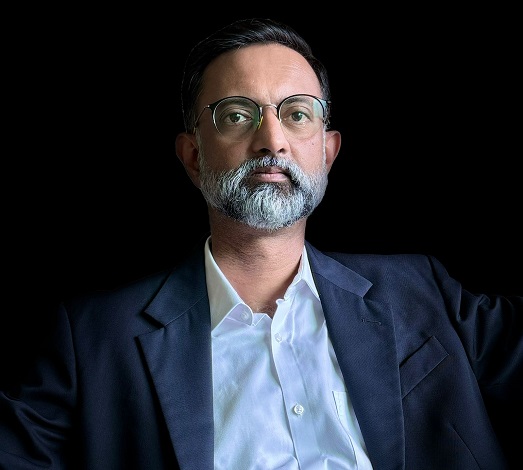

CXOTtoday engaged in an exclusive interview with Deepraditya Datta, Founder, Venator Search Partners

-

What trends are you currently seeing in the recruitment of CXOs and board members in the banking sector? How do these trends differ between traditional banks and FinTech companies?

-

- Recent trends are very much aligned with the digitalization of the sector.

- Before, we applied for a loan. Today you have a pre-approved loan based on analytics. The “Risk” function has been completely overhauled. Traditional skills are obsolete, for all practical purposes the core work will be done by AI, you won’t need a human.

- Likewise, a certain number of functions are redefined.

- These are indeed very different from traditional recruitment. New age skills do not exist and are not a sunrise phenomenon. You often have to rely on the closest partner or a different vertical such as insurance, FMCG or technology companies to find talent.

-

How has the emergence of FinTech changed the landscape of executive recruitment in the banking sector?

- The age ranges in FinTech are alarming and I use the word “alarming” consciously as financial services is a regulated industry. With the exception of a few large, well-formed organizations, most of them have fairly young founders and a very young team underneath. Executive Search has a limited role to play. However, most of these organizations are funded and often investors determine some key hires.

- A large part of FinTech works in payment solutions and banks had much of this talent pool. We have seen many bankers turn to FinTech for the excitement of working on something new, coupled with high cash flow and wealth creation opportunities.

-

In your experience, what are the key qualities that banks and FinTechs look for in their management teams?

Skill sets may be very different from those sought, while leadership qualities are often common. It revolves around the quality of leadership, the ability to play as a team, stakeholder management, strategic thinking, the ability to work with ambiguity, the ability to evolve, orientation towards processes, which would be key traits apart from core traits like integrity, self-motivation, etc. A visible difference in approach. Banks will look for talent who has “been there and done that”, while FinTechs will look for someone “who can do it”.

-

As Venator looks to tap into the FinTech segment, what specific challenges do you expect in recruiting top talent for these companies?

- All senior hires are a challenge, simply because they are different in nature. We exist because there are challenges!

- When it comes to attracting credible talent to the sector, one of the main challenges remains FinTech. Banking industry achievers feel comfortable in a stable industry like banking, while Fintech has gone through some ups and downs. It’s a small percentage of Fintech that ultimately makes it successful.

- Age range is another barrier we often face when hiring Fintechs. An overly old individual is unlikely to have full experience with limited years of experience and will not adapt to young people.

-

How do you assess cultural fit when placing leaders in the fast-paced FinTech business environment?

Culture is subjective. It’s not necessarily measurable. We call it our secret sauce. We have our means of evaluating based on parameters that differ on a case-by-case basis. We have rarely been wrong on this point.

-

What unique challenges do private banks and NBFCs face in attracting high caliber executives compared to large financial institutions?

The big one always attracts while the small one is beautiful as they say. It takes time to climb the ladder in a large organization. It takes more than exceptional performance to reach the top. Whereas in a smaller organization, one can think about a bigger role much earlier in their career. This is exciting for young aspirants. High achievers are often impatient and have high aspirations that lead them to pursue positions in smaller, larger, strategic organizations.

-

How do you see the role of private banks evolving in the fintech era, and what implications does this have for recruiting?

-

- There is no conflict between banks and FinTech. They are certainly not threatened by each other. Banks will partner with FinTechs. Talents will move between the two entities and see movement in both directions.

- One of the impacts we have seen and hope to see in the future is the increase in compensation. In order to attract and retain talent, FinTechs pay higher salaries. This comes in the form of higher cash compensation and stock options. This will continue to drive compensation levels higher until the markets correct at a later date.

-

In your opinion, which technological advances will have the greatest impact on the recruitment process for banking and FinTech executives in the years to come?

AI is expected to be a game changer in recruiting. The basic work should be taken over by AI, which will bring more efficiency. This can be up to 70% of the hiring process depending on the processes. Balance requires human intervention. When it comes to leadership, the personal touch remains key. This is essential for the level of engagement. At the beginner and intermediate level, recruitment will necessarily be largely automated.

-

How is Venator adapting its recruiting strategies to align with the rapidly evolving fintech landscape?

We have completely moved to the SalesForce platform since 2018. We are adopting more and more of it. We use AI in various parts of our process without compromising the quality of delivery. In the future, we will adopt technology where our clients and candidates will see us very differently. We will share these plans in the future.

-

How important do you think diversity in leadership is to the success of traditional banks and fintech companies?

I firmly believe in letting the best get the job. When we say “diversity and inclusion,” we accept that something is missing. This is no longer true. We were going through a period of socio-economic change when women began to work. Today it is a norm. Performance should be the factor and no longer gender.