DoPay has raised a total of $37.15 million, including its Series A-2 funding round completed in July 2024.

FINANCING | Egyptian Fintech DoPay Raises $13.5M Series A Expansion Following “True Hockey Stick Trajectory Growth” – https://t.co/f5rDHg1lcc#Funding #Startups #fintech #financialinclusion

🌟Summary of news in response🌟https://t.co/FC1BceKTUS

– Funding News (@fundingnews_) July 23, 2024

Its investors include:

- Barclays Accelerator

- ACE & Company

- Force on mass capital

- Techstars Ventures

- MasterCard startup path

- FMO

- Hub71

- Alder

- Kube VC

- Mbuyu Capital Partners

- NN Group

- Partner of Ruisseau Argentem.

According to CB Insights, Dopay’s current valuation stands at $19.5 million, an intriguing figure given that it has raised nearly double that amount in funding.

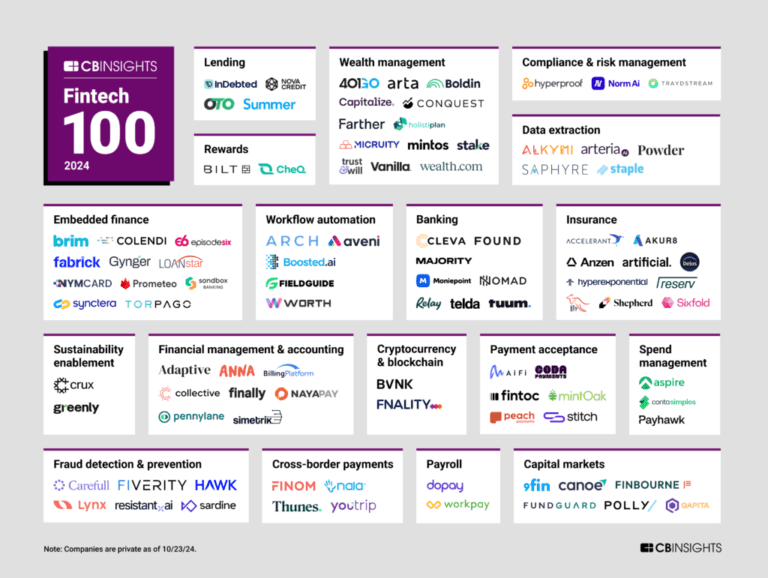

Dopay ranks 41st on the overall list.

3.) NALA (Tanzania)

Nala is classified as a Kenyan startup according to CB Insights, offering international money transfers and mobile payment solutions.

Founded in 2017 by Tanzanian CEO Benjamin Fernandes, the company offers a mobile app that allows users to send money at competitive exchange rates and is known for its transparent fee structure.

NALA has raised a total of $50 million over multiple funding rounds, the latest being a $40 million Series A round in July 2024.

🇹🇿FUNDING | Tanzanian fintech Nala raises $40M Series A after 10x revenue growth and ~500,000 user growth

“To our more than 200 mobile money banking partners, regulators and investors, your support has been invaluable to us in enabling fast and secure cross-border payments… pic.twitter.com/zYoYU243H5

–BitKE (@BitcoinKE) July 10, 2024

The startup’s investors include:

- Nyca Partners

- VentureSouk

- Accelerate

- Alex Bouaziz

- Amplo

- Bessemer Venture Partners

- Digital Financial Services Lab

- Jonas Templestein

- Laura Spiekerman

- Peeyush Ranjan

- Vladimir Tenev

- Capital of brilliance

- Acre Capital

- Amplo

- World Daylight Saving Time

- HOF Capital

- Norrsken22

- Ryan King, and

- Vlad Tenev

The startup’s valuation is undisclosed and it sits at number 68 on the 100 list.

4.) Peach Payments (South Africa)

Peach Payments, founded in 2012 by South African immigrants Andreas Demleitner and Rahul Jain, focuses on online payment solutions.

The Pretoria-based startup offers a comprehensive suite of services, including online payment processing, subscription management, payment solutions and advanced fraud protection, primarily targeting businesses in the e-commerce sector.

In April 2023, Peach Payments secured its largest venture capital funding to date, raise $31 million in a Series A funding round, with the participation of:

- Launch Africa

- Google Umbono

- Allan Gray

- UW Ventures, and

- API Partners

Peach Payments, South Africa’s second largest online payment gateway, secures $31 million in Series A funding

Peach is aiming for further expansion, supported by the strong growth of recent years. The fintech startup’s revenue has increased by more than 650% since 2020, and by 80% in… pic.twitter.com/CwYFPmfnAt

–BitKE (@BitcoinKE) April 14, 2023

This funding round brought the startup’s total funding to $31.06 million.

Peach Payments is ranked number 76 on the list.

5.) Stitch (South Africa)