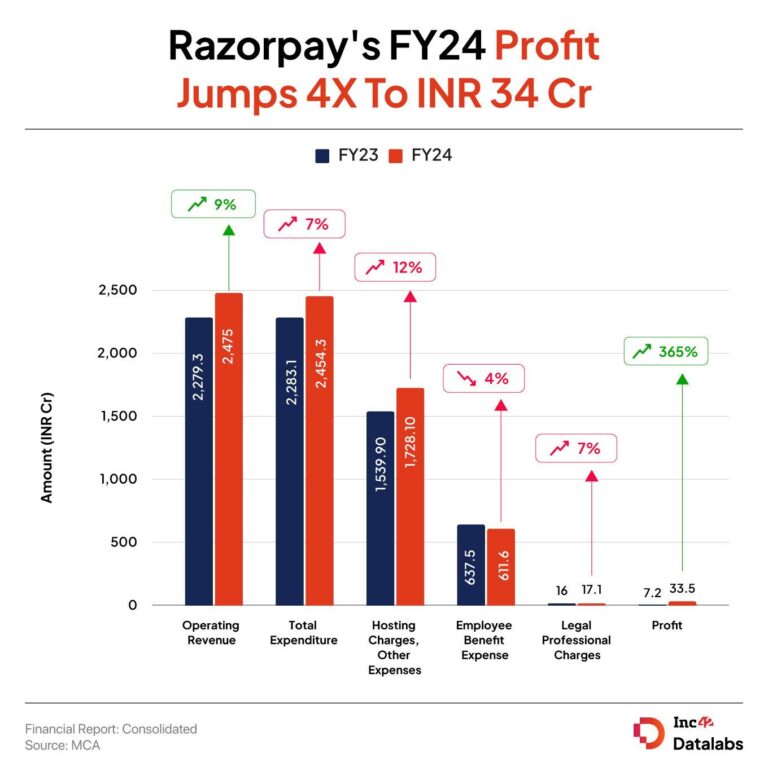

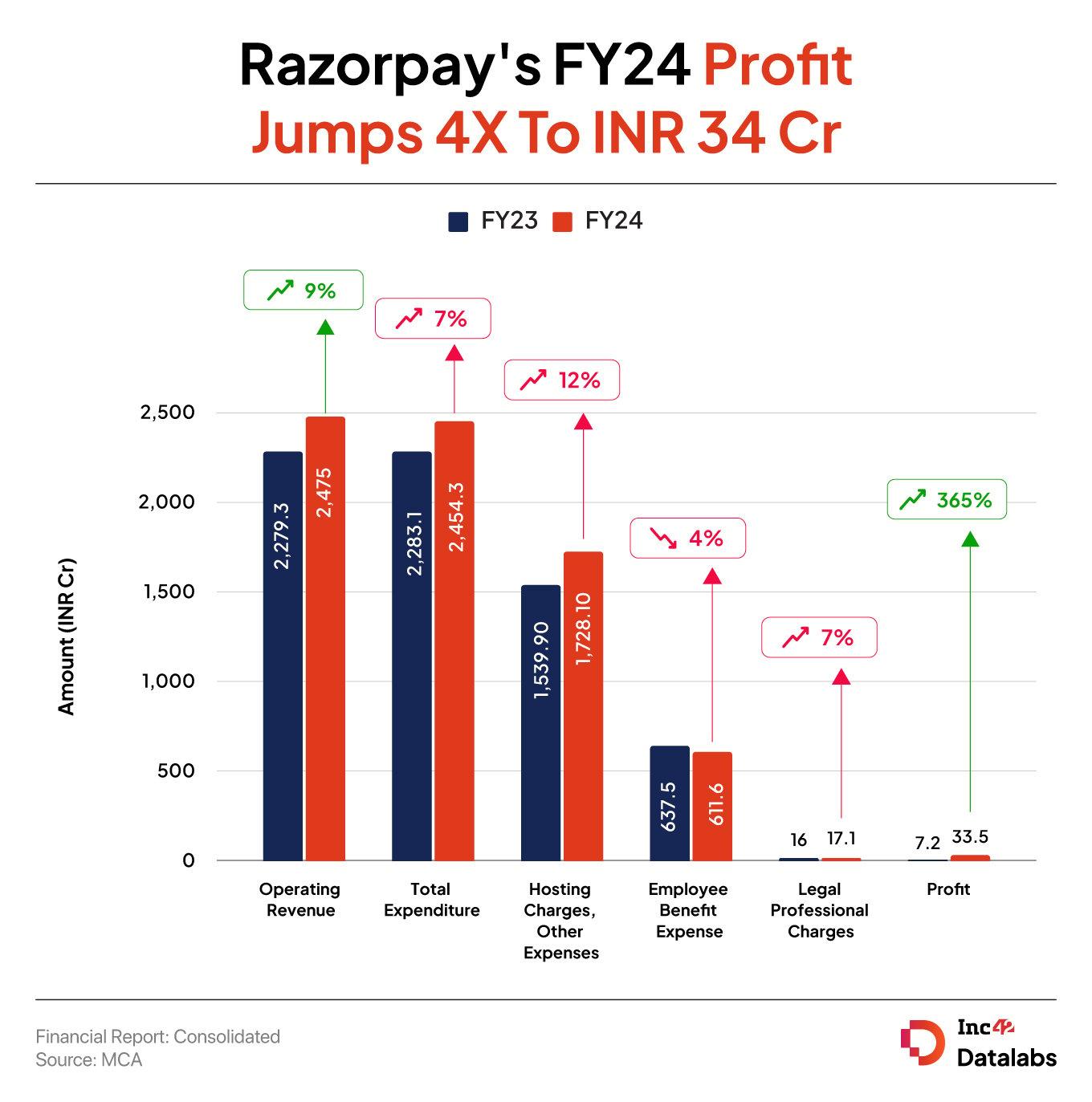

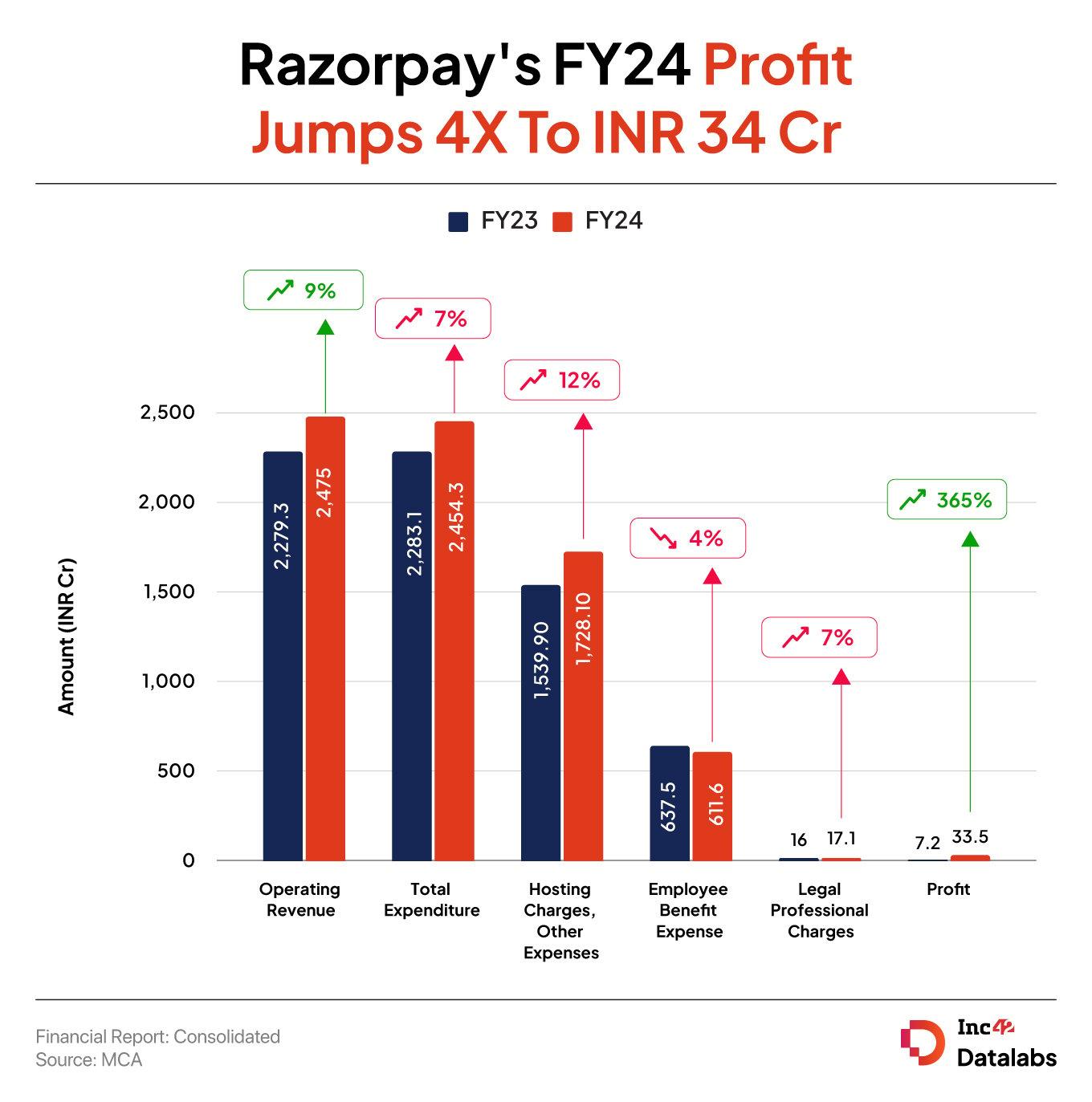

Bengaluru-based fintech unicorn Razorpay’s profits grew more than 4x in the financial year ending March 31, 2024. The Peak XV-backed startup reported a profit of INR 33.5 Cr, i.e. a jump of 365% compared to the INR 7.2 Cr announced the previous one. year.

The startup’s rise in profits is attributed to its increase in operating revenue. In FY24, the startup’s operating revenue grew 9% to INR 2,475 Cr. compared to INR 2,283 Cr during the previous financial year.

The startup generates most of its revenue from payment fees it earns by providing online payment services to merchants. As a result, it earned INR 2,068.1 Cr from payment aggregation services, accounting for 83% of the startup’s total operating revenue in FY24.

Including other revenues, the startup’s total revenue stood at INR 2,501.4 Cr in FY24, 9% higher than the INR 2,279.3 Cr in FY24. previous exercise.

