Key global FinTech investment statistics in Q3 2024:

- Global FinTech investment fell 55% year-on-year

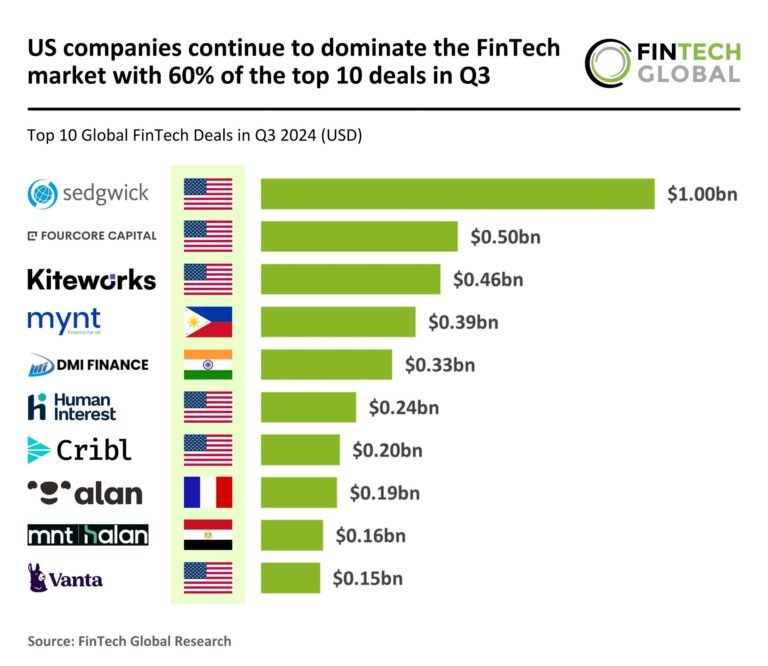

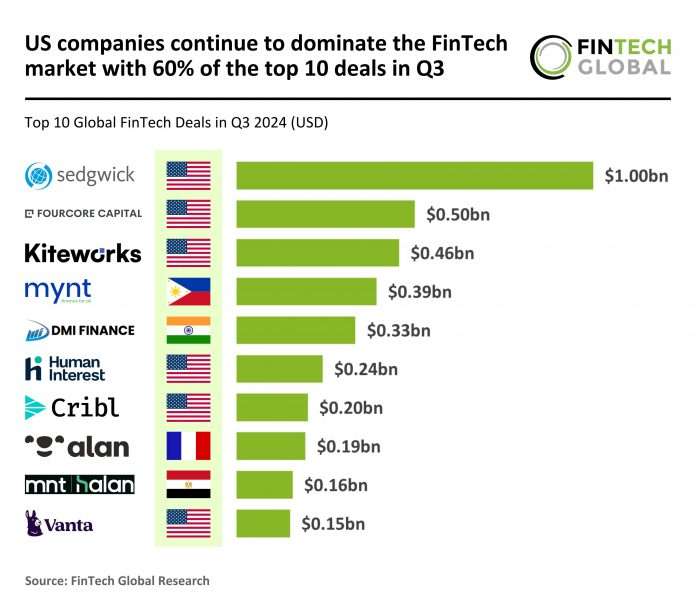

- US companies continue to dominate the global FinTech sector, completing 60% of the top 10 deals in the quarter.

- AlanThe French insurance unicorn known for its streamlined health insurance and digital health has secured a $193 million Series F round to be the only European company to make the top 10 deals.

In the third quarter of 2024, the global FinTech sector recorded 981 deals, reflecting a 57% decline from the 2,275 deals closed in the third quarter of 2023, but a slight increase of 7% from the 916 funding rounds recorded in the second quarter of 2024.

Total FinTech funding in Q3 2024 was $16.4 billion, a substantial 55% decline from the $36.7 billion raised in Q3 2023 and down 10% from to the $18.3 billion raised in the second quarter of 2024.

These figures highlight a sustained reduction in funding and activity across the sector, despite a slight increase in deal volume between the second and third quarters of 2024, suggesting renewed momentum in deal-making , resulting in a significant decline in valuations and total funding levels.

The top 10 deals in Q3 2024 were spread across six countries, with the US maintaining its strong lead with six major deals, consistent with its dominance in Q3 2023.

Unlike the third quarter of 2023, where Singapore and Israel collectively secured four of the best deals, the latest period saw broader representation, with countries like Egypt, France, India and the Philippines each contributing one major chord.

This shift indicates diversification in the global FinTech landscape, with emerging markets outside the United States gaining ground in high-value transactions.

The entry of Egypt and the Philippines into the top 10 reflects a potential expansion of FinTech growth into less traditionally dominant regions, signaling a shift in global interest and investment in more geographically diverse markets.

Alan, the French insurance unicorn known for its streamlined health insurance and digital health services, solidified its market expansion with a $193 million Series F funding round led by Belgian. Belfius Bankpositioning Alan as the only European company among the top 10 FinTech deals globally for the quarter.

Initially created to complement the French national healthcare system with an automated, user-friendly claims experience, Alan has since expanded its offering to include medical consultations, mental health resources and much more via its mobile app.

The partnership with Belfius will not only provide new capital, but also bring Alan’s health insurance products to Belfius’ extensive corporate customer base in Belgium, driving growth of Alan’s users beyond its half a million existing policyholders.

Keep up to date with all the latest FinTech research here

Copyright © 2024 FinTech Global

Investors

The following investors have been identified in this article.