The fintech landscape in the Philippines is growing rapidly, with digital payments skyrocketing and more than 300 companies innovating across verticals, according to the Fintech Report in the Philippines 2024.

Produced by Fintech News Philippines in partnership with Fintech Alliance PH and sponsored by Alibaba Cloud and Zoloz, the report paints a picture of a thriving fintech sector, highlighted by strong government support, growing digital adoption and a strong commitment to financial inclusion.

The report provides a comprehensive overview of the Philippine fintech ecosystem, highlighting significant developments and innovations from the past year and key trends that will shape 2024.

Philippines exceeds digital payment target

The Philippines has exceeded its goal for 2023 to convert 50% of total retail payments volume to digital form. At the end of last year, digital payment transactions accounted for 52.8% of total monthly retail payments in the country, up from 42.1% in 2022.

The data, highlighted in the Bangko Sentral ng Pilipinas (BSP) 2023 Electronic Payments Metrics Report, shows that digital payments are growing at a faster pace than expected.

The target is part of the Philippines Roadmap for digital payments transformation 2020-2023a strategic initiative of the BSP aimed at reducing dependence on cash, promoting digital payments and fostering financial inclusion in the Philippines.

The roadmap aims to establish a robust digital financial infrastructure and introduce regulatory reforms to foster digital payment innovation, with the aim of expanding financial inclusion to 70% of Filipino adults by 2024, among other objectives.

Although more recent data has not yet been released, the BSP’s 2021 Financial Inclusion Survey revealed significant progress in terms of accessibility. In 2021, 56% of adults nationwide had a bank account, a remarkable increase from 23% in 2017 and 17% in 2015.

Digital banking is growing but profitability remains a challenge

Since the launch of the Philippines’ first digital bank in 2021, only two of the six licensed players have achieved profitability, suggesting intense competition and high operational costs.

The BSP wait Losses are expected to persist in the medium term as the nascent industry searches for the right business models, diversifies its offerings and optimizes its operations. It is estimated that it takes around five to seven years for a digital bank to become profitable.

Digital banks are a new category of banks in the Philippines, which have only been granted licenses by the BSP since 2020. So far, six entities have received a digital banking license: GoTyme Bank, Maya Bank, Overseas Filipino Bank, Tonik Digital Bank, UnionDigital. Bank and UNOBank. These players collectively generated around 8.7 million deposit accounts, which represents around 7% of the total Philippine banks, according to to the director of the BSP, Melchor Plabasan.

To boost the performance of the sector and its contribution to the objectives of digital transformation and financial inclusion, the BSP planned to resume accepting applications for digital banking licenses. Up to four new digital banking locations will be up for grabs next year, with the application window starting on January 1, 2025, ending a three-year moratorium.

Philippines Fintech Report 2024 Highlights Dominance of Payments Sector

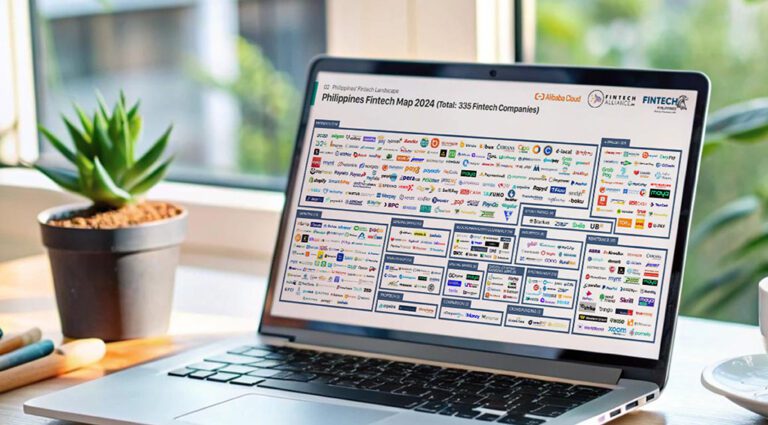

In 2024, payments continued to dominate the Philippine fintech sector, accounting for 35.4% of all fintech companies in the country with 116 companies, according to the Philippines Fintech Map 2024.

This is followed by loans (22.2% and 73 companies), remittances (9.1% and 35 companies) and e-wallets (7.1% and 29 companies).

The payments industry is not only the busiest but also the most developed fintech sector, with some of the largest and most successful fintech companies in the country including GCash, a mobile payments service owned by Globe Fintech Innovations and the first fintech unicorn in the countryas well as Maya, GCash’s biggest competitor and a company growing as a financial super app with a digital banking license.

Fintech is also the fastest growing investment segment in the Philippines. Philippine Venture Capital Report Data 2024 reveal that the sector was the preferred investment target in 2023, accounting for 23% of all funding rounds with 22 venture capital deals.

The digital identification project is moving forward

The Philippines is also advancing its digital infrastructure with the launch of digital national identification in June. The new service aims to improve service delivery, promote inclusion and support the wider digital transformation and the country’s economy and society.

As of July 2024, more than 88 million Filipinos have registered with the Philippine Identification System (PhilSys) for a national ID card, with a total of 52 million physical PhilID cards issued.

The Digital National ID is the digital version of the PhilID card that can be used on mobile devices. It contains the owner’s national identity card number, digital identification number and basic demographic information, such as full face photo, full name, date of birth, current address, gender, blood type, marital status and a unique QR code.

Two authentication platforms, National ID eVerify and National ID Check, were also launched. National ID eVerify provides users with a suite of verification tools, including facial recognition and real-time data verification, to quickly confirm personal information. National ID Check, meanwhile, allows institutions to validate personal information via QR scanning, targeting organizations with limited technology resources.

The digital national identity supports the government’s strategies outlined in the Philippine Development Plan 2023-2028, a strategic framework designed to guide the country’s development over six years, with the ultimate goal of achieving inclusive growth, reducing poverty and improve people’s quality of life. all Filipinos.

Central Bank Digital Currency Efforts Advance

The Philippines is also making progress in its efforts to implement a central bank digital currency (CBDC). Agila Project East is part of the BSP’s broader efforts to understand and leverage digital currencies within the financial system.

BSP Deputy Governor Mamerto E. Tangonan said the proof-of-concept phase of the Agila project should conclude by the end of this year. He indicated that the wholesale CBDC could be launched at the start of BSP Governor Eli M. Remolona Jr.’s six-year term, which runs from 2023 to 2029.

The BSP has identified several potential use cases for CBDC, such as liquidity management, which allows transactions between banks even on weekends and public holidays. Another potential use case is securities settlement, which could become “nearly instantaneous” with CBDCs, potentially boosting capital markets.

Cross-border payments have also been identified as a use case, with the mBridge project, a multi-CBDC platform from the Bank for International Settlements (BIS), being a potential collaboration for the Philippines.

The first phase of the Agila project was completed in 2023, selecting HyperLedger Fabric’s distributed ledger technology (DLT) for BSP’s sandbox experiments. Director BSP Atty. Bridget Rose M. Mesina-Romero noted that two tests of sandbox experiments are currently underway.

Featured image credit: edited from free pik