(Bloomberg) — Samsung Electronics Co. plans to buy back about 10 trillion won ($7.2 billion) of its own shares over the next year, setting in motion one of the largest return programs to the shareholders of its history.

Most read on Bloomberg

Korea’s largest company will repurchase its shares in stages over the next 12 months, it said in a regulatory filing on Friday. As a first step, it will buy back around 3 trillion won of paper from Monday until February 2025, all of which it will cancel. The board will deliberate on how best to carry out the remaining 7 trillion won buybacks.

The move coincides with growing investor concern over the company’s memory chip business, which is struggling to keep pace with SK Hynix Inc. Samsung’s smaller rival has become the dominant supplier of broadband memory network from Nvidia Corp., which uses cutting-edge technologies. chips in its popular AI accelerators.

That’s fueling fears that Samsung — long the dominant force in the global memory semiconductor space — is missing out on the artificial intelligence boom. Investors are also trying to gauge its vulnerability to Donald Trump’s protectionist trade policies, given its exposure to China.

Samsung shares rose 8.6% on Friday before the buyout announcement, although they remain down 32% for the year. The world’s largest smartphone maker is also grappling with a global consumer electronics crisis.

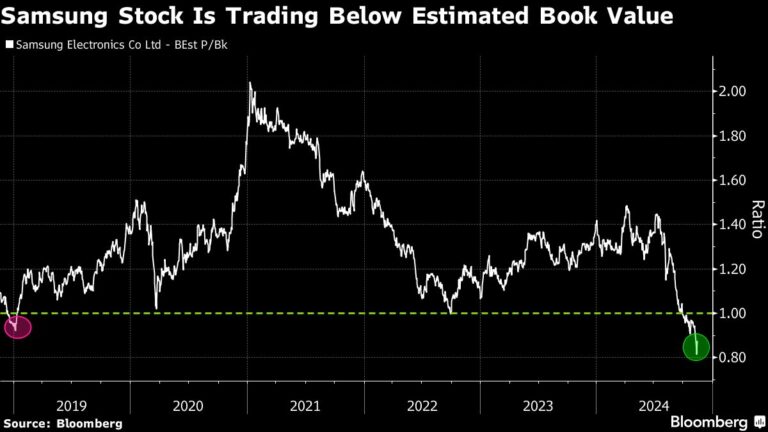

Its stock trades at a discount of more than 10% to the consensus estimate of its one-year forward book value, according to data compiled by Bloomberg.

In October, Samsung reported progress in qualifying and supplying its most advanced AI memory chips to Nvidia. The Korean company now plans to sell its most advanced HBM3E memory chips in the fourth quarter, Jaejune Kim, executive vice president of Samsung’s memory business, said during an earnings conference call at the time.

Some investors nevertheless remain cautious about the outlook.

“A lower valuation is justified given the business risks around Korea and also the catch-up of HBM, which will take time, and a weak memory environment,” said Janus Henderson Group fund manager Sat Duhra , referring to high-bandwidth memory. “There are better tech stocks to own here – most of them are in Taiwan.”

–With the help of Shinhye Kang and Sangmi Cha.