Artificial intelligence (AI) server shipments have increased significantly over the past two years as cloud service providers have invested huge amounts of money in infrastructure capable of training AI models, as well as for AI inference purposes to deploy these models in real-world applications.

Market research firm TrendForce estimates that the global AI server market could generate a whopping $187 billion in revenue this year, up 69% from 2023. Several companies are already profiting greatly of this huge end market opportunity. Chipmakers such as Nvidia to custom chip producers such as Broadcom and server solution providers such as Dell TechnologiesThere are multiple ways to invest in the booming AI server market.

However, in this article we will take a closer look at the prospects of Micron technology (NASDAQ:MU) And Marvell Technology (NASDAQ:MRVL)two companies that manufacture critical components for AI servers.

Micron Technology’s high-bandwidth memory chips are in high demand

High-bandwidth memory (HBM) is used in AI server chips such as graphics processing units (GPUs) because of its ability to enable faster data transfer to reduce processing times and improve performance, as well as reduce energy consumption. Demand for HBM is so strong that Micron says it has sold all of its capacity for this year and next.

Better yet, Micron management emphasizes that it “will have a more diversified HBM revenue profile” for 2026 thanks to the new business it has landed for its latest HBM3E chip. The chipmaker emphasizes that it has already started shipments of this new chip to its customers for approval.

Micron claims the HBM3E uses 20% less power and offers 50% more capacity compared to competing offerings. The company plans to start production of the HBM3E in early 2025 and increase production as the year progresses. Better yet, Micron is confident that it will continue to gain market share in the HBM market.

Singapore-based news channel CNA points out that Micron aims to capture 20 to 25 percent of the HBM market by next year. This is expected to provide a boost to Micron’s growth next year, as the company expects revenues from the HBM market to reach a staggering $25 billion in 2025, up from just $4 billion. dollars in 2023.

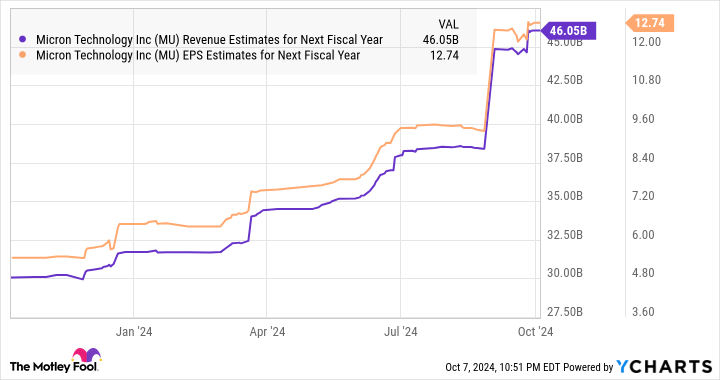

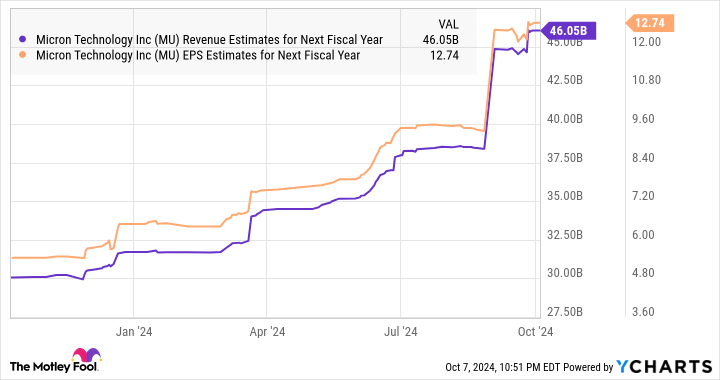

End market expansion along with Micron’s push to capture a larger share of the HBM space are reasons why the company’s revenue is expected to grow 52% to $38 billion in the during the current financial year (which began on August 30). . Meanwhile, analysts expect Micron’s profit to rise to $8.94 per share from $1.30 per share a year earlier.

