Moniepointa Nigeria-based fintech company, successfully raised $110 million in a Series C funding round.

The financing was led by International development partners African Development Partners Fund III (ADP III), with the participation of investors such as Google Africa Investment FundVerod Capital and Lightrock.

Strategic Focus on Business Banking and Financial Access

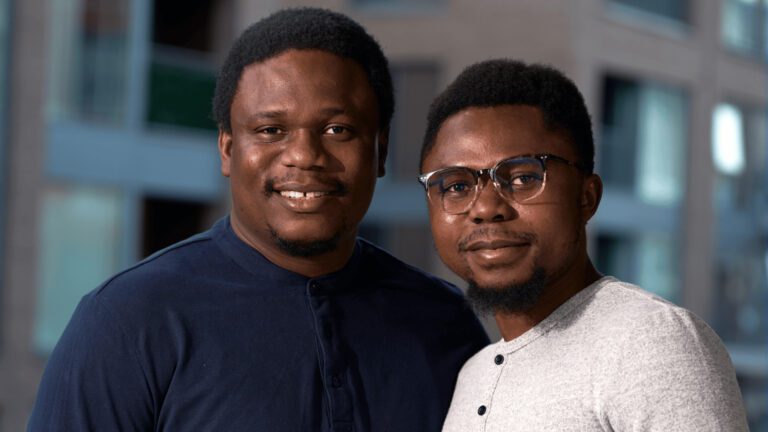

Founded in 2015 by Tosin Eniolorunda And Felix IkeMoniepoint was initially launched under the name TeamApt.

The company has since grown from banking infrastructure support to one of Nigeria’s largest business banking providers, serving millions of African businesses.

According to Moniepoint, it currently processes more than 800 million transactions each month, totaling more than $17 billion.

Moniepoint’s platform offers a range of services beyond standard banking, including business loans, expense management tools, bookkeeping solutions, and more.

In 2023, the company also entered the personal banking market with an app and debit card, positioning itself as a one-stop financial solution for businesses and individuals.

Financing to fuel regional growth and financial inclusion efforts

Moniepoint’s latest funding round is expected to support its expansion into more African countries.

The company said profits would be dedicated to creating additional digital financial services, including foreign exchange and credit options, to offer comprehensive financial tools tailored to various African markets.

The company’s approach aligns with broader financial inclusion efforts, as many African countries seek to integrate more businesses and individuals into formal financial systems.

“Our mission is to help our customers solve their challenges by making our platform more innovative, transparent and secure,” Eniolorunda mentioned in the press release. shared with AfroTech.

“Proceeds from this increase will accelerate our efforts to drive financial inclusion and support Africa’s entrepreneurial potential. I would like to sincerely thank the entire Moniepoint team for making this achievement possible.

Significant growth and market potential

Moniepoint has experienced rapid growth, with its personal finance user base increasing 2,000% over the past year and revenue growing at an annual rate of 150%, according to the company.

This growth comes as Moniepoint seeks to expand its operations to serve Africa’s large informal sector, which employs approximately 83% of the continent’s workforce.

With the support of new and existing investors, Moniepoint plans to use this capital injection to continue its commitment to financial access and strengthen its position in the competitive fintech space in Africa.

Featured image credit: Moniepoint