Founded by Shashank Kumar and Harshil Mathur in 2014, Razorpay is an omnichannel payment and banking platform. The startup has ventured into SME payroll, banking, lending, payments, and insurance, among others, over the years.

Where did Razorpay spend?

The fintech startup managed to control its expenses during the year under review, with the increase in operating revenues outpacing the increase in its expenses. In FY24, the startup’s total expenses stood at INR 2,454.3 Cr, an increase of 7% from the INR 2,283.1 Cr reported in the previous fiscal year.

Accommodation costs, other expenses: According to the startup’s financial statements, the startup spent INR 1,728.1 Cr on its hosting fees, which was 12% more than the previous year’s INR 1,539 Cr. Besides hosting costs, this expense item also includes advertising expenses, making it the largest expense.

Employee costs: Interestingly, the startup’s salary costs have decreased slightly in the current financial year. In FY24, the startup spent INR 612 Cr, which was 4% less than the INR 637.5 Cr, indicating a decline in headcount.

Legal professional fees: The startup spent INR 17.1 Cr on legal professional fees in FY24, 7% more than the INR 16 Cr spent in the previous FY.

The startup’s cash and cash equivalents at the end of the financial year stood at INR 902 Cr, 1.2% lower than INR 913.5 Cr in FY23.

The startup has raised over $740 million from notable investors including GIC, Tiger Global, and Lightspeed Ventures. During its last financing, i.e. in December 2021, it obtained $375 million at a valuation of $7.5 billion.

Earlier this year, the startup’s offline payments arm – Razorpay POS was launched Q-Zap for offline retailers to reduce billing time. Last month, it launched DataSync, a no-code data integration platform that claims to offer real-time data access to enable businesses to timely improve their financial reporting and strengthen fraud detection.

Razorpay is among the growing list of Indian tech startups changing their home abroad in India to save taxes and also to list the company on the country’s stock exchanges. According to media reports, the startup will ultimately have to pay $200 million (~INR 1,600 Cr).