Micron is also expected to continue growing at a breakneck pace in the next fiscal year.

Buying Micron Technology stock now could prove to be a smart move for investors looking to benefit from the growing deployment of AI servers. The stock has a multiple of forecast profits of just 11, while its price-to-earnings-to-growth ratio (PEG ratio) of just 0.16 further reinforces that it is incredibly undervalued relative to the growth it is expected to generate.

Marvell Technology gets a big boost from its custom AI chips

Marvell Technology is known for manufacturing application-specific integrated circuits (ASICs), which are custom chips designed to perform specific tasks. It is worth noting that the demand for these custom chips deployed in AI servers is increasing since major cloud service providers such as Metaplatforms, Alphabetit’s Google, and Amazon looking to reduce costs by developing internal processors.

As a result, ASICs are expected to account for 26% of the overall AI server chip market in 2024. Better yet, the deployment of ASICs in AI servers is expected to increase rapidly in the future and open up a potential revenue opportunity. worth an impressive $150 billion. Marvell is already taking advantage of this lucrative opportunity.

The company’s overall revenue decreased 5% year-over-year in the second quarter of fiscal 2025 (for the quarter ended August 3) to $1.27 billion, due to weakness in carrier, consumer, automotive and enterprise network infrastructure end markets. However, it delivered a whopping 92% year-over-year increase in data center revenue to $881 million.

There’s a good chance that Marvell’s data center business will continue to grow at a healthy pace as the company’s AI chip production is poised to ramp up, as noted CEO Matt Murphy during the latest earnings conference call:

Our AI custom silicon programs are progressing very well and our first two chips are now entering volume production. The development of new custom programs that we have already won, including projects with the new Tier 1 AI client that we announced earlier this year, are also tracking well on key milestones.

As a result, Marvell expects growth in its data center business to “accelerate sequentially to 10% percent” in the current quarter, which would be an improvement over sequential growth. 8% recorded in the previous quarter. This explains why Marvell’s guidance for the current quarter points to an improvement in its financial performance.

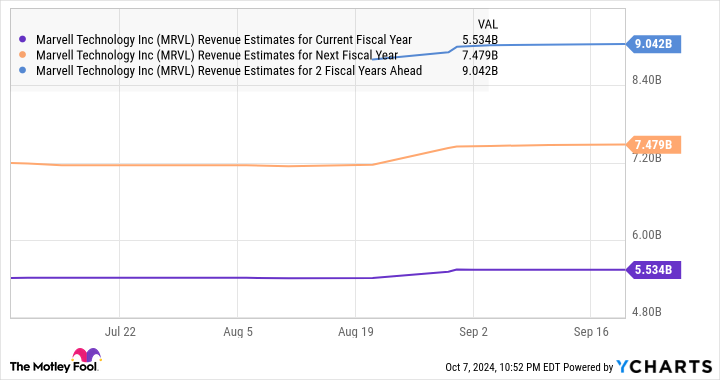

The company expects revenue of $1.45 billion in the fiscal third quarter, up from $1.42 billion in the same quarter last year. Thus, Marvell is poised to return to growth from the current quarter, and analysts expect robust growth over the next two fiscal years.

Additionally, analysts expect Marvell’s earnings to grow at a compound annual growth rate of 21% over the next five years. So, investors looking to get their hands on a semiconductor stock to benefit from the growing demand for custom AI chips can consider adding Marvell technology to their portfolios. Its growth is expected to accelerate thanks to the tremendous opportunity in the AI server market.

Should you invest $1,000 in Micron Technology right now?

Before buying Micron Technology stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Micron Technology was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $826,130!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns October 7, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Alphabet, Amazon, Meta Platforms and Nvidia. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

Artificial Intelligence (AI) Servers Poised to Become a $187 Billion Industry in 2024: 2 Hot Stocks Set to Skyrocket on This Massive Opportunity was originally published by The Motley Fool