MACAU SAR – EQS Newswire – October 23, 2024 – On October 20, the Financial Street Forum 2024 annual conference concluded in Beijing. Themed “Trust and Confidence – Working Together to Promote Financial Openness, Cooperate for Shared Economic Stability and Growth”, this year’s conference attracted more than 500 guests from more than 30 countries and regions around the world. In a side session titled “Fintech: Bridging the Digital Divide”, notable speakers such as Yin Yanlin, deputy director of the economic committee of the 14th National Committee of the CPPCC, Zeng Zhicheng, deputy general director of the Beijing Municipal Branch of the People’s Bank of China. , Jiang Guangzhi, Director of Beijing Municipal Economic and Information Technology Bureau, Han Xinyi, Chairman of Ant Group, and Sun Ho, Chairman and CEO of Macau Pass Group Holdings Limited, shared practices innovative and offered suggestions. They highlighted the importance of leveraging fintech to improve financial services in the real economy, reaching more people and businesses through advances in tech finance, green finance, inclusive finance, pension financing and digital finance.

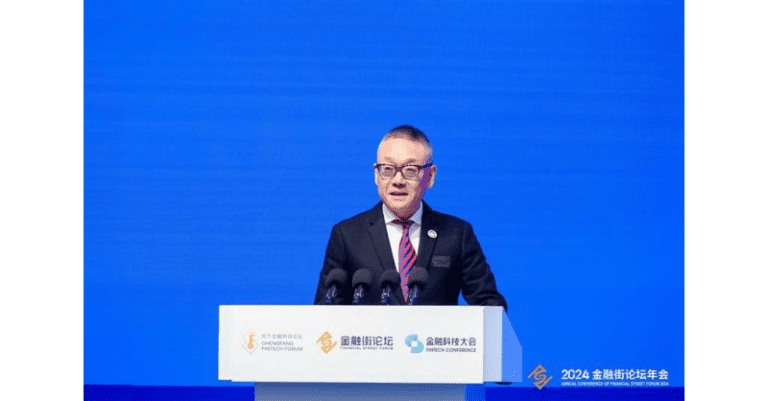

Sun Ho highlighted the potential of fintech to transform Macau into a smarter city. He mentioned the Macao SAR government’s “1+4” strategy, which promotes modern finance as a key pillar of economic diversification. Macau Pass aligns with this initiative by providing convenient living and inclusive financial services to consumers and businesses through digital products, technologies and data capabilities, while contributing to the digital economy and infrastructure necessary for a smart city.

Macau Pass is committed to creating an open and one-stop platform for digital life and financial services, leading Macau’s mobile payment industry through technological innovation and integration of daily consumption and service scenarios . MPay has become the preferred electronic payment platform for Macau residents and has developed into a super application covering various scenarios such as retail, catering, culture, leisure and tourism, providing users with local services practices. Additionally, Macau Pass leverages its large user base to help merchants with their digital transformation and growth. MPay is now accepted by over 98% of merchants in Macau, playing an important role in their online operations. Together with Alipay+ cross-border solutions, MPay has expanded its payment services to 50 countries and regions, supporting more than 10 foreign e-wallets for payments in Macau, improving convenience for residents and visitors.

Macau Pass has issued more than 5 million mCards, continually improving users’ smart travel and payment experiences with innovative features. The upcoming launch of the Macau Pass – China T-Union Card aims to simplify public transportation for Macau residents traveling between mainland China and Macau SAR, making travel more convenient.

Mr. Sun also shared his views on smart finance innovations. As a licensed bank in Macau, Ant Bank (Macau) leverages cutting-edge technology to provide digital banking, internet securities investment and insurance services, ensuring safe, inclusive and convenient financial solutions. By synergizing Macau Pass’s payment services with Ant Bank (Macau) digital banking services, they plan to integrate “payment plus inclusive finance” services with business scenarios and ecosystem resources, responding thus meeting the diversified financial needs of the market and stimulating the digital economy of the smart city.

The issuer is solely responsible for the content of this announcement.