Nvidia (NASDAQ: NVDA) is one of the hottest artificial intelligence (AI) stocks in the market since the technology exploded in popularity in late 2022. The company’s graphics processing units (GPUs) are seeing massive demand due to their ability to train large language models (LLMs) and handle inference workloads.

However, recent price action suggests that Nvidia investors are now looking for alternatives to capitalize on the AI boom. The stock hasn’t really taken off since Nvidia reported its Q2 FY2025 results late last month. Investors are likely skeptical about Nvidia’s prospects, as the company has seen incredible growth in recent quarters and could potentially be heading for a slowdown.

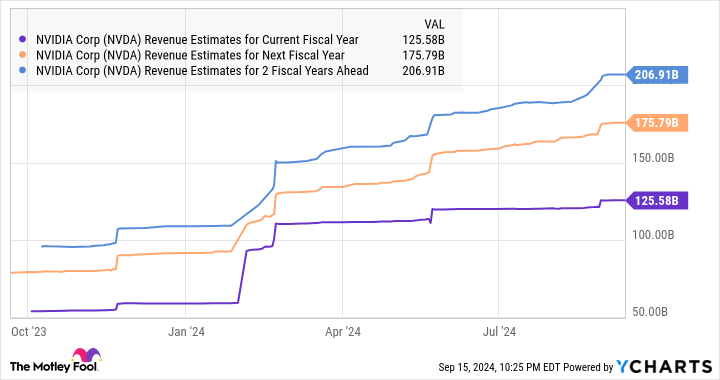

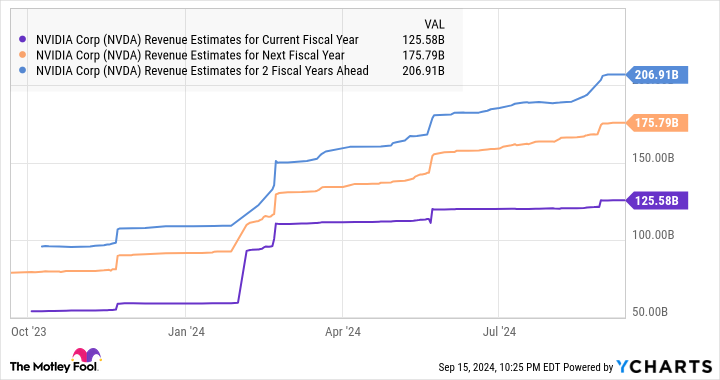

For example, Nvidia’s forecast for year-over-year revenue growth of 80% for the current quarter would be slower than the 122% growth it posted in the previous quarter. It’s also worth noting that the chipmaker ended fiscal 2024 with a 126% increase in revenue to $60.9 billion. Analysts expect its revenue to grow by a similar margin this year to $125 billion. But as the following chart shows, Nvidia’s growth is expected to slow over the next two fiscal years.

Of course, Nvidia’s business isn’t limited to the AI chip market. The company has a a huge potential market worth $1 trillion which could help maintain its exceptional growth for a long time. But even then, investors looking for AI Actions that present better value at the moment would be tempted to look for alternatives. This is where Dell Technologies (NYSE: DELL) And Qualcomm (NASDAQ: QCOM) to intervene.

Let’s take a look at why buying these two AI stocks instead of Nvidia might be a smart move.

1. Dell Technologies

Dell may not be a household name in the AI space yet, but a closer look at the company’s recent results and the nature of its business tells us that it could benefit greatly from the growing adoption of this technology in the long term.

The company, known for making server platforms, personal computers (PCs) and peripherals, reported its second-quarter fiscal 2025 results (for the three months ended Aug. 2) late last month. Dell’s revenue rose 9% from a year earlier to $25 billion, driven largely by strong demand for the company’s servers that are used to assemble AI chips.

Specifically, Dell’s Infrastructure Solutions Group (ISG) revenue jumped 38% year over year to a record $11.6 billion. It’s worth noting that Dell’s server revenue increased 80% year over year to $7.67 billion. AI servers accounted for $3.1 billion of revenue in the most recent quarter, suggesting that the company is now generating a healthy portion of its revenue from this growing market.

Additionally, Dell’s AI server backlog stood at $3.8 billion at the end of the previous quarter. Management added that its “AI server pipeline expanded again to Tier 2 CSPs and enterprise customers in the second quarter and now represents several times our backlog.” This is not surprising, as the AI server market is growing at a staggering rate.

According to one estimate, annual sales of AI servers could reach $430 billion by 2033, up from $31 billion last year. So there’s a good chance that Dell’s server revenue will continue to grow at a healthy pace in the long term.

Investors should also note that there is another serious AI-driven catalyst for Dell: the PC market. Market research firm Canalys estimates that the market for AI-enabled PCs could grow from 48 million units shipped this year to 205 million units by 2028. Dell is the third-largest PC vendor in the world with a 15.5% market share, meaning it is well-positioned to capitalize on this lucrative market.

The company’s client solutions business, which represents sales of business and personal computers, declined 4% from a year earlier to $10.5 billion. However, Dell said it expects the next PC refresh cycle to drive a recovery in that business. Overall, Dell sees an additional $174 billion in revenue opportunity from AI.

It would therefore not be surprising to see the company’s growth accelerate going forward. The company has already upgraded its guidance for the current fiscal year, and the discussion above indicates that it could continue to raise its growth expectations due to AI. With an attractive valuation of just 14 times forward earnings, Dell’s long-term outlook could translate into impressive gains.

2. Qualcomm

Qualcomm is another incredibly cheap stock to consider buying right now to take advantage of the growing adoption of AI in the smartphone and PC markets. It currently trades at just 15 times forward earnings.

As a leading player in the smartphone processor space, with an estimated 31% market share in the second quarter of 2024, up from 29% in the same quarter last year, Qualcomm is well positioned to capitalize on the surge in demand for AI-enabled smartphones. Counterpoint Research estimates that the global market for generative AI smartphones could see a four-fold increase in shipments between 2023 and 2027.

According to Counterpoint, the company has already established a solid lead in this market, with half of all generative AI smartphones expected to feature its chips by 2024. Its main rival, MediaTek, is expected to have just 13% market share of AI smartphones this year. More importantly, Qualcomm is currently seeing healthy double-digit growth thanks to the proliferation of AI smartphones.

The company’s revenue for the third quarter of fiscal 2024 rose 11% from a year earlier to $9.4 billion. Its adjusted earnings grew at a faster pace of 25% to $2.33 per share. The company’s revenue for the first nine months of the current fiscal year rose 5% to $28.7 billion. Analysts expect Qualcomm’s revenue growth to accelerate to nearly 10% in the next fiscal year.

The chipmaker’s growth rate could continue to accelerate due to its dominance in the AI smartphone chip market. Observers have already seen how Nvidia’s dominance in the AI data center graphics card market has translated into astonishing revenue and profit growth for the company. Qualcomm could follow in the footsteps of its more illustrious counterpart and could see its revenue and profit growth accelerate due to the lucrative opportunity it finds itself in.

Investors should therefore consider using the stock’s attractive valuation to buy more shares, as an acceleration in its growth could eventually lead to a healthy upside for the stock in the long term.

Should You Invest $1,000 in Dell Technologies Right Now?

Before you buy Dell Technologies stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors Should Buy Now…and Dell Technologies Isn’t One of Them. These 10 Stocks Could Deliver Monster Returns in the Years to Come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $715,640!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Qualcomm. The Motley Fool has a disclosure policy.

Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool