The Netherlands-listed investment arm of Naspers has expanded its deal pipeline in India, marking its third major investment in fintech and finance after Mintifi and Vastu Housing Finance.

This follows Jar raising $22.6 million in its Series B funding round with a post-money valuation of $300 million from Tiger Global and Eximius Ventures, among others.

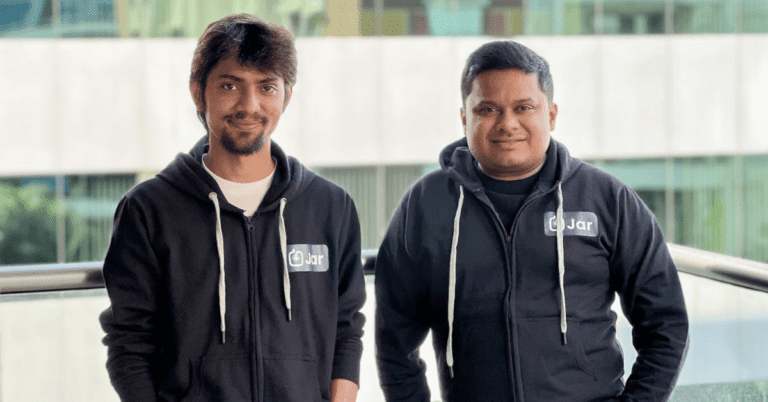

Founded in January 2021 by Nischay and Misbah Ashraf, Jar operates a mobile application, which allows users to invest as little as 1 INR. It claims to have over 1.5 Cr users on the platform.

Global investment giant Prosus is reportedly in discussions to lead a $50 million (INR 4,242 Cr) funding round in fintech startup Jar.

The Netherlands-listed investment arm of Naspers has expanded its deal pipeline in India, marking its third major investment in fintech and finance after Mintifi and Vastu Housing Finance.

Additionally, she backed jewelry brand Bluestone, which had its IPO earlier this year.

“Due diligence is underway and Prosus, through its venture capital arm, will likely lead the new funding round,” a person with knowledge of the matter told ET, adding that the final contours of the deal could further evolve as other investors may also come on board. the turn.

Founded in January 2021 by Nischay and Misbah Ashraf, Jar operates a mobile application, which allows users to invest as little as 1 INR. It claims to have over 1.5 Cr users on the platform.

This comes right after Bagging of jars $22.6 million in its Series B funding round with a post-money valuation of $300 million from Tiger Global and Eximius Ventures, among others. He recently joined PhonePe to roll out a new “Everyday Savings” feature to boost the purchase of digital gold.

Jar has so far raised over $61 million since its inception in 2021.

“Not only gold, they (Jar) also sell synthetic diamonds. There is a strong affinity for buying jewelry as an investment and that is why Jar launched his own brand. Its gross sales rate touched INR 100 Cr in October,” a person aware of the matter told ET.

Responding to Inc42’s question about the development, Prosus said: “ET’s story today is based on speculation, and we do not comment on such market rumors. »

The development comes a few days after Prosus invested $79.9 million in fintech startup Mintifi in October to acquire a 10.65% stake. Apart from Mintifi, the Dutch investor also invested $100 million for an 8.4% stake in Vastu Housing Finance in the same month.

Meesho, Elastic Run and Eruditus are among its other big bets in India. It also runs PayU in India.

For Prosus, investments in Indian entities coincided with the public listing of its first investment in India, Swiggy.

The food tech giant went public on November 13, with its shares listed on the BSE at INR 412 apiece, a 6% premium to its IPO price of INR 390.

Prosus sold 109.09 million shares of Swiggy through the IPO, raking in around $500 million. “The internal rate of return (IRR) of our stake in Swiggy, based on the IPO price and the net proceeds of the stake we sold, was 18%,” the group said in its first half report. .

Buoyed by strong returns from Swiggy’s IPO, it was reported last month that the investor is now eyeing an IPO of the Indian arm of its fintech company PayU in 2025. Prosus investments, Ervin Tu, said in November that the investor is I watch the best moment for the IPO.

Besides PayU, Prosus also sees Potential public listings for Meesho and BlueStone materialize in the next 18 months. He also expects Eruditus, Captain Fresh, Mintifi, Vastu and Mensa to be potential IPO candidates in the future.