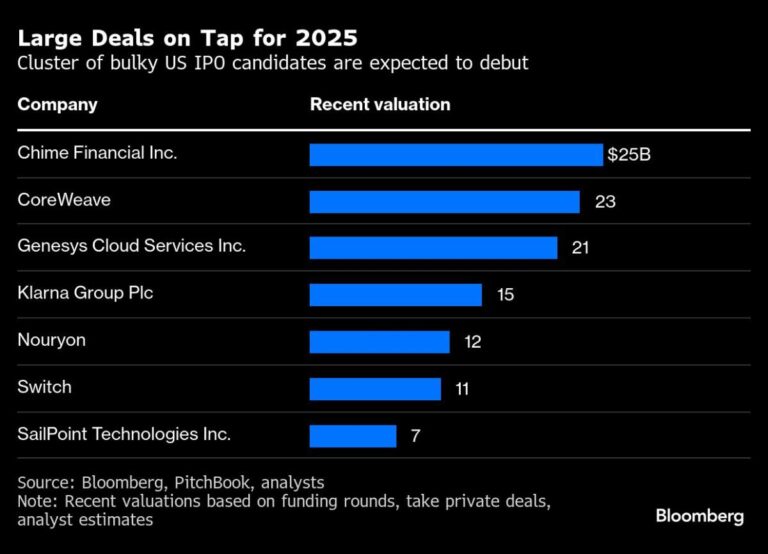

Chime reached a valuation of $25 billion in 2021 at the height of a tech boom that then faded as interest rates and inflation rose. Bloomberg previously reported that Chime had hired Morgan Stanley for the role of lead underwriter in its IPO, targeting 2025. The IPO market has shown signs of recovery and optimism heading into the year next year, with companies partly supported by the positive reaction of stock markets to the election of Donald Trump. as president.

–With the help of Vlad Savov.

(Updates with additional details from third paragraph)

Most read from Bloomberg Businessweek

©2024 Bloomberg